ETH/BTC Boom? Will Ethereum Finally Surge Like a Riverboat on the Mississippi?

While the crowd’s attention is elsewhere for the moment, ETH could just stroll right into success before you can say Jack Robinson. 😅🚶♂️🚀

While the crowd’s attention is elsewhere for the moment, ETH could just stroll right into success before you can say Jack Robinson. 😅🚶♂️🚀

Key takeaways:

Yet fortune, that fickle mistress, turned her gaze with a dry smile. Almost at once the balance shifted, and within hours the trade lay down by roughly $325,000, as if the ledger would rather whisper misfortune than sing victory. But the larger tragedy, the one that weights the scales of men’s souls, is found in the ledger itself: his Hyperliquid account now sits $22.5 million in cumulative losses and more than $67 million below its peak equity, a mountain of numbers that makes a man pause and wonder at the arithmetic of risk 🤔.

Under the definitive agreement, Bakkt Holdings Inc., with a flourish of quills and seals, shall issue Class A common stock equal to 31.5% of the “Bakkt Share Number,” as decreed in a previously disclosed cooperation agreement between these two noble houses. 🖋️

Oh, what a tangled web we weave, when we practice the noble art of predicting the future! Ukraine, that bastion of moral clarity, has deemed Polymarket a den of iniquity, a siren song luring souls into the abyss of unlicensed gambling. How quaint, how quaint, to think that the fate of nations can be bartered like so many coins on a roulette table. 🎰

On Monday, the NCA unveiled the results of its inquiry into the hearts and minds of 2,000 U.S. adults, conducted on the auspicious date of January 9th. The findings, one might say, illuminate a chasm between the public’s thirst for innovation and the banking sector’s recent legislative entreaties-akin to the tension between Elizabeth Bennet and Lady Catherine de Bourgh.

Chainlink Price on the one-hour chart shows the definite transition of the previous stage of distribution to a wider corrective pattern. Having reached its peak around the $14.00 area, the token has established a series of lower highs and lower lows, a fact that testifies to short-term bearish control. 📉

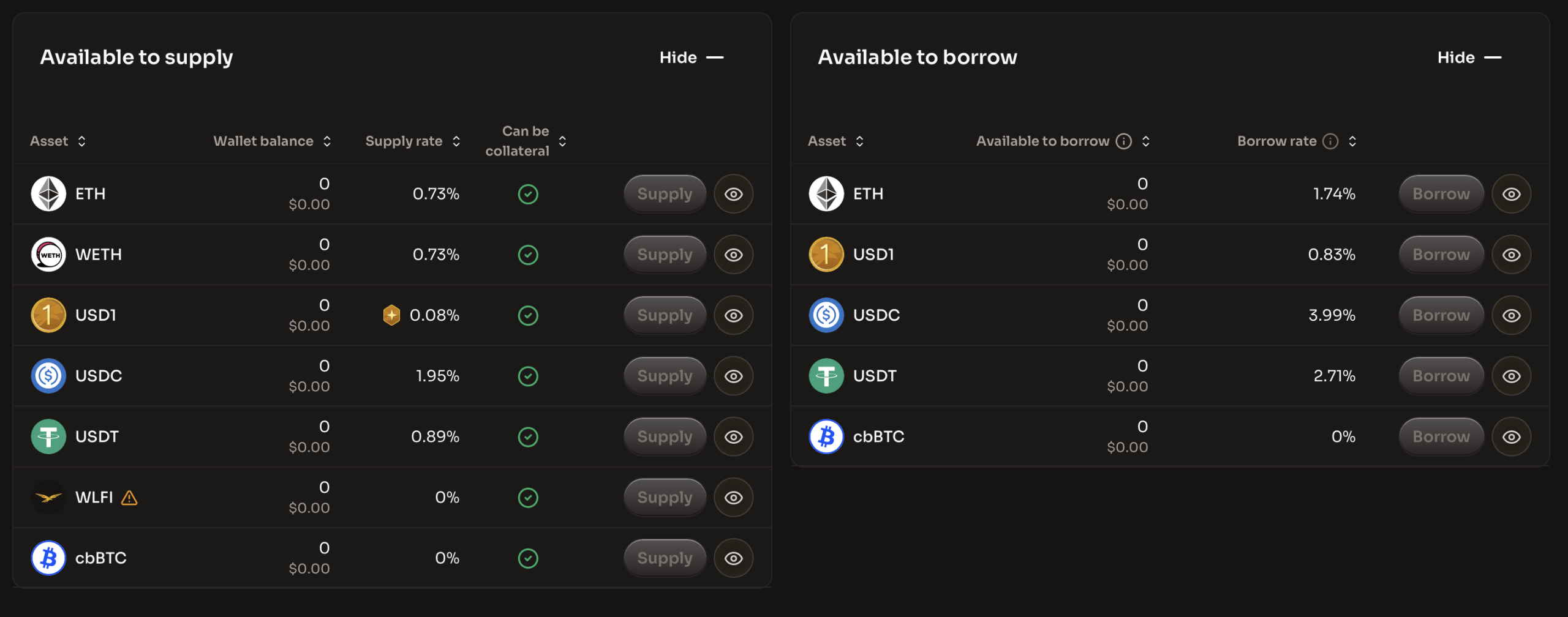

Thus, World Liberty Financial has unveiled World Liberty Markets, a web-based contraption for the genteel practice of lending and borrowing-though one wonders if Mr. Darcy would approve of such Dolomite-assisted entanglements. The platform invites users to supply their USD1 stablecoin (or post collateral of acceptable pedigree) to partake in this most modern of financial dalliances.

//media.crypto.news/2026/01/SOLUSDT.P_2026-01-13_03-14-55.webp”/>

These scholars, in their Sunday best of jargon, argue that without a state-sanctioned digital euro, Europe risks surrendering monetary sovereignty to faceless tech overlords. One wonders if they’ve considered the irony of trusting a central bank over a corporation-like swapping one cage for another, slightly shinier one.