MYX’s Wild Dance: Will It Waltz to $3 or Stumble? 🎭💸

They whisper of selective accumulation, cooling leverage, and liquidity pockets – guiding whether MYX waltzes to 3.0-3.5 or stumbles to 2.3. 🕊️💨

They whisper of selective accumulation, cooling leverage, and liquidity pockets – guiding whether MYX waltzes to 3.0-3.5 or stumbles to 2.3. 🕊️💨

Trading at a humble $2.31, XRP is caught in a tug-of-war between the bulls and the bears. FenzoFx’s charts paint a picture of a tightening noose-er, range-between $2.072 and $2.223. A place where buyers, like starving peasants, gather in hopes of a feast. 🍞🐂

Consider Portage Biotech, a name that once whispered of sterile labs and pipette serenades. Now, it squirms in the spotlight as a Toncoin (TON) treasury maestro, its coffers fattened by staking and Telegram’s digital carnival of games and mini-apps. A pivot so audacious, one might think the founders inhaled too many fumes from a faulty NFT printer. 🤖

Now, here comes the fun part: the debates and theories. Is this just another round of Bitcoin’s natural volatility, or is this the slow but sure arrival of the dreaded bear market? Oh, let me tell you, there’s a fascinating theory floating around, suggesting that once certain technical levels are breached, the price could spiral into what feels like an eternity of correction. Brace yourself, dear reader. It’s a bumpy ride ahead!

Imagine a world where privacy transactions are not only cloak-and-dagger but also cheap enough to make your grandmother’s knitting club look extravagant. Modern privacy networks now process transactions so inexpensively they’d make a penny look like a fortune. The days of spending $100 in gas are as outdated as dial-up internet.

Zcash, the belle of the privacy ball, has yet to make a proper splash with Joe Public. According to Google searches, the interest in ZEC’s price is as lively as a Sunday sermon, trailing behind XRP and Solana (SOL), who are prancing about like they’re at a Venetian masquerade. Delphi Digital, that wise old owl, confirms that while privacy tokens are gaining some traction, ZEC’s gains are mostly the playground of the high rollers-up tenfold from its lows, no less! Meanwhile, TORN, that cheeky underdog, has been hitting new all-time high TVLs (Total Value Locked, if you please).

“Zcash keeps shining in the privacy spotlight, while the crowd watches from the sidelines. Typical, really.” – Delphi Digital, probably with a monocle and a cigar, circa 2025.

The cryptocurrency, that fickle lover of the financial world, has plummeted to its lowest in six months, slipping beneath the critical $100,000 threshold like a weary traveler seeking shelter in a storm. 🌩️

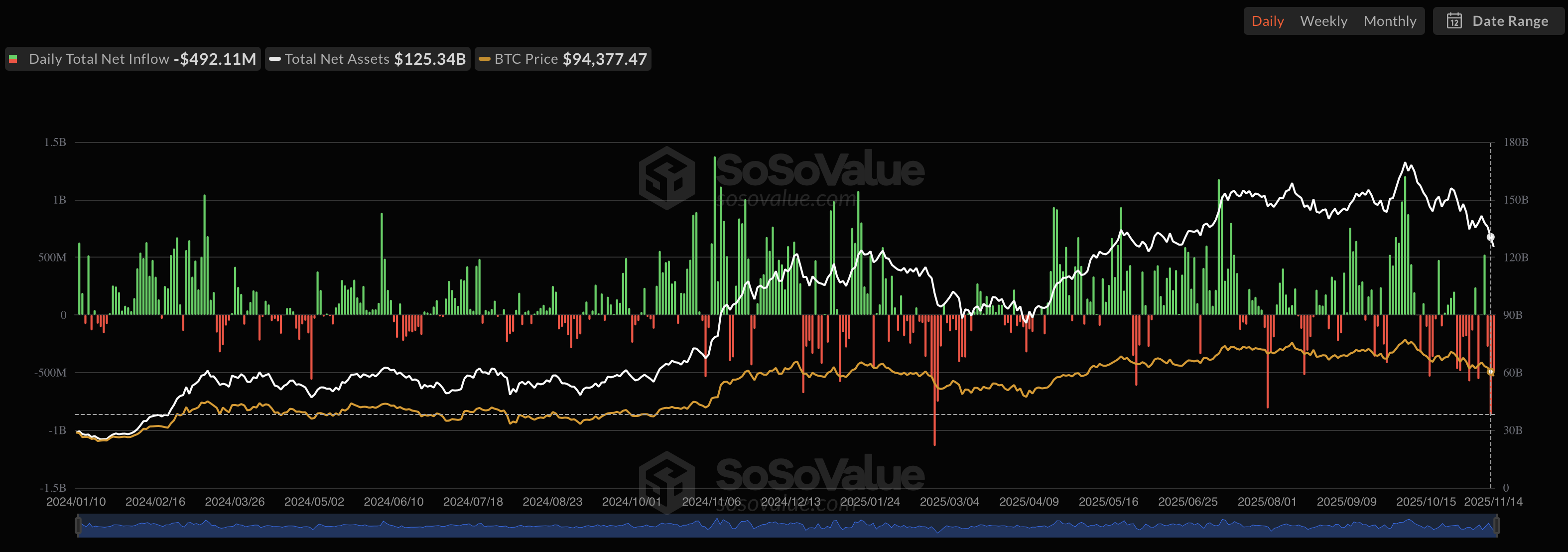

Our dear Bitcoin ETFs have been on a losing streak longer than a Sunday matinée, with three consecutive days of liquidity loss-peaking in chaos on November 13th, the worst since the dawn of the last nine months, according to SoSoValue. A staggering $1.6 billion evaporation in just three days-oh, the drama! November 2025 might just take the cake as the most theatrical month since Molière himself was alive.

In what might seem like a plot twist worthy of a Netflix binge, analyst ZAYK Charts dropped a hot take on November 14, 2025 – the SEI/USDT 2-day chart has done its best impression of a falling wedge. Now, don’t get me wrong, wedges aren’t exactly the love story of technical analysis, unless you’re into participants exhausting themselves before a potential bullish kiss. Apparently, SEI’s been doing this dance since early 2024, each wedge ending with a lovely breakout and a bit of a gain-like a yo-yo with ambitions.

The market is split as kids over a new toy – those in the “fallen angel” camp think we’re headed for a bigger crash, while the “optimists” still wait for the skies to clear, seeing this as an all-too-lovely dip. It all boils down to one level: reclaim it and boom, it’s up! Miss it? Fasten your belts, ’cause the abyss awaits.