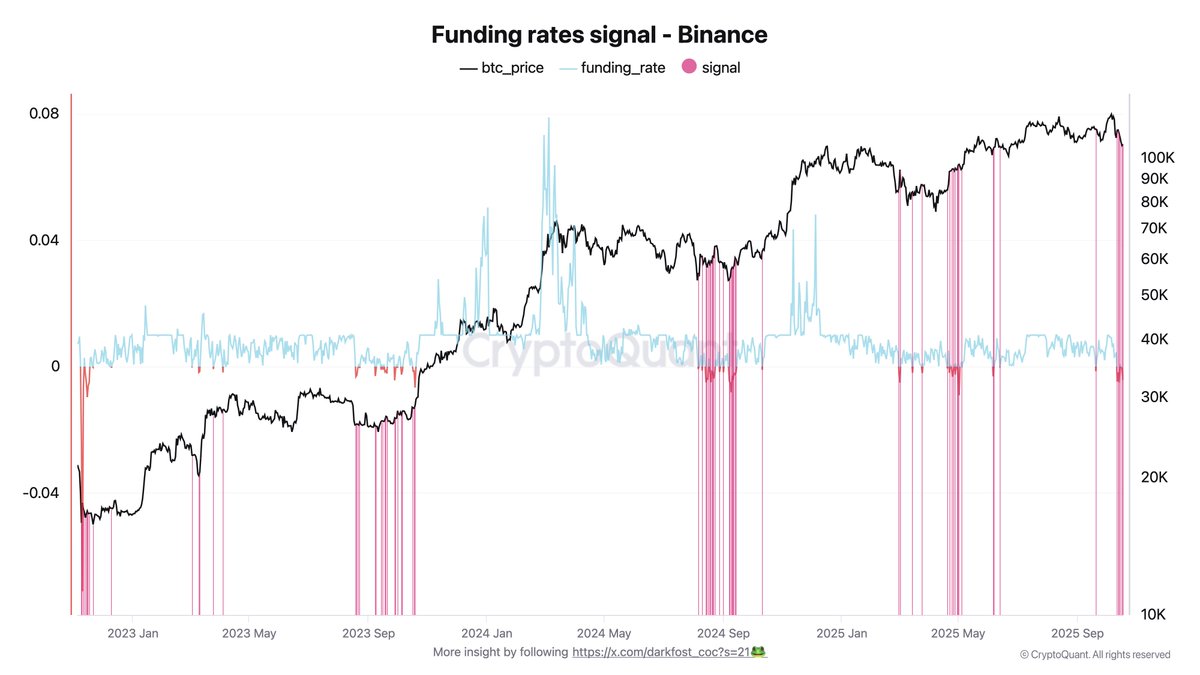

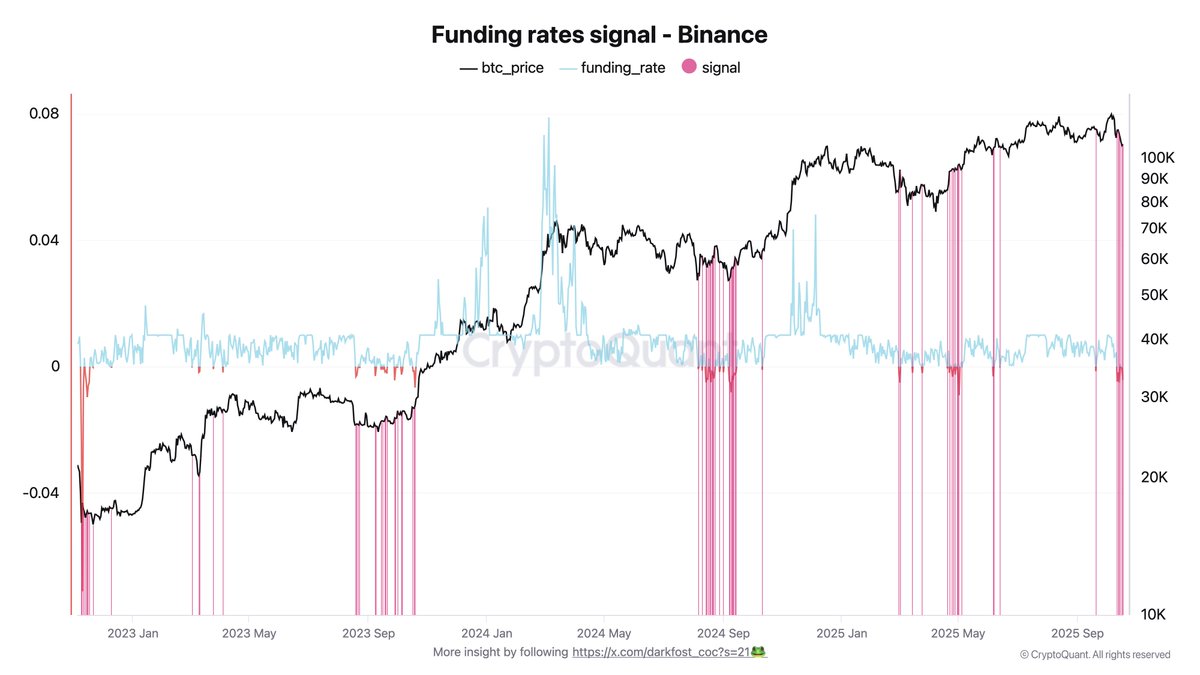

According to the esteemed oracle of doom, Darkfost, Bitcoin may now be entering a “phase of disbelief,” a term that sounds like the latest fad in existential therapy. This, dear reader, is the moment when investors, having been scorched by recent volatility, regard any hint of recovery with the trust one might afford a bridge in a thunderstorm. The derivatives market, that chaotic bazaar of wagers, reflects this turmoil through funding rates that have turned as sour as a forgotten fruitcake. On Binance, that paragon of trading virtue, negative funding rates have persisted for six days running, a testament to the market’s preference for shorting over longs, as if betting against the sun rising.