BTC’s Descent: Long-Term Holders Stay Calm! 💸

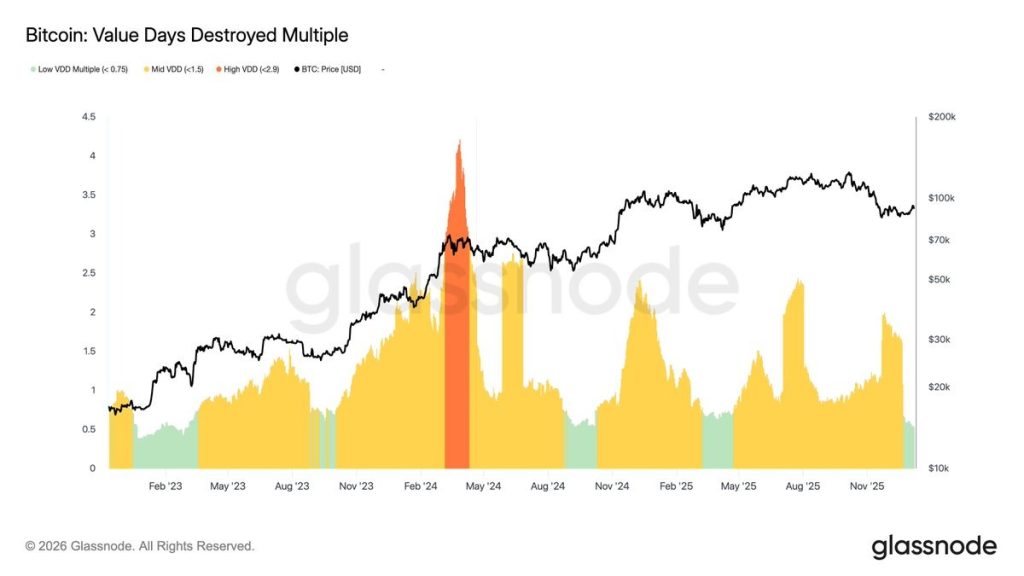

Though the price has slipped below its former glory, the on-chain data whispers a tale of quiet defiance. The older coins, like seasoned aristocrats, remain tucked away, their owners uninterested in the chaos of short-term traders and leveraged whims. A most refreshing contrast to the tumultuous antics of the speculative lot! 😏

Why Crypto Marketing is Over: Founders are Now the New Product! 🤯🚀

So, what happened, you ask? Well, it turns out trust took a vacation, and good luck getting it back! With scams popping up faster than a bad Tinder date and metrics as genuine as my Aunt Edna’s “secret” cookie recipe, buyers decided that maybe, just maybe, they should stop believing in all that marketing mumbo jumbo. The result? Attention no longer converts, and frankly, it’s as tragic as finding out your favorite show got canceled.

BlackRock Dumps $359M in Bitcoin & Ethereum – Is the Market’s Titanic Just Taking on Water?

Imagine the scene: BlackRock, the grand pontiff of asset management, sneaking around like a finance ninja, shifting a cool $359 million to Coinbase just as the crypto world was throwing a tantrum, perhaps over a bad coffee order-oh wait, that’s just the markets. Both Bitcoin and Ethereum took a nosedive, probably tired of being the punching bags for the latest “What if we all panic sell?” episode. 🥋

BNB to the Moon? 🚀 (Maybe?)

