So, here we are-Jerome Powell, that guy running the Federal Reserve, might just be packing up his office before you know it. He gave a little speech yesterday, you know, the kind where he’s *careful* about everything. I mean, who knew central banking could be this dramatic? 🙄

Anyway, the financial markets, as they do, took his cautious words and ran with them like kids in a candy store. Suddenly there’s talk of an interest rate cut happening as soon as September. Sure, why not? It’s like announcing a pizza party and only serving garlic bread. 🍞

Polymarket is Not Lying

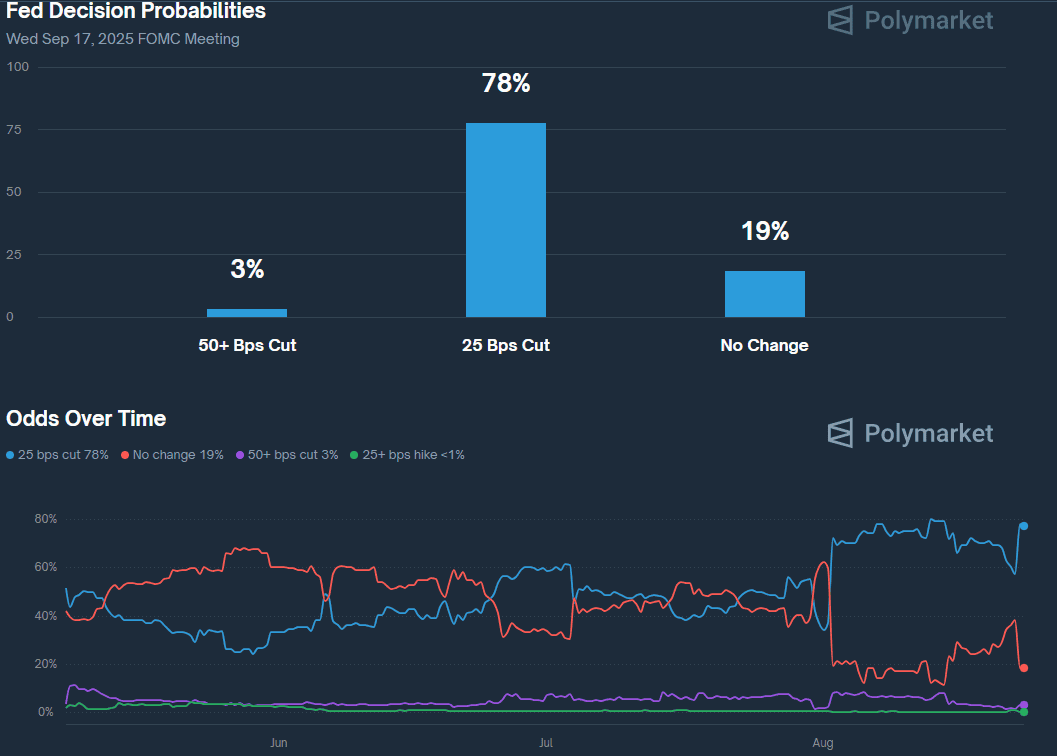

Now, Polymarket, the betting site that almost sounds too good to be true, agreed with this idea. With a success rate over 90%, I mean, who wouldn’t want to toss their money in the ring for a rate cut? I’d bet on it too if my office had snacks. They say the odds shot up from 35% to 80% real quick when we got some good news about the US economy. But don’t get too excited; those odds dropped like my hopes for a beach day after the weather forecast. 🌧️

After hotter-than-expected Producer Price Index data came in, the odds took a dive to 57%. That’s like pulling the rug out right before you trip. It was slim pickins’ by the time Powell took the stage at Jackson Hole. Did he lay out any solid plans? Nope. But he did drop some “hints,” which is basically fed-speak for “I’m keeping my options open.”

Crypto, however, had its own little party. ETH and BNB shot up like they were on a pogo stick while BTC climbed from beneath $112,000 to over $117,000-before realizing it might’ve had too many drinks and corrected itself a bit. Classic! 🎉

Now the spotlight is on next month’s FOMC meeting. Are we really gonna see a rate cut? Let’s hope Powell doesn’t pull an “oopsie” at the last second. Even Trump thinks it’s a good idea, and when you get that level of bipartisan finger-pointing, you know it’s serious! 🤦♂️

Over on Polymarket, the odds for a 25 bps cut are back at 78%. Someone’s playing it safe. And they probably should!

What’s the Impact of Powell’s Solo Act?

CryptoPotato caught up with Marcin Kazmierczak, co-founder of RedStone, to discuss the fallout from Powell’s words. I mean, who wouldn’t want a backstage pass to that show? 🎤

“He opened the door to potential rate cuts, but his careful attitude means he won’t just throw a party for assets like Ethereum without some thought. Like anybody throwing a party at their house, you don’t want to be cleaning up a massive mess afterwards, right?”

ETH did better than BTC right after all this, which is like finding out your less popular friend is actually funnier than you thought. Kazmierczak didn’t seem too upset about ETH’s performance, saying it might just break through that $4,800-$5,000 resistance zone like a kid who finally figured out how to ride a bike without training wheels. 🚴♀️

“If the Fed eases up and plays it cool, this could be the catalyst ETH needs to nail those new highs,” he said, probably wishing he had a crystal ball to see how this all plays out.

But, of course, nothing comes without a warning. Kazmierczak suggested that Powell’s “careful tone” means any rally better have some good solid support-not just wishful thinking. Sounds like a plan, right? 😅

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- EUR USD PREDICTION

- USD TRY PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- USD MYR PREDICTION

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- EUR JPY PREDICTION

- Silver Rate Forecast

- GBP EUR PREDICTION

2025-08-23 14:28