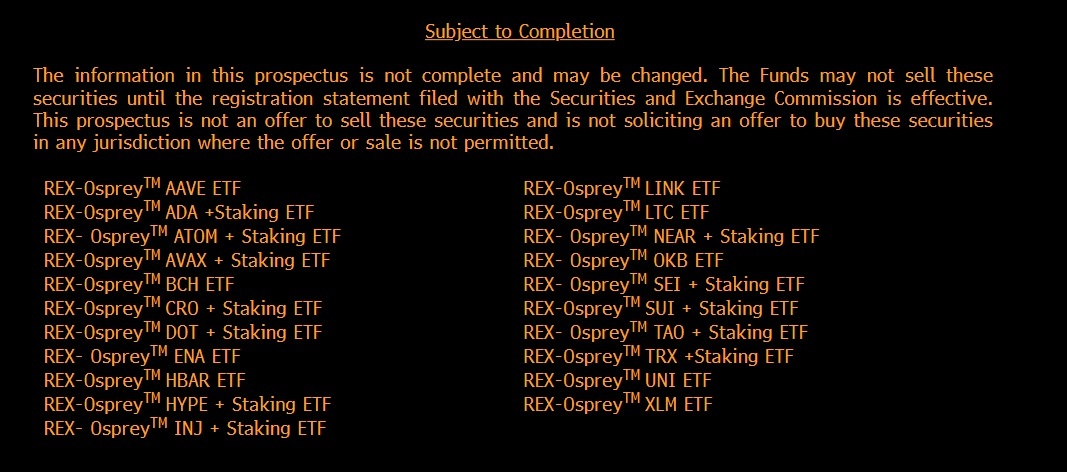

🤑 Crypto ETF Frenzy: Wall Street’s Wildest Gamble Yet! 🎭

Mark my words, dear reader, a seismic shift-or should I say, a theatrical upheaval-is upon us! More than 30 cryptocurrency exchange-traded fund (ETF) applications have flooded the U.S. Securities and Exchange Commission (SEC), a deluge so absurd it rivals the plots of my own comedies. Institutional interest, they say, is expanding-or perhaps, simply losing its wits! 🌪️