Ethereum’s Gas Crisis: 100 Gwei and a World of Suffering! 💸🔥

Ethereum [ETH] kicked off September on shaky footing. 🧱

Ethereum [ETH] kicked off September on shaky footing. 🧱

My dear, Vivopower International Plc, that darling Nasdaq-listed enterprise with a penchant for all things green, announced on the most unremarkable day of Sept. 2, 2025, that it has partnered with Doppler Finance. The objective? To enhance its XRP-based treasury strategy, of course! How très chic! The announcement, dripping with financial flair, states:

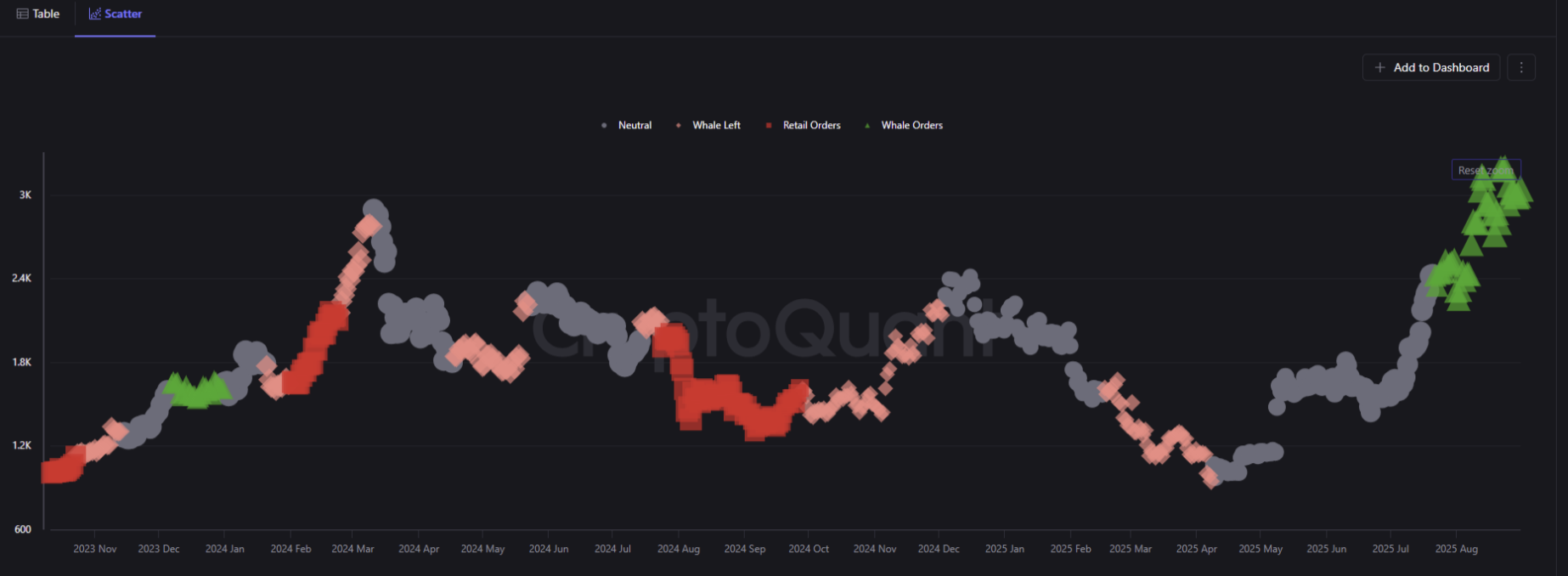

In a report that could only be titled “Don’t Sleep on Those Whales,” analyst Crazzyblockk (yes, that’s the name they chose) breaks down how *large* investors are flexing their muscles on Binance. The average ETH order size is climbing faster than my anxiety on a Monday morning!

On-chain data shows whales dumping nearly 250 million DOGE since late August. Yes, you read that right-*dumping*. It’s like they’re playing Jenga with the market, and we’re all just waiting for the tower to collapse. Funding rates on derivatives exchanges have gone negative too, meaning short sellers are paying longs. Sounds like someone owes someone else a drink at the crypto bar. 🍸

Mark thy calendars, dear reader, for on the 12th and 13th of November, 2025, the esteemed event, Bitcoin Histórico, shall commence! 🏛️ The National Bitcoin Office, with its cadre of luminaries-Ricardo Salinas, Jeff Booth, Max Keiser, and others-shall grace the stage. A veritable feast of words, though one wonders if their wallets are as full as their promises.

