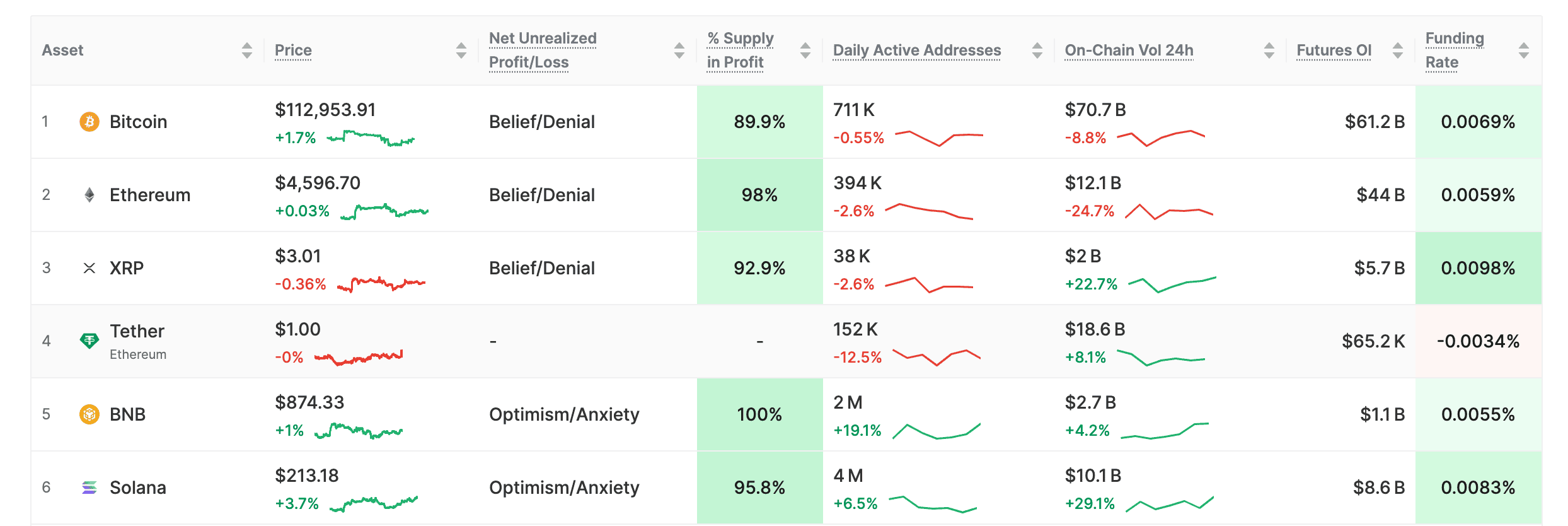

Crypto Chaos: Why Everyone’s Profiting But Still Losing Their Shirts! 😂💸

So, apparently, a lot of people are making money in crypto. Who knew? Analysts are now warning that this could lead to a mass exodus of profit-taking. Because, you know, why not ruin a good thing?