Ah, the fickle dance of the markets! 🕺💹 The so-called “experts” at CryptoBullet, with their charts and patterns, predict a glorious ascent to the heavens of $0.70. But is this not merely the wishful thinking of those who gaze too long into the candlestick charts? If their breakout-a term as grandiose as it is uncertain-proves successful, they claim a price target between $0.50 and $0.70. A 50% surge, they say, with the gravity of men foretelling the movement of stars. 🌟 But who are we to trust in this carnival of speculation?

Meanwhile, the Crypto Tigers-a name that evokes both ferocity and folly-roar about a breakout from a two-year downtrend wedge. 🦅📉 They speak of accumulation phases and shifts in momentum, as if the market were a great beast awakening from its slumber. Yet, is this not the same market that has devoured the hopes of many a trader? Their optimism is as boundless as it is questionable, predicting a swift upward move, a rally as explosive as a firework on a summer night. 🎆

The Bullish Pennant: A Harbinger of Fortune or Folly?

Behold, the bullish pennant-a pattern so revered in the annals of technical analysis! 📈 It forms when the price, after a sharp movement, consolidates within a narrowing range, like a great ship gathering its sails before the wind. CryptoBullet, with their charts and predictions, insists that this formation signals a continuation of the upward trend. But is this not the same pattern that has led many astray, promising riches only to deliver ruin? If the breakout succeeds, they say, the price could reach $0.50 to $0.70-a 50% rise. But what of the other 50%? The fall into the abyss? 🕳️

Historically, they claim, bullish pennants are reliable indicators. But history, as we know, is written by the victors. What of the pennants that failed, the breakouts that never came? The market, like life itself, is unpredictable, a tempestuous sea that cares not for patterns or predictions. 🌊

The Two-Year Wedge: A Prison or a Launchpad?

The breakout from the two-year downtrend wedge has captured the imagination of analysts. Crypto Tigers, with their keen eyes, point to this as a significant event. The asset, they say, is poised for a sharp upward rally after a long period of accumulation. But is this not the same accumulation phase that has trapped many a trader, like a fly in amber? 🕸️ The chart shows a clear wedge formation, but charts, like maps, can lead one astray if not read with caution.

This breakout, they say, is notable because it follows a prolonged phase of consolidation. The accumulation phase, according to Crypto Tigers, is complete, and market participants have secured their positions. But what if the positions are secured in quicksand? A successful move above resistance levels could lead to rapid gains, but what of the resistance of reality? 🧱

Price Action: A Dance of Hope and Despair

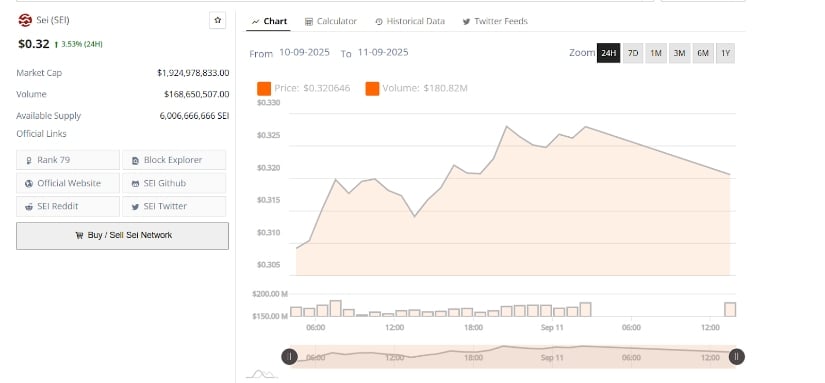

At the time of writing, the price movement demonstrated moderate fluctuations with an upward trend, reaching a peak of $0.32 after starting the day at $0.31. A 3.53% increase, they say, reflecting positive market sentiment and growing interest. But is this not the same sentiment that has led to bubbles and bursts? The trading volume followed the price, with spikes during increases-a strong correlation, they claim. But correlation, as we know, does not imply causation. 📊

Towards the end of the day, the price consolidated around $0.31 to $0.32, a temporary pause in momentum. The volume decreased slightly, suggesting the market is waiting for the next move. But what if the next move is a step off a cliff? 🌋 To maintain upward momentum, the token needs sustained volume and price action above $0.32. But what if the winds change, and the sails are torn?

Market Position and Liquidity: The Illusion of Stability

The market capitalization approaches $1.93 billion, with a circulating supply of over 6 billion tokens. Considerable liquidity, they say, crucial for maintaining upward momentum. But is liquidity not a double-edged sword, allowing for both swift rises and swift falls? A consistent trading volume is necessary, especially as the asset approaches key resistance levels. But what if the resistance is insurmountable? 🛡️

If the asset can maintain momentum above current levels, it could reach the target price range of $0.50 to $0.70. But what if it cannot? Market participants must monitor trading volumes and price behavior, but monitoring is not control. The market, like a wild horse, cannot be tamed. 🐎

Read More

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ETH PREDICTION. ETH cryptocurrency

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-09-12 01:27