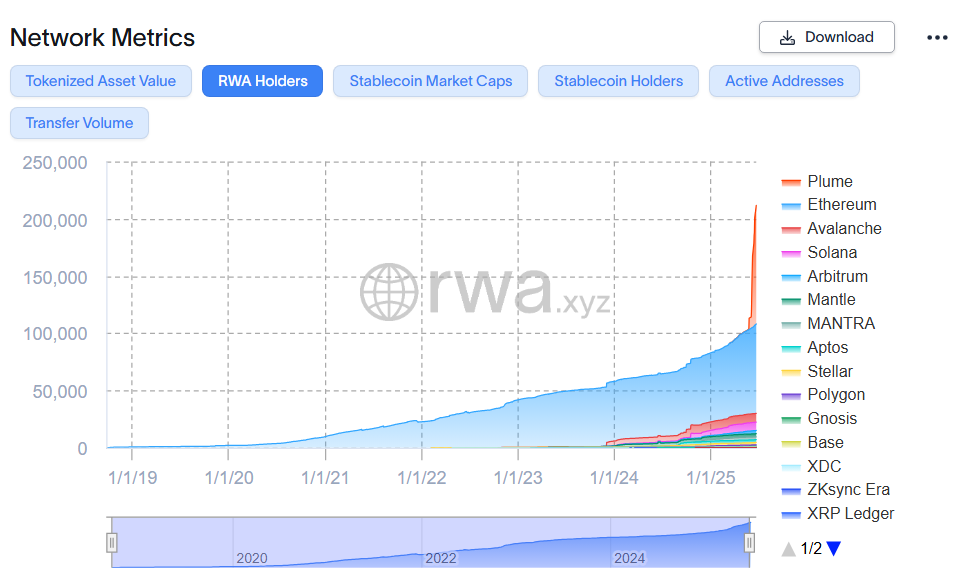

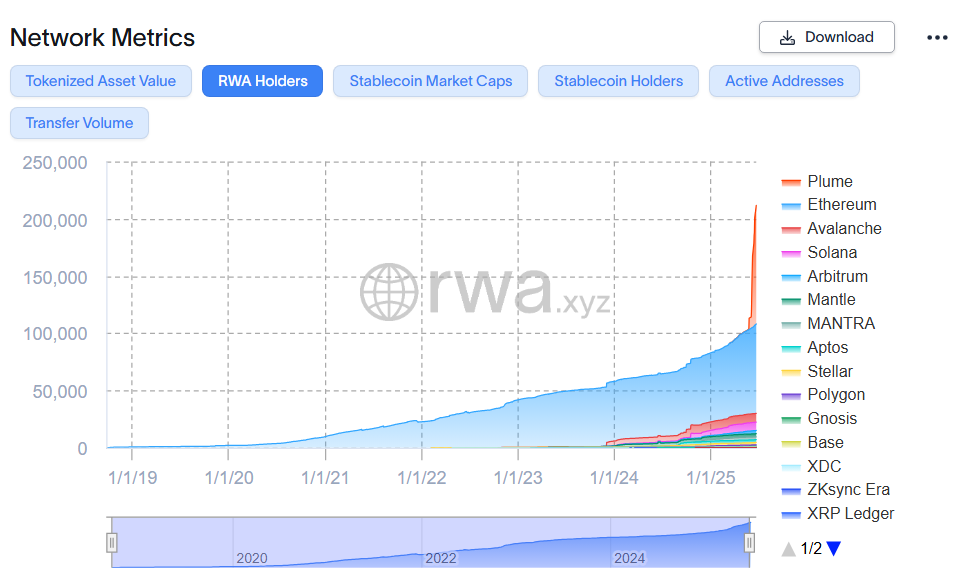

You Won’t Believe How Plume Became the King of RWA Holders Overnight 😲

How did this happen? Was it dark magic, a strategic masterstroke, or did someone just accidentally click “Duplicate Wallets” too many times? Let’s investigate 🕵️.

How did this happen? Was it dark magic, a strategic masterstroke, or did someone just accidentally click “Duplicate Wallets” too many times? Let’s investigate 🕵️.

SHIB, that legendary offspring of the meme gods, rose today not like a Phoenix, but like someone who’s just realized their mother-in-law is arriving for the weekend. Up 8%! Even the pigeons in Patriarch’s Ponds are gossiping about it. 🐦

But lo! Only yester-morn, our enterprising financiers, not content with mere modesty, seized 1,111 new Bitcoins as if picking apples in autumn. And now, with their “555 Million Plan” (for who settles for small, unremarkable numbers?), Metaplanet charges forth, aiming for a staggering 210,000 coins by 2027. Pray, does Molière spot a touch of ambition here? Or simply a penchant for the grandiose?