Crypto ETFs: The Billion-Dollar FOMO Party 🎉💸

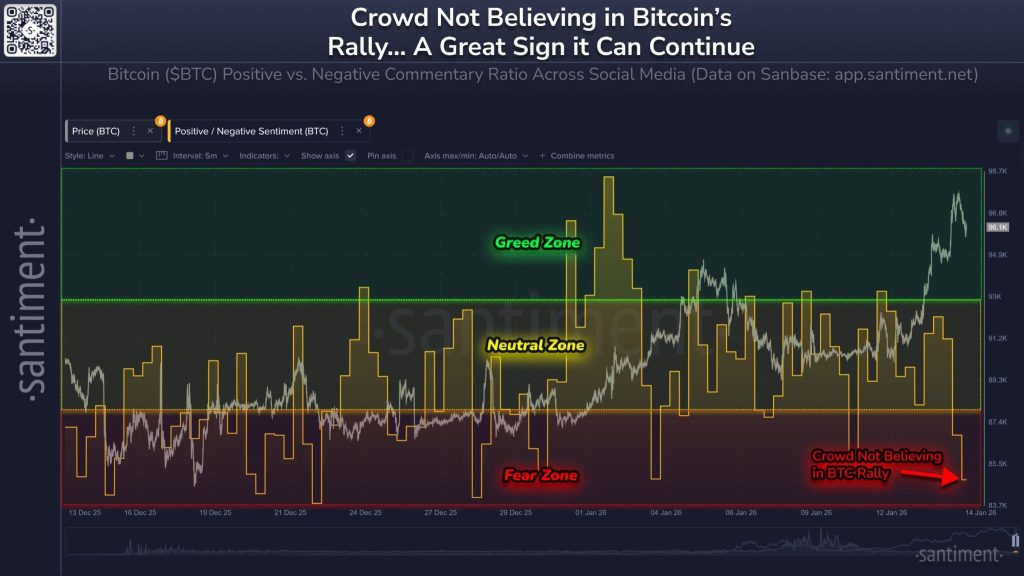

Bitcoin ETFs are still the life of the party, even when Bitcoin itself is sulking in the corner below its local highs. New inflows are outpacing outflows, which is basically the financial equivalent of “I’m fine, YOU’RE fine.” Institutions are treating dips like a sale at Zara-an opportunity, not a disaster. 🛍️💰