Oh, what a week it has been! Ripple, the darling of the crypto world, has decided to join the ranks of the respectable by applying for a US national banking license. How delightfully conventional! But, alas, the market’s reaction was as tepid as a lukewarm cup of tea. And there’s a reason for that, my dear readers.

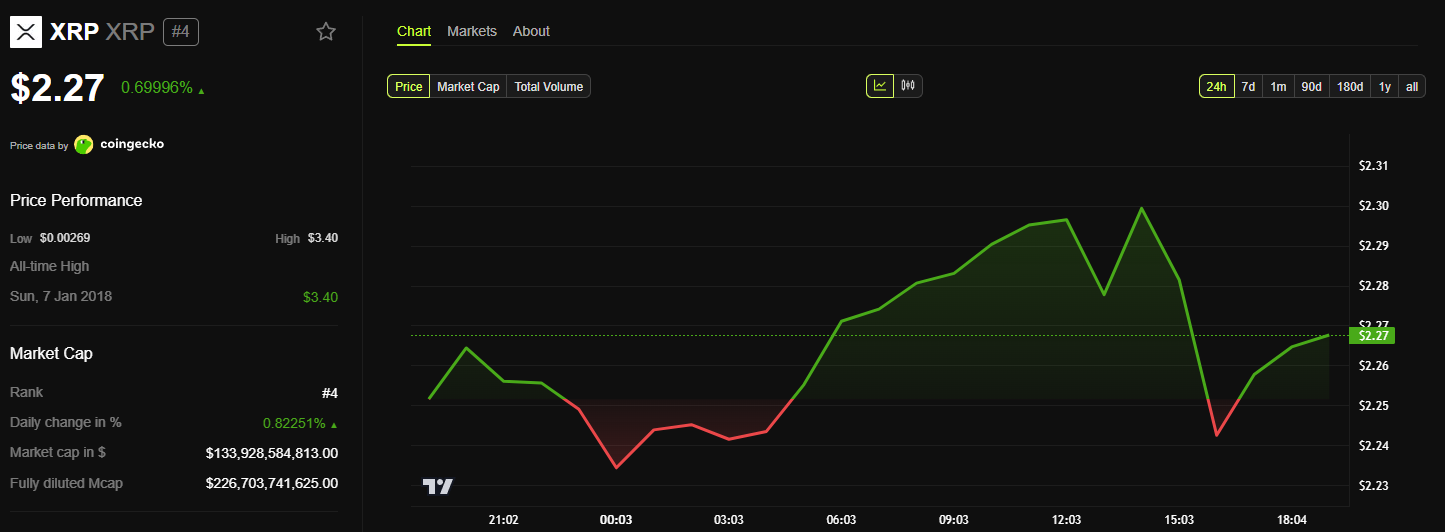

The price of XRP, that darling of digital currencies, managed a mere 3% increase after the news. A modest rise, indeed, which only serves to highlight the fact that a banking license, should it be granted, does not directly enhance XRP’s utility or legal standing—at least not yet. How thrillingly unexciting!

Ripple’s Leap into Compliance: A Non-Event for XRP

The application was filed with the Office of the Comptroller of the Currency (OCC), the very same federal regulator that oversees trust bank charters. Ripple’s grand ambition is to operate as a regulated bank entity, allowing it to custody digital assets and manage stablecoin reserves for its new product, RLUSD. A move that echoes the steps taken by other crypto firms, like Circle and Fidelity. How quaint!

However, this strategic maneuver has limited implications for XRP’s price or demand in the near term. It’s almost as if Ripple is playing a game of chess while the rest of us are still setting up the board.

True to our long-standing compliance roots, @Ripple is applying for a national bank charter from the OCC. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.

Earlier in the week via…

— Brad Garlinghouse (@bgarlinghouse) July 2, 2025

Crucially, the OCC license would not alter XRP’s current regulatory status in the US. Ripple, in a move that could only be described as a strategic retreat, dropped its cross-appeal against the SEC in the XRP lawsuit. This means the federal court’s 2023 ruling stands, unchallenged and unyielding.

To recap, the ruling found that XRP retail sales are not securities, but institutional sales by Ripple did violate securities laws. The injunction still stands, and Ripple cannot sell XRP to institutions in the US without proper SEC registration or exemption. How delightfully restrictive!

Therefore, even if Ripple gains bank status, it cannot use that charter to restart institutional XRP sales domestically. Nor does it make XRP a regulated or approved asset under federal securities law. How disappointingly mundane!

A Conditional Bullish Scenario: A Glimmer of Hope?

What the license could enable is improved integration between Ripple’s services—especially RLUSD—and its broader infrastructure. If Ripple uses its banking capabilities to serve regulated clients, XRP might indirectly benefit as a liquidity bridge. But that would depend on new business flows and corridor expansion, not legal change. How tantalizingly indirect!

Now, Ripple could eventually use its bank status to build trust with US institutions. This would potentially revive interest in using XRP within tokenized asset systems or cross-border payment rails. However, that’s a long-term narrative, not an immediate catalyst. How frustratingly patient we must be!

For now, XRP’s price action reflects that. Traders are pricing in a corporate compliance story, not a token utility upgrade. Until XRP becomes central to Ripple’s bank-backed operations, the market will likely view this move as neutral from a token value standpoint. How wonderfully uneventful!

Ripple’s bank license, if approved, could reshape the company’s regulatory profile. But XRP remains where it was—partly cleared for retail, restricted for institutions, and waiting for a bigger use-case breakthrough. How tantalizingly stagnant!

Read More

- EUR PHP PREDICTION

- USD JPY PREDICTION

- USD MYR PREDICTION

- EUR USD PREDICTION

- EUR RUB PREDICTION

- Gold Rate Forecast

- SUI’s Surprising Rise: The Saga of a Blockchain That Smirks at the Rest

- ETH Price Stalls at $3K Amid $19M ETF Exodus!

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

2025-07-03 22:26