Bitcoin’s Calm Seas: A Year Without Drama (Sort Of)

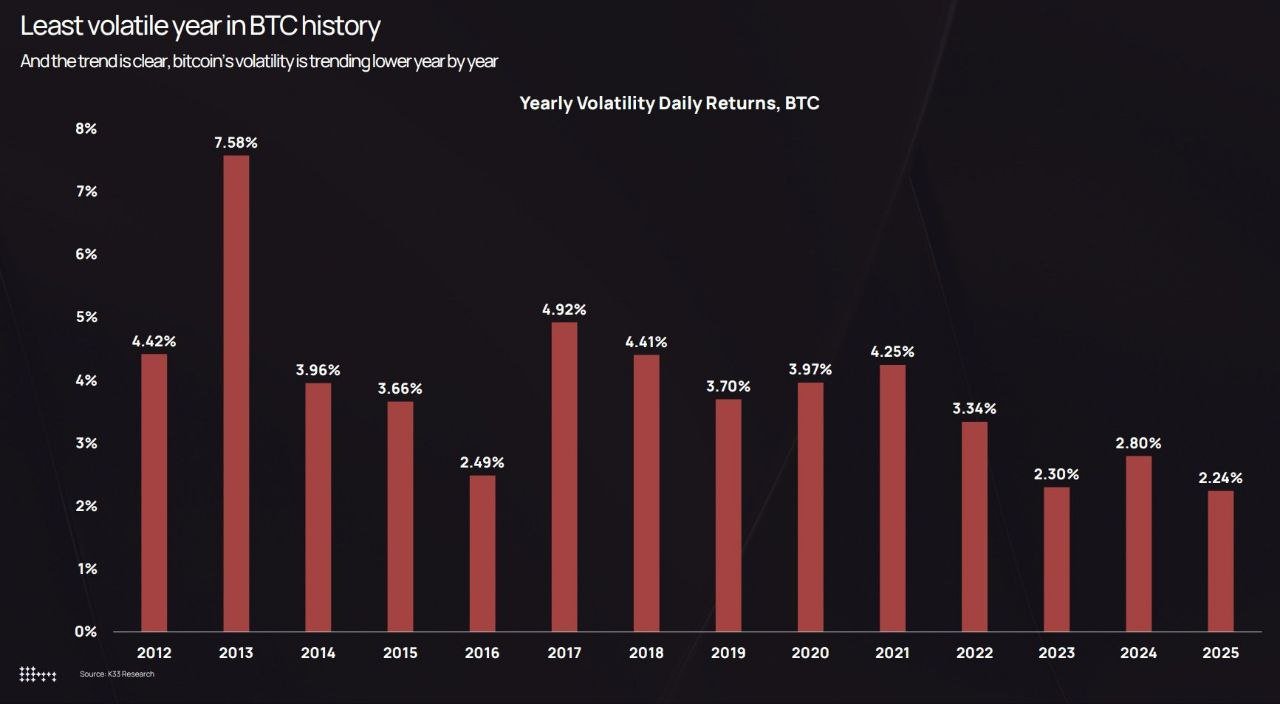

Friday rolled in with K33 Research’s data, though I wish they’d presented it with a sizzle. Turns out Bitcoin wrapped up 2025 as the least erratic it’s ever been. Imagine, just 2.24% average deviation in daily returns. Last year’s bad-tempered tantrums look like those annoying little outbursts your toddler throws when they learn to walk. In 2023, by comparison, that figure slunk up to 2.30%. You can practically hear the collective sigh of relief from Wall Street analysts everywhere!