XRP: ETF Hype vs. Price Crash 🤯

We’re here to unpack this, because frankly, it’s baffling. Let’s dive into the latest happenings around this cross-border token and the company that birthed it, Ripple Labs.

We’re here to unpack this, because frankly, it’s baffling. Let’s dive into the latest happenings around this cross-border token and the company that birthed it, Ripple Labs.

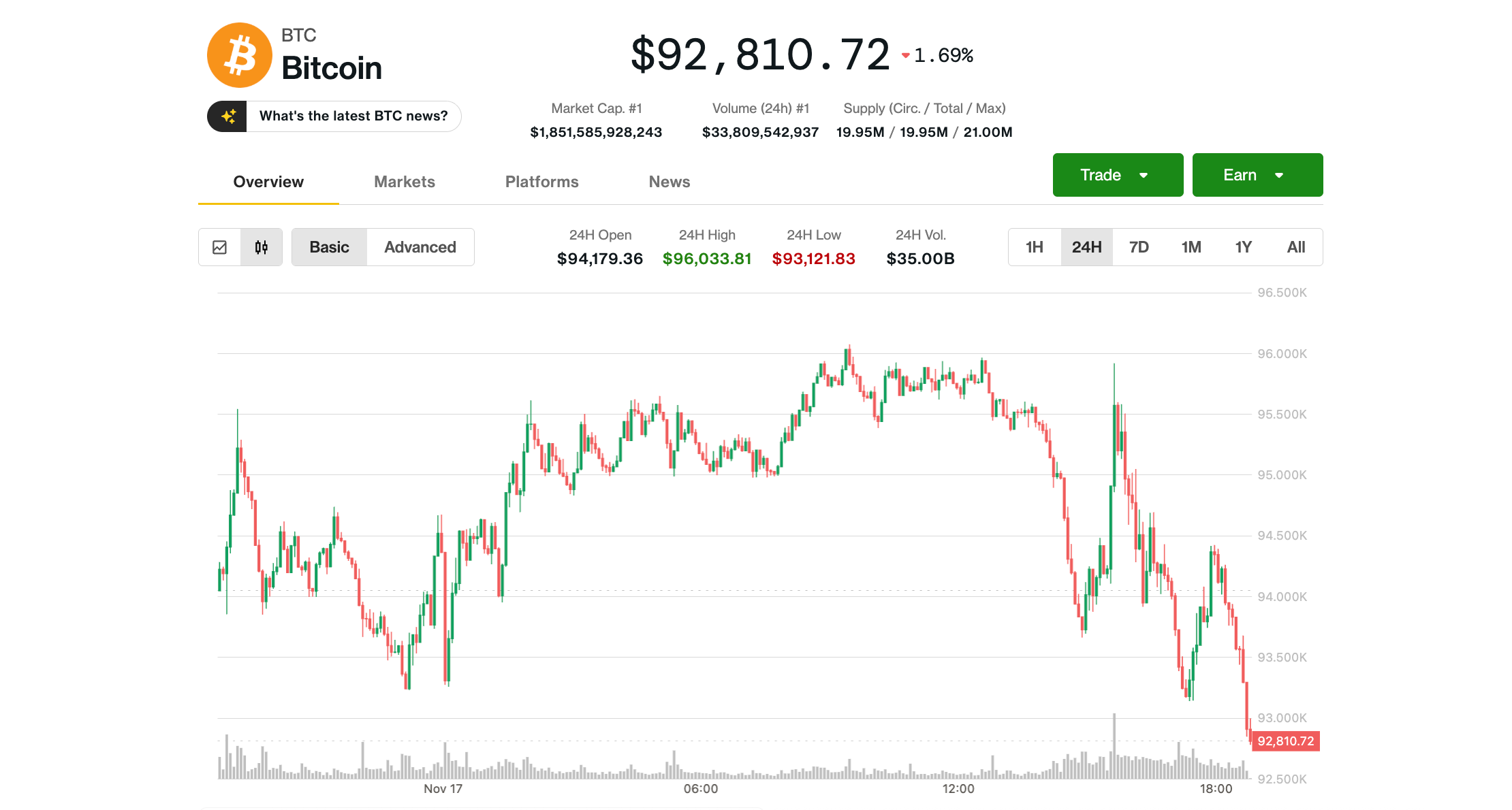

The descent of Bitcoin below that arbitrary figure of ninety thousand, it seems, is a confluence of many small, yet potent, currents. There is talk of “whales” – those immense holders of the digital coin – shifting their fortunes, and of a certain…thinning of the buying spirit. And, of course, the ever-present winds of ‘macro’ uncertainty, a phrase which simply means that those in positions of power have grown anxious and their anxieties spread like a poorly contained rumour.

Prices were down since fundamentals like DEX volume and TPS were declining on top of a bearish market structure. 🐻❄️ Classic: “We’re doing great on paper, but my wallet says otherwise.”

XRPM will proudly flaunt its presence on the Cboe BZX Exchange, CUSIP 032108375 (pretend you understand what that means), with a reported $750,000 net asset size, 30,000 shares outstanding, and a total expense ratio of 0.75%. Because 75 basis points is, by all definitions, reasonable-for a fund that’s basically a rocket ship wearing a straitjacket.

The VanEck Solana ETF (VSOL) moseyed into town on Monday, joining the likes of Bitwise and Grayscale, who’ve already staked their claims late in October. Together, they’ve lassoed over $380 million in inflows, proving that even in the Wild West of crypto, there’s gold in them thar blockchains.

Enter: World Liberty Financial. Not to be confused with a circus, though one might be forgiven for the mistake. This noble venture – proudly backed by the Trump dynasty, because why not? – launched a stablecoin called USD1, presumably because “Trump Bucks” sounded too honest.

The ambitious LevelField, with its eye on a grand prize, plans to become the very first Federal Deposit Insurance Corporation-insured chartered bank offering a veritable smorgasbord of crypto-integrated services across the entire U.S. But alas, the financial details remain as elusive as a well-guarded treasure chest. A mystery for now, perhaps forever? 🤔

According to the wise soothsayers at Santiment, the chatter on social media has grown as concentrated as a shot of vodka in a Russian winter. The Social Dominance metric, that curious barometer of online obsession, measures the percentage of crypto-related babble dedicated to a single asset. And lo, Bitcoin has claimed its throne, with 36.4% of all discussions swirling around its volatile crown. 👑

Once upon a time, in the land of decentralized finance, there lived a noble creature named Dappradar. Born in 2018 during the blockchain gold rush, it soared high, tracking dapps across 50+ blockchains like a digital dragon with a spreadsheet. But alas, even heroes must bow to the whims of the market.

Bitcoin, that mercurial dancer, stumbled to a fresh six-month low on Monday, its steps faltering as crypto sentiment, that fragile bird, took flight into the abyss. 🦋💸