Bitcoin’s $116K Wall: A Tale of Stagnation and Hope! 🚧

Yet, lo! Two potential catalysts, like mischievous sprites, hover on the horizon, promising to lift the spirits of the downtrodden investors! 🧙♂️

Yet, lo! Two potential catalysts, like mischievous sprites, hover on the horizon, promising to lift the spirits of the downtrodden investors! 🧙♂️

The illustrious crypto exchange, Binance, has thusly issued a proclamation to the refined Web3 projects and their respective teams, warning of the opportunistic scammers that incessantly promise victims a coveted spot on the exchange’s comprehensive list-should a not-inconsiderable fee be forthcoming.

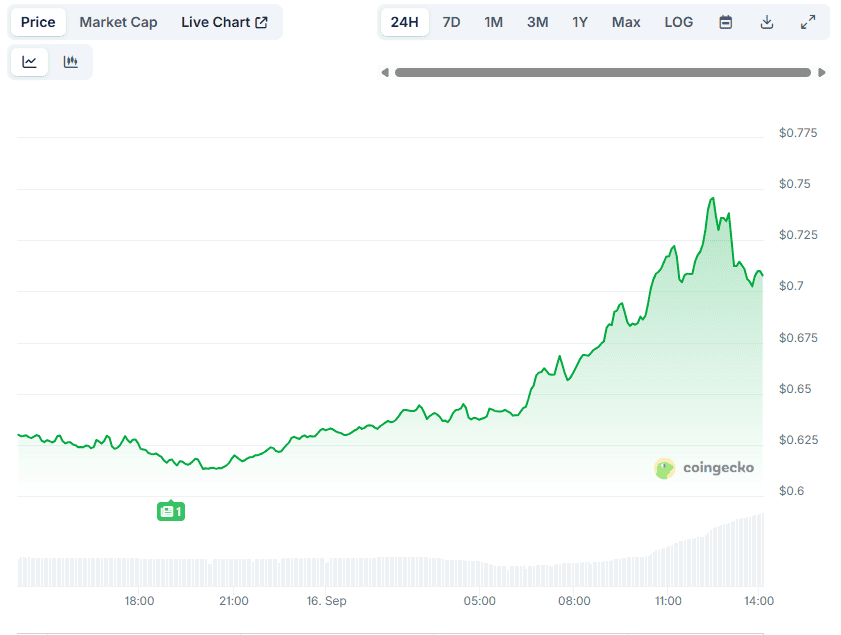

Leading South Korean platforms Upbit and Bithumb revealed four crypto token listings, driving price volatility. Meanwhile, OKX and Bybit will also add trading support for two altcoins. Because nothing says “we care” like a 40% price surge followed by a 23.5% crash. 📉💥

In the shadow of the banking oligarchs, Santander-that Spanish leviathan of finance-has decreed through its digital vassal, Openbank, that the proletariat of Germany (and soon Spain) may now dabble in the arcane arts of cryptocurrency. Bitcoin, Ether, Litecoin, Polygon, and Cardano-names that once whispered only in the dark alleys of the internet-now sit alongside the staid investments of the bourgeoisie. 🪙

Hougan’s memo swings the pendulum from that slowpoke, case-by-case approval shuffle to a slick 75-day greenlight route-so long as your crypto’s got futures trading on some U.S. regulated rodeos like CME, Cboe, or the Coinbase Derivatives Exchange.

Those clever chaps at Bitfinex, in their Alpha report, whisper sweet nothings about market conditions aligning for a grand encore once September’s gloomy seasonality takes its final bow. 🎭 The crypto market cap, my loves, has swollen by a delectable 4.8%, adding a cool $180 billion to its already lavish coffers. Trillion-dollar club, here we come! 🥂

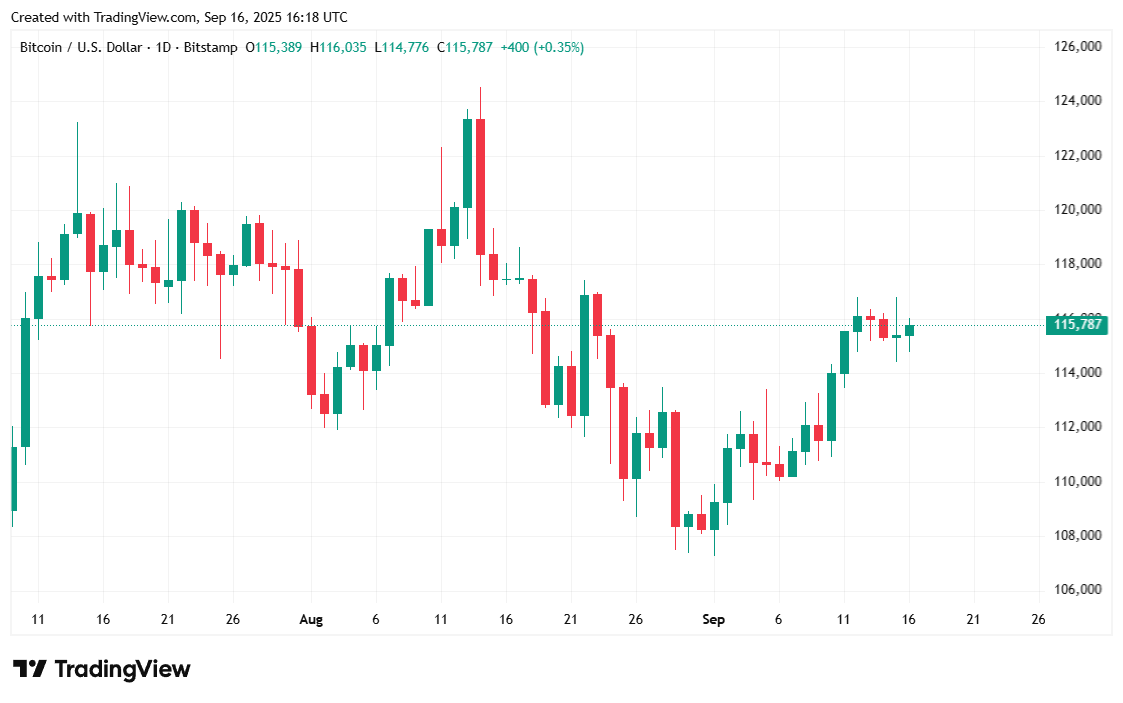

The last 24 hours? Well, let’s just say they were a *bit* underwhelming in the crypto world. Most of the heavy hitters stayed as still as statues, barely twitching in price.

Monday saw the Nasdaq, S&P 500, and even gold hit all-time highs, but bitcoin has climbed up more cautiously as the crypto market braces for what may be the first interest rate cut in 2025 after the Fed emerges from its two-day meeting, which starts today and ends with Fed Chair Jerome Powell’s press conference tomorrow. It’s like watching a toddler learn to walk while everyone’s holding their breath-except the toddler is wearing a suit and has a PhD in economics.

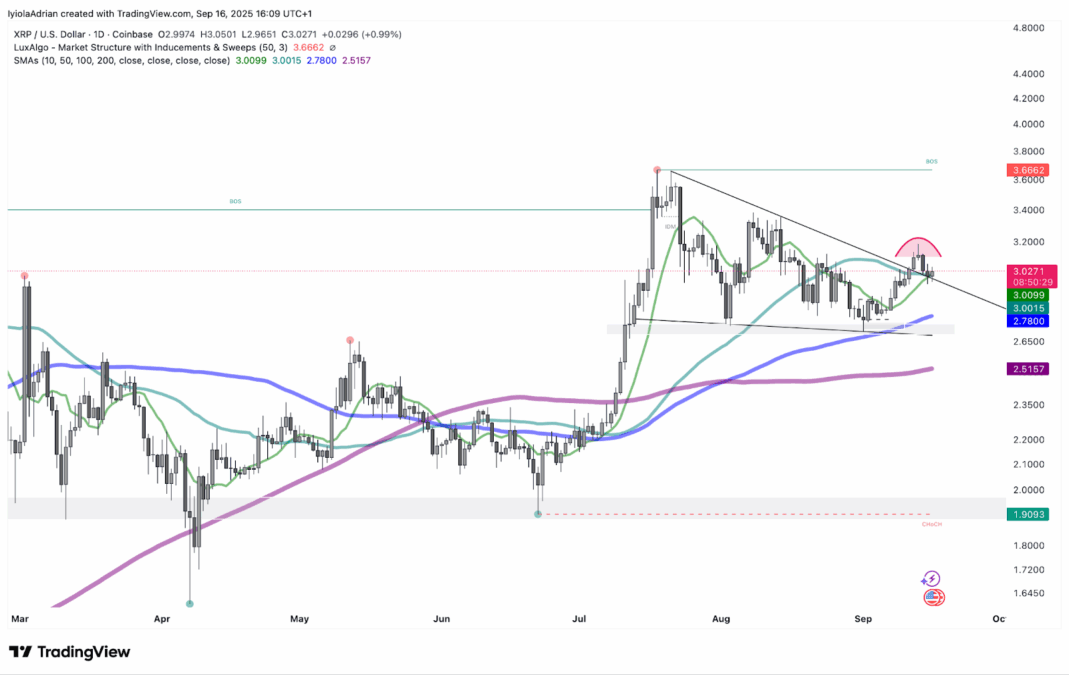

Pray, cast thine eyes upon the chart from TradingView, where a descending triangle hath formed since XRP’s lofty ascent to $3.66. A pattern most dire, marked by a stubborn support and a resistance line that slopes downward like a scoundrel’s luck. ‘Tis a sign of doom, I say! 🌊

It’s that time of year when the Federal Open Market Committee (FOMC) holds a meeting to pretend to decide the fate of the economy while Bitcoin, like an anxious teenager, waits for the verdict. This Tuesday marks the start of a two-day meeting, and investors are bracing for a Wednesday that could either launch Bitcoin to the moon or leave it stuck in traffic. Bitcoin hit an all-time high of $124,533 in August, before slipping to $109,907 (because why not?) on September 1. But don’t worry, it’s back in action, trading between $114,395 and $116,833 – at least it’s trying! 😅