L’ambiance ? Électrique, comme un éclair dans une bibliothèque de mages. Soit vous entrez maintenant, soit vous regarderez le marché s’envoler sans vous, comme un dragon qui a oublié de vous inviter. Cette phase finale ne laisse place à aucune hésitation : le claim imminent va transformer cette ICO en un crash-test digne des meilleures farces de Rincevent. 🤪

On the fateful day of September 2, the tokenization platform Chintai Nexus, with a flourish worthy of a Victorian novelist, announced its partnership with the U.S. gold IRA provider SmartGold. The result? A staggering $1.6 billion of vaulted physical gold has been unceremoniously hauled onto the blockchain. 📜⛓️

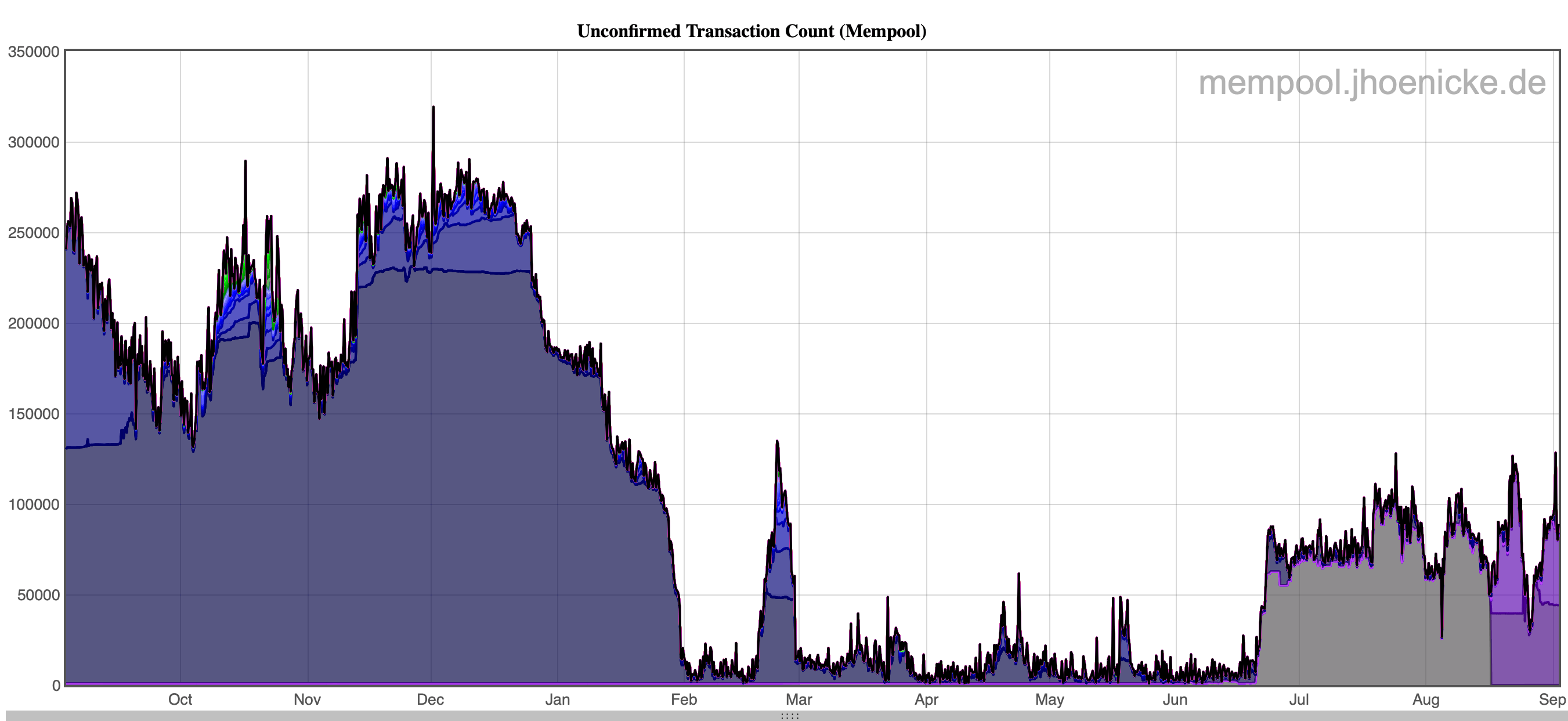

According to mempool.space and Johoe’s tracker, the blockchain is busier than a Starbucks on a Monday morning. There are 85k-93k unconfirmed transactions sitting in limbo, and fees are creeping up. On Sept. 1, sending BTC cost $1.75-perfect for that “I’ll just send $10” moment that turns into a $20 transaction. 😬

Now, if you think they tried this whole creator fee thing a few months ago and it crashed faster than a budget spaceship, you’re right. But fear not! Project Ascend is here to fix it, with a fancy tiered system based on how shiny and valuable your tokens are. Because nothing says “trust” like a good old fashioned market cap hierarchy.

On September 1st, the World Liberty Financial (WLFI) token graced the trading floors of Binance, OKX, and Bybit, and lo, the Wall Street Journal reported that early market activity had bestowed a paper valuation of over $5 billion on the Trump family’s stake.