Six Solana ETFs? Let’s Stalk the Market Like a Stalker on Solana!

Bitwise’s BSOL is the 🦁 lion of the pack with $478.40M-80% of the market! Grayscale’s GSOL trails behind with $99.97M, clutching its “runner-up” trophy. 🐢

Bitwise’s BSOL is the 🦁 lion of the pack with $478.40M-80% of the market! Grayscale’s GSOL trails behind with $99.97M, clutching its “runner-up” trophy. 🐢

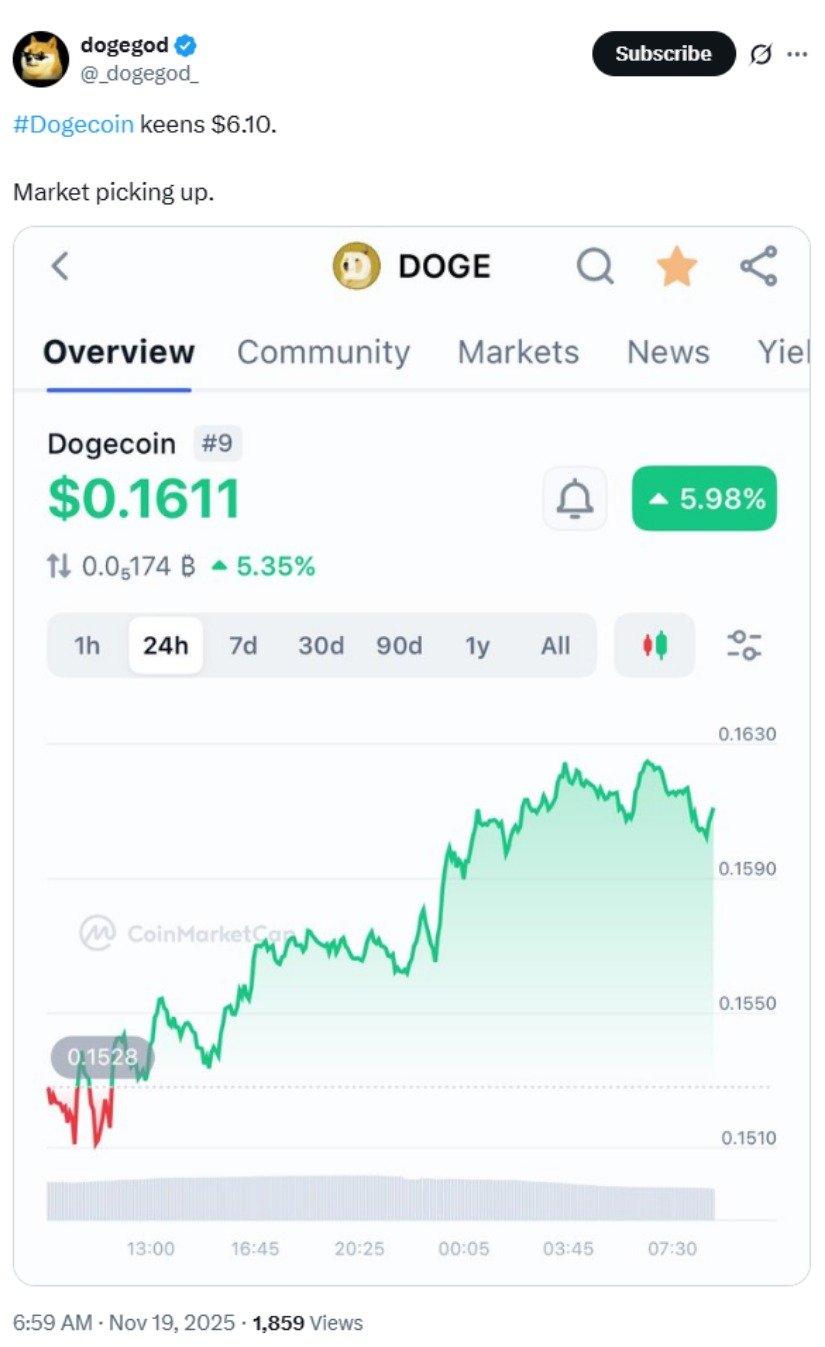

But let’s not get carried away. This speculative projection, while utterly entertaining, lacks the kind of serious modeling that we like to pretend we understand. To truly get the pulse of the market, analysts are now comparing Dogecoin’s charm against past market cycles and macroeconomic catalysts. The most notable factor? A classic reaction from the $0.15 support level, which has been a trusty friend throughout 2025-think of it as Dogecoin’s personal bodyguard. 🛡️

Industry observers, ever eager to speculate, believe this move could open the door for digital assets to enter the global debt market, a realm as vast and formidable as the ocean. Indeed, the market is valued at about $140 trillion, a sum so colossal it would make even the most extravagant of Regency-era estates blush.

Ah, Circle’s USYC, that tokenized money-market fund, has finally graced the BNB Chain with its presence. Developers, those modern-day alchemists, now have access to regulated, yield-accruing collateral within the DeFi ecosystem. How utterly convenient! 🧙♂️

For the uninitiated, Form S-1 is the bureaucratic equivalent of a résumé for companies trying to go public. Kraken, based in Wyoming (because why not?), has yet to decide how many shares it wants to sell or at what price. Imagine planning a dinner party without knowing how many guests or how much the appetizers will cost. Charming. 🍽️❓

And what revelation, you ask? Why, the Senate, in its infinite wisdom, has unsealed the Epstein files, a Pandora’s box of secrets that may yet cast a shadow over our dear TRUMP. Will it weather the storm, or shall it be swept away like a leaf in the autumn wind? 🍂

Currently, Zcash is lounging around at approximately $623, which, if you’re keeping score, is a triple-digit binge on the monthly scale. Its market cap jumped to a glorious $10.2 billion, enough to put it ahead of Bitcoin Cash (BCH), thus flipping the script and earning the shiny badge of being the 18th biggest cryptocurrency. Take that, BCH! 🎉.

According to Bloomberg, ADIC went full “YOLO” with Bitcoin, boosting its stake in BlackRock’s IBIT ETF from 2.4 million to 8 million shares by September 30. That’s a cool $518 million bet on a digital coin that later decided to play rollercoaster without a safety harness. 🎢

According to Capital News, these “Bankless Bitcoin” contraptions-bright orange, vaguely menacing-now loiter in malls like Two Rivers (Gigiri) and Westlands, sharing real estate with conventional ATMs. This juxtaposition is either a masterstroke of financial inclusivity or a harbinger of retail hell, depending on whether one believes Bitcoin will replace cash or merely replace one’s savings. 🎉💸