What’s New in Pi Network Verification? A Tale of Delays and AI

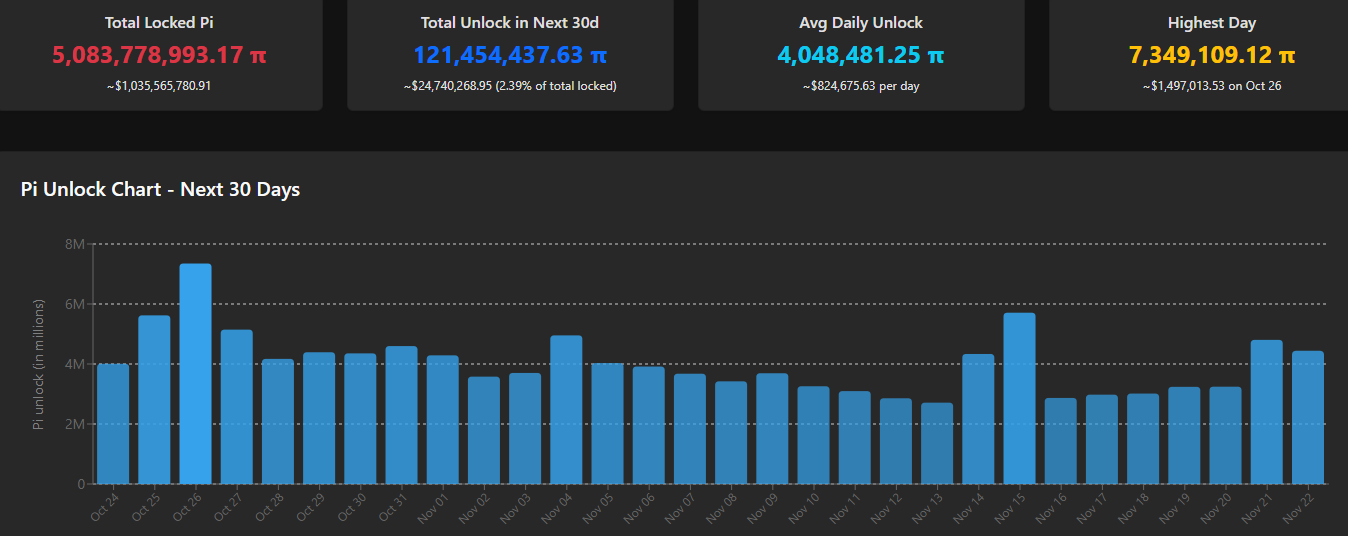

Among these crowds of eager pioneers, there were those who had been plugging away at their computers, the lungs heaving while they waited to hear about their verification-their golden ticket. Some waited weeks, some more, only to be met with the cold shoulder of rejection. The internet isn’t kind, as you know, and here they were, shouting into the void about their woes. Now, in a beautifully orchestrated twist, the bright folks at Pi Network have come out of the shadows with an update, shedding light on the treacherous, twisting path to KYC paradise.