Cash Over Crypto: A Tale of Strategy’s Dollar Delight! 💰

But lo! The funds are not spent on BTC, but on… gasp… cash reserves. How pedestrian! 🤭 A curious choice for a company that once bought Bitcoin with the fervor of a poet chasing muse.

But lo! The funds are not spent on BTC, but on… gasp… cash reserves. How pedestrian! 🤭 A curious choice for a company that once bought Bitcoin with the fervor of a poet chasing muse.

Ah, the sweet irony! While others freeze their hands or begin to shed assets when prices dip, our brave souls at BitMine continue piling up ETH, perhaps in a desperate pursuit of some elusive, mythical 5% of the supply. Last week, ETH tumbled from $3,170 to below $2,800-nature’s way of reminding everyone that fortunes can turn as swiftly as a gambler’s luck.

In the meantime, Bitcoin (BTC) has strutted its stuff and surged to a staggering $90,000! Meanwhile, the cumulative market cap of all cryptos known to CoinGecko has inflated by a modest 2% to a staggering $3.12 billion-nothing to sneeze at, I assure you. Tokens like Audiera, Terra, Monad, and Midnight are basking in newfound glory beside the crypto campfire.

Analyst Mark Palmer, with a wink and a nod, proclaims that the structure, counterparties, and cash-flow quality set HUT’s deal apart from the recent wave of AI data center agreements. He doth reiterate his “buy” rating and lifts his price target to $85 from $77, suggesting a 93% upside from Friday’s close of $44.12. Shares, in a premarket frolic, rise by 2.8% to $45.34. 🎢💹

Behold, the mighty Bitmex has witnessed a 53,255% surge in Dogecoin futures volume, which is roughly the same as a toddler discovering a bag of confetti. $260.34 million in 24 hours? Clearly, someone’s been binge-watching The Wolf of Wall Street and forgot to pause for snacks. 🧃💰

Thus unfolds the eternal debate-shall the cold, calculating minds of quantum machines unravel the digital gold rush? Or is this merely another tempest in a teapot, a modern-day parable of Chicken Little shouting “The sky is mathematically falling!”?

In the labyrinth of decentralized dreams, Aave Labs and its DAO brethren find themselves locked in a tango of mistrust. The proposal, a brainchild of Ernesto Boado, sought to wrest control of Aave’s crown jewels-domains, trademarks, and social handles-from the grasp of Aave Labs, placing them in the hands of the DAO. Yet, the manner of its advancement smacked of a midnight coup, with Boado himself crying foul, his name dragged through the mud of haste and secrecy.

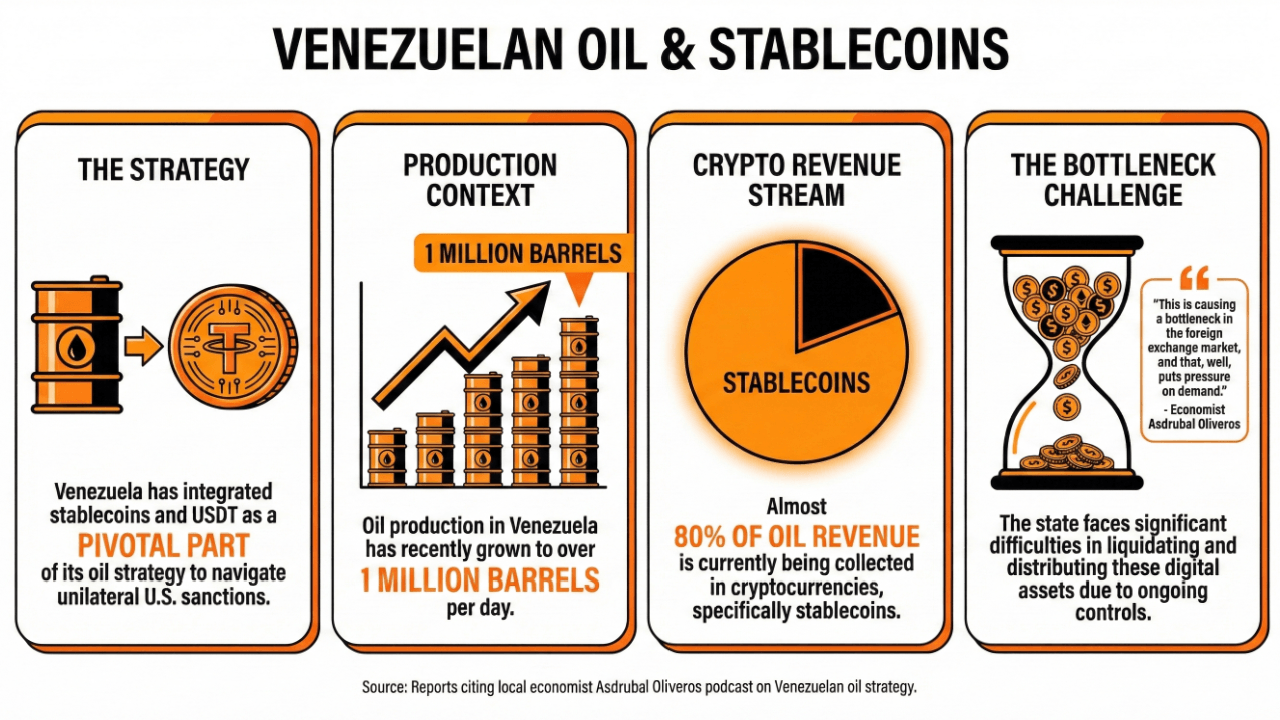

It is, perhaps, a comedy of errors-or a tragedy-when a nation, once wealthy in black gold, now tries to sell its riches in bits and bytes. The clever economist Asdrubal Oliveros, with a twinkle in his eye and a shrug, proclaims that nearly 80% of all the Venezuelan oil-yes, the stuff that once fueled the world-is now paid for with USDT. Who needs the old-fashioned dollar or euro when one can settle debts with a stablecoin that’s perhaps more stable than the government itself?

In a recent X post that screamed “look how responsible we are!”, UXLINK vowed to spend a chunk of monthly profits buying back at least 1% of its token supply. These tokens will then be tucked into Strategic Reserves™️-a fancy term for “we’re hoarding them until we figure out what to do with our life choices.”

Now, let’s talk about this USD1 from World Liberty Financial. With a $2.72 billion market cap and the Treasury’s backing, it’s like the stablecoin equivalent of a trusty dwarf with a crossbow-reliable, if a bit dull. And it’s all under BitGo custody, which is just a fancy way of saying “we’ve got a dragon guarding the gold.” 🐉