Filecoin’s Descent: A Bear Market Ballet 🐻🔥 (Spoiler: Support Isn’t Supporting)

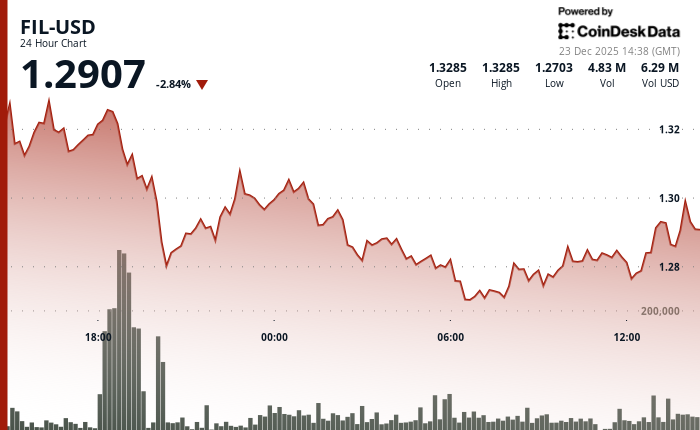

The token’s descent into a bearish channel-complete with lower highs and a 5-cent trading range-is a masterclass in despair, per CoinDesk Research’s model. 🎓

The token’s descent into a bearish channel-complete with lower highs and a 5-cent trading range-is a masterclass in despair, per CoinDesk Research’s model. 🎓

On a Sunday, no less-a day typically reserved for repose-Selig was sworn in as the 16th chairman of the Commodity Futures Trading Commission. 🌟✨ Acting chair Caroline Pham, after a four-year odyssey, relinquished her scepter, leaving behind a legacy of regulatory bravado.

In the heart of Brussels, the esteemed Council of the European Union has unveiled its stance on two pivotal proposals. One proposes a regulation for the issuance of a digital euro-because who wouldn’t want to add another layer of complexity to their financial existence?-while the other seeks to safeguard the sacred status of euro cash across our beloved euro area. How utterly delightful! These declarations were made with the pomp and circumstance befitting such weighty decisions, with the Council preparing itself for vigorous negotiations with the ever-so-reasonable European Parliament.

Gold recently broke $4,420 per ounce on Dec 22, 2025-because nothing says “I’m valuable” like pretending to be a shiny rock while inflation chases you like a dog with a PhD in chaos. Central banks are apparently playing hot potato with gold, and geopolitical risks are the referee. 🏐💣

Eighteen bipartisan House members, led by Rep. Mike Carey (because nothing says “unity” like 18 people agreeing taxes are confusing), wrote a letter to the IRS begging them to fix staking rules before 2026. Their logic? Taxing rewards only when you sell them would “better capture actual economic gain.” Translation: Stop making people pay taxes on gains that exist only in the ether of market whims. They also warned that current rules might discourage staking-oh no, what if people stop securing blockchains? The chaos! Next thing you know, we’ll be printing money on toilet paper.

According to the oracles at crypto.news, Chainlink (LINK) languished at $12.49 on Tuesday, Dec. 23, its market cap a mere $8.84 billion. The price, once so buoyant, has plummeted 16% from its monthly zenith and a staggering 55% from its year-to-date glory. Oh, the hubris of it all! 📉💔

Selig, with that tone of a man who’s seen enough to know it’s never quite as simple as it looks, proclaimed this shift not as a mere policy tweak but as a “strategic repositioning”-fancy words, yes, but perhaps a sign that the long and tangled saga of crypto regulation is finally getting its act together, or at least trying to.

“Retail investors expecting a rising tide to lift all boats will be disappointed,” Ko told CryptoMoon. “We predict no traditional altseason; instead, liquidity will be ruthlessly selective, flowing only to blue-chip survivors with real adoption.” Let’s be honest, that’s just a fancy way of saying “only the cool kids get invited to the party.” 🎉

Mr. Wall Street, in his exhaustive dissection of technical and psychological intricacies, elucidated that his broader perspective on Bitcoin had crystallized a week prior, dispelling any ambiguity surrounding his mid and long-term stance. With these temporal horizons now impeccably defined, he turned his gaze to the short-term tableau, delineating the prevailing market behavior with the precision of a seasoned cartographer.

Funding rates, those sly little serpents, have slithered from 0.04% to 0.09%, a feverish dance of longs and shorts playing Russian roulette with leverage. Glassnode, ever the grim reaper in a suit, declares: “Behold, the longs are back, like vultures circling a dying bull.” Perpetuals, those immortal contracts, now hum with the tension of a thousand unspoken prayers: Please, just don’t crash before Christmas.