In a most thrilling turn of events, our dear SEI has burst forth from its slumber, having spent an eternity-well, a few weeks-consolidating between the rather pedestrian bounds of $0.15 and $0.30. This delightful breakout has formed an ascending triangle, a pattern that, if one were to believe the technical analysts, is a veritable harbinger of strength. One might say it’s the crypto equivalent of a well-brewed cup of tea-invigorating, yet requiring a certain finesse to maintain its warmth.

SEI Breakout Above Resistance Level Signals Bullish Momentum

Our intrepid analyst, the ever-astute @follis_, has pointed out the clear breakout above $0.30, confirming that there is indeed a pulse of buying interest following the consolidation phase. The chart, a veritable tapestry of numbers and lines, reveals the formation of an ascending triangle-an emblem of bullish sentiment, or so they say. One can only hope it doesn’t turn out to be a mere mirage in the desert of crypto.

Technical indicators, those fickle friends, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), are flashing signs of robust bullish momentum, aligning perfectly with the price surge. It’s almost as if the universe is conspiring to make SEI the belle of the ball.

However, dear reader, let us not get ahead of ourselves. The RSI is approaching overbought territory, which, as any seasoned trader will tell you, is a polite way of saying, “Hold your horses!” A price correction or a temporary consolidation could be lurking just around the corner, like an unwelcome relative at a family gathering.

Our analyst advises a keen eye on the $0.30 support level; should this bastion hold firm, $SEI might just gallivant towards the next resistance around $0.40 or higher. Retracements to the support level may serve as delightful buying opportunities, akin to finding a forgotten £5 note in an old coat pocket.

Market Activity Reflects Active Trading and Volatility

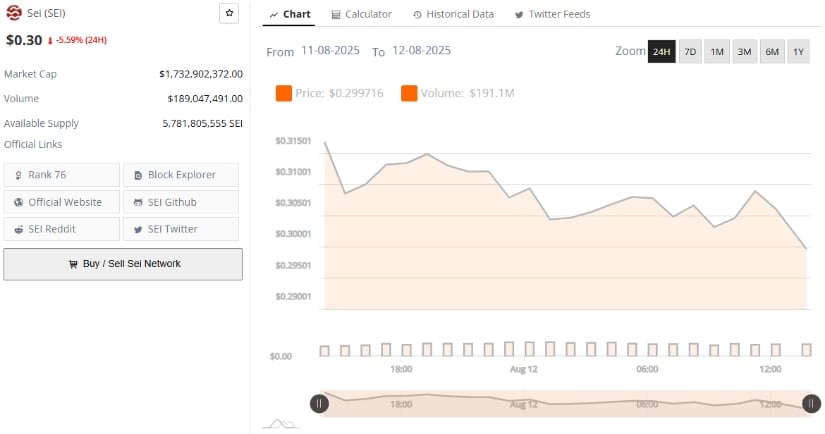

According to the ever-reliable Brave New Coin, SEI’s 24-hour chart reveals a price fluctuating between $0.295 and $0.315, finally settling at a rather unimpressive $0.2997-a decline of 5.59% over the period. This decline, it seems, is merely a case of short-term profit-taking or perhaps a broader market malaise, rather than a full-blown panic sell-off. Trading volumes remain stable at around $189 million, which is over 10% of the market cap-enough to keep the lights on, if not the champagne flowing.

The market cap hovers near $1.73 billion, placing SEI at a respectable 76th among cryptocurrencies by capitalization. This indicates a mid-to-upper tier status, with liquidity and institutional interest balanced precariously against the inherent volatility of the crypto realm. It’s a bit like walking a tightrope while juggling flaming torches-thrilling, yet fraught with peril.

Volume patterns mirror price movements, revealing a slight selling pressure that seems to outweigh the buyers. If this trend persists, SEI may find itself testing lower support levels, but fear not! It could stabilize near the $0.31 range if buying activity strengthens, much like a cat landing on its feet.

Technical Indicators Highlight Crucial Support and Trend Strength

As I pen these words, the TradingView chart reveals SEI trading close to $0.2995, with a recent decline of approximately 1.84%. The Chaikin Money Flow (CMF) indicator, bless its heart, shows a slight bearish bias at -0.03, indicating that while selling pressure exists, it is hardly overwhelming. One might say it’s a gentle nudge rather than a shove.

The MACD, that ever-reliable oracle, shows a minor bearish crossover, hinting at short-term weakness. Yet, the consolidation around key levels suggests a potential base forming between $0.25 and $0.30. If SEI can stabilize and decisively break above $0.30, we may witness a bullish momentum that accelerates faster than a London cabbie in rush hour, increasing the likelihood of testing higher resistance such as $0.35.

Volume was relatively low during the price decline, indicating a lack of conviction among sellers. This supports the notion that the next few sessions will be crucial in determining the near-term direction. Holding above $0.30 is essential for maintaining the breakout’s validity and continuing the upward trend. So, dear reader, let us keep our fingers crossed and our wallets ready!

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- Get Ready for Rate Cuts: Morgan Stanley’s Shocking Forecast Will Leave You Speechless!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-08-13 00:12