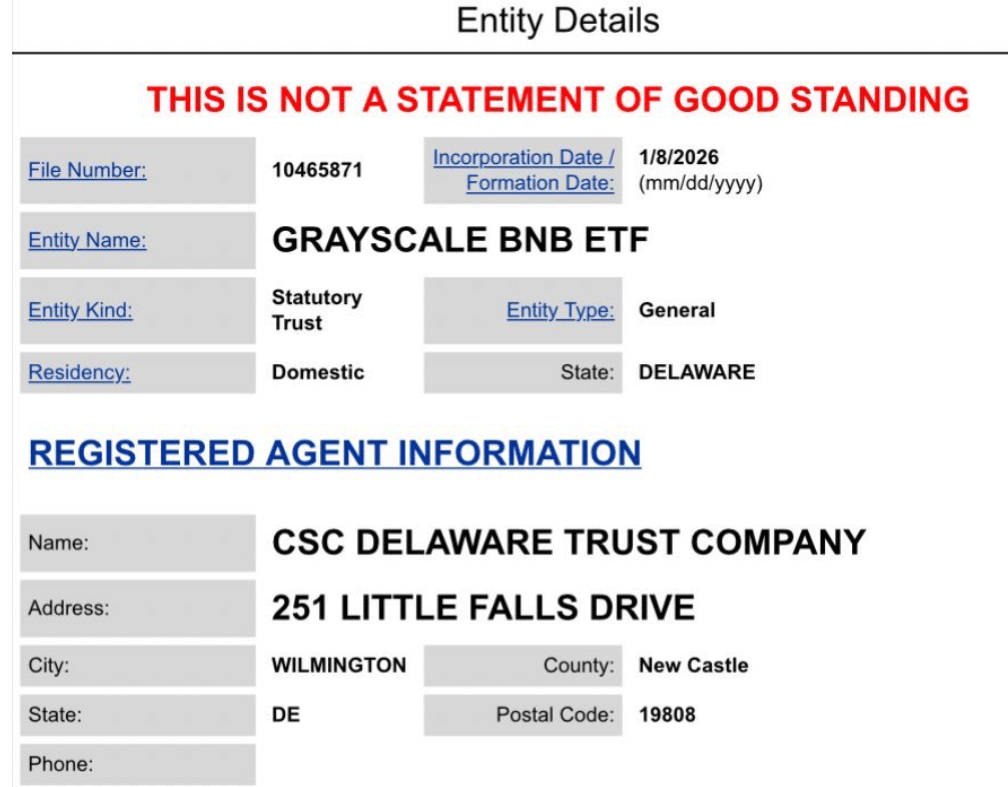

So, Grayscale has registered a statutory trust in Delaware. A very official-sounding thing, isn’t it? It preceded a formal application to the US Securities and Exchange Commission (SEC). A preliminary move, they call it. As if anything involving cryptocurrency isn’t already a bit… preliminary. VanEck, poor souls, are attempting the same. A veritable stampede towards the BNB pot of gold.

Free Money?! Nexo’s Bold New Move 🤯

So, on the eighth of January, in the year of our Lord 2026 (a date laden with… significance, no doubt), Nexo announced this… “Zero-Interest Credit” (ZiC). A widening of their Nexo Credit Line, they claim. One can now pledge their precious bitcoin and ethereal ethereum – yes, those fleeting digital phantoms – as collateral for a loan devoid of interest. They speak of “liquidity,” as if a man’s soul isn’t already drowning in a sea of uncertainty. They promise the avoidance of dreaded “liquidation” – a fate worse than debtor’s prison, surely? 🧐

XRP Crumbles Like Soviet Bureaucracy-Will It Survive $2.00? 😱📉

Like a dissident briefly pardoned by a capricious commissar, XRP dared to rise above $2.25. But hope was crushed swiftly. With all the grace of a collapsing tractor factory, it plunged-past $2.20, past $2.150, into the sub-basement of bearish sentiment.

Whales, Channels, and Crypto Chaos: HYPE’s Dance with Destiny 🌊💸

Earlier, this same wallet, like a magician pulling coins from thin air, received 500,000 HYPE ($13.3 million, no less) from a burn address. A noble act of supply reduction, or a cunning ploy? The gods of crypto only smirk. 🔥

🚨 XRP ETF Drama: WisdomTree Bails, Crypto World Goes 😱

So, here’s the tea: WisdomTree, after filing for an XRP ETF just over a month ago (in December 2024, yes, we’re still processing that), has now asked the SEC to hit the eject button. 🚀💥 The filing? Rule 477 of Regulation C under the Securities Act of 1933. Fancy, right? But what it means is: no shares were sold, and the whole shebang is officially kaput before it even got to the market. Talk about a plot twist! 🍿

Is Zcash on the Brink of Collapse? Foundation Claims Everything’s Fine! 😂

Yet, as the winds of change howl, one cannot help but notice a peculiar decline in development activity-a veritable ghost town since 2021, according to the learned analysts at Santiment. The GitHub events have dwindled like autumn leaves in an empty park, coinciding with reports of core developers leaving as if chased by a rabid dog.