In the vast and often tumultuous sea of digital assets, a small but significant ripple has emerged, one that promises to turn into a wave of considerable magnitude. SEI, a token that has long been a subject of both hope and skepticism, has found itself in the midst of a remarkable transformation, much like a humble grain of sand that, under the right conditions, can become a pearl of great value.

According to the chroniclers of crypto.news, SEI surged over 26% on the 11th of July, reaching a six-month high of $0.33, before settling at the more modest, yet still impressive, $0.32. This token, which was languishing in the shadows just a month ago, has now risen by approximately 113% from its lowest point. Its market capitalization, now standing at $1.78 billion, has elevated it to the 70th largest digital asset, a position that, while not the pinnacle, is certainly a step in the right direction. The daily trading volume, too, has seen a dramatic increase, jumping by over 200%, a clear sign that the market has taken notice and is eager to participate in this burgeoning narrative.

The catalyst for this surge, one might say, was the announcement that the SEI network will soon support native USDC, the stablecoin issued directly by Circle, an entity known for its stringent regulatory compliance and institutional adoption. This development, akin to a knight arriving on a white horse, promises to bring a new level of stability and trust to the SEI ecosystem. The integration of Circle’s Cross-Chain Transfer Protocol (CCTP) will allow users to move USDC seamlessly between SEI and other major chains like Ethereum, Solana, and Avalanche, without the need for third-party bridges or wrapped assets. This, dear reader, is no small feat, as it significantly enhances SEI’s value proposition, enabling fast, secure, and cost-efficient capital flows across ecosystems. Native USDC on SEI can power more efficient global payments, deepen liquidity across DeFi protocols, and lay the groundwork for institutional-grade financial applications. 🌐💼

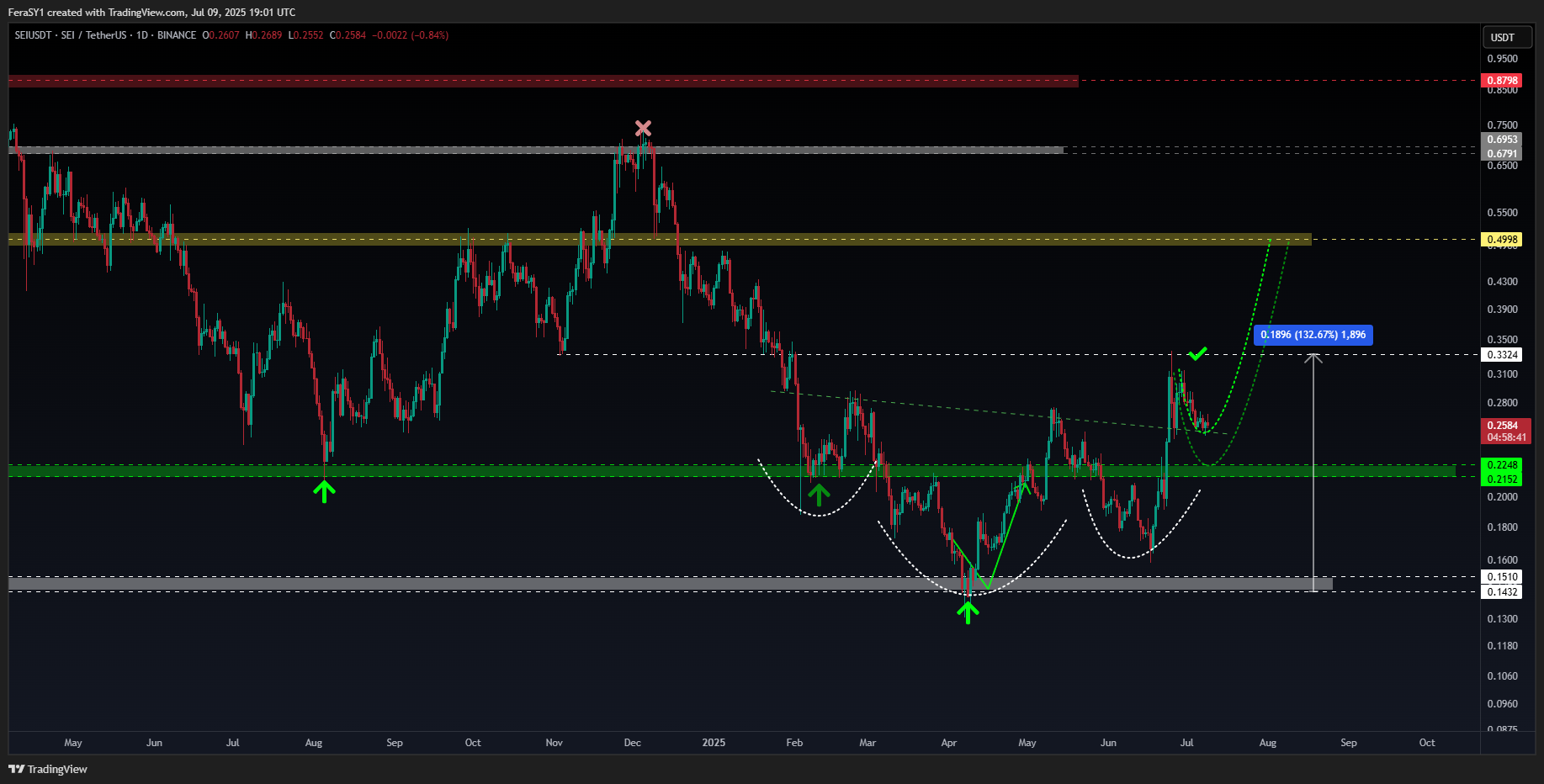

The significant surge in trader interest and sustained buying pressure helped SEI break out of a well-defined inverse head and shoulders pattern on the daily chart. The neckline, positioned between $0.26 and $0.27, was decisively breached, and a successful retest has confirmed the validity of the breakout. According to the sage known as Crypto Feras, the breakout projects an upside target of approximately $0.499, based on a measured move from the pattern’s base near $0.15. As of press time, this target remains nearly 55% from the current price level. 📈🚀

Bullish sentiment is also being echoed by other market analysts, