In the grand hall of economic discourse, Federal Reserve Chair Jerome Powell, a man of considerable stature and wit, delivered a speech of monumental importance on August 22, 2025, at the illustrious Jackson Hole Economic Symposium. This speech marked a significant turning point, a return to the tried and true methods of yesteryear, a departure from the experimental strategies of 2020, much to the relief and bemusement of many.

Fed Chair Unveils Revised Inflation Strategy

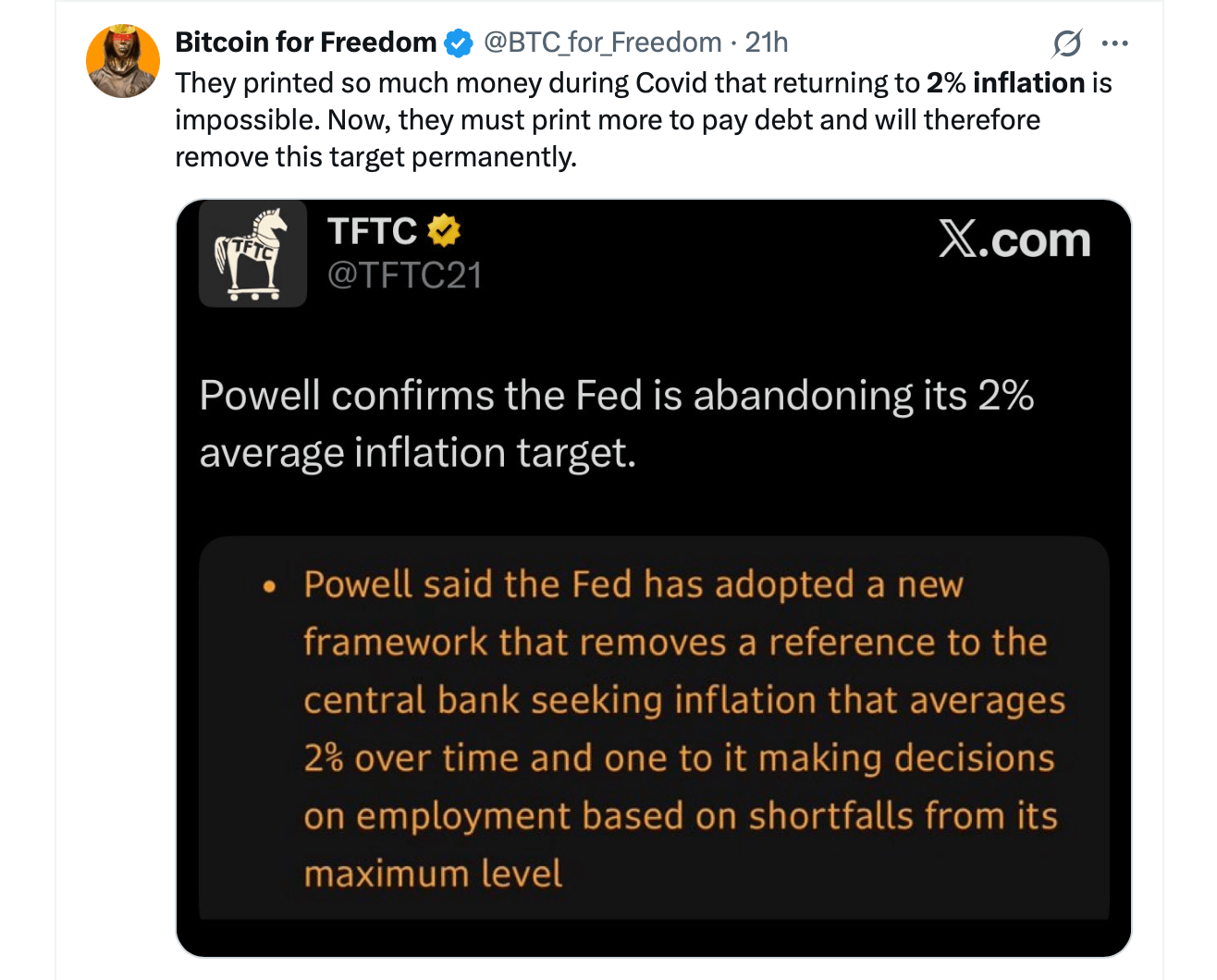

The revered document, the Statement on Longer-Run Goals and Monetary Policy Strategy, has been reimagined, reaffirming the Fed’s unwavering commitment to “maximum employment” and “stable” prices, with a steadfast 2% inflation target, as measured by the personal consumption expenditures price index. Alas, the once noble pledge to allow inflation to “average” 2% over time, a policy that permitted the occasional indulgence above 2%, has met its end. Farewell, makeup policy; you were a bold experiment, but perhaps too whimsical for our current economic climate.

The Federal Reserve’s new framework, with a flourish of the pen, has removed the focus on employment “shortfalls” alone. The previous strategy, one might say, had a penchant for boosting jobs when they were below sustainable levels, while conveniently overlooking the potential perils of overexertion. Now, the Fed adopts a more balanced stance: maximum employment is defined as the highest level consistent with price stability, a delicate balance that requires the scrutiny of a wide array of indicators in an ever-changing world.

Powell, in his eloquent address, noted that the 2020 framework was a product of its time, a response to the low-rate, low-inflation era that followed the Global Financial Crisis. However, the world has turned, and post-pandemic inflation reached heights not seen in four decades. The new framework, he assured, aims to simplify communication, increase flexibility, and align with the current higher-rate environment, where inflation risks are as unpredictable as the weather. Naturally, this announcement stirred quite the debate on social media platforms like X, where opinions are as varied as the colors of the rainbow.

The Fed’s strategy, now more versatile, no longer fixates on the effective lower bound on interest rates as a central challenge. Instead, it applies across a spectrum of economic conditions. The Fed, ever prepared, emphasized its readiness with tools such as quantitative easing, should the need arise. When the paths of employment and inflation diverge, a “balanced approach” will guide the Fed, considering both the magnitude of the gap and the speed at which each objective can be achieved.

As the dust settles, Powell hinted at the possibility of interest rate cuts beginning in September 2025, a move that reflects the cooling of inflation and the slowing of the labor market. The framework, a living document, will be reviewed annually, with a comprehensive public assessment every five years, ensuring that the Fed remains attuned to the evolving economic landscape.

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- USD JPY PREDICTION

- GBP EUR PREDICTION

- USD TRY PREDICTION

- USD KZT PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

- EUR CHF PREDICTION

- EUR ARS PREDICTION

2025-08-23 22:57