🚨 WLD Price Plummets: Is This the End of the World(coin)? 🚨

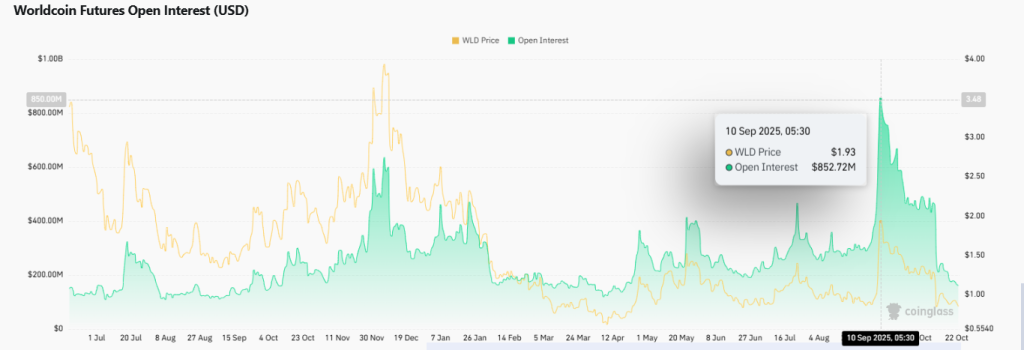

Meanwhile, the technical patterns-those squiggly lines that analysts love to overanalyze-show that WLD has broken down from an ascending channel. This channel, once the backbone of its upward momentum, now lies in ruins, like a forgotten Lego tower after a toddler’s rampage. 🧱💥 The analyst (probably sipping coffee and looking concerned) notes that if the bleeding continues, the next support level is around $0.40. That’s a steep correction, or as I like to call it, “a trip to the financial bargain bin.” 🛒