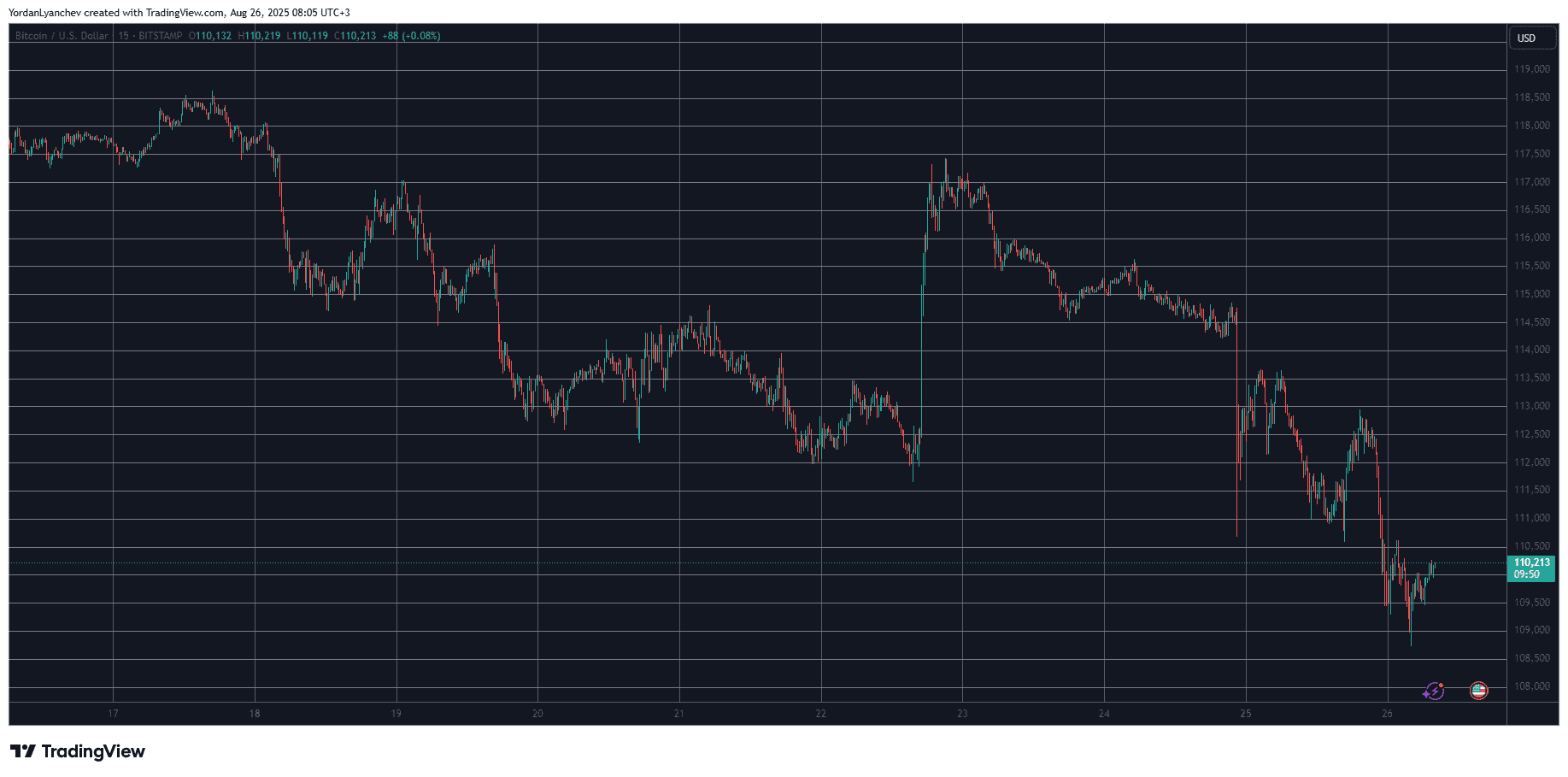

Bitcoin’s Wild Ride: Fed, Gaps, and Retail Tears 😱💸

Enter Doctor Profit, the market guru who’s been staring at charts like they’re the Rosetta Stone. 📈🔍 Ahead of the Federal Reserve’s September meeting (aka the financial world’s version of a soap opera), he’s waving his hands and shouting about technical indicators. Spoiler alert: they’re as bleak as a Monday morning without coffee. ☕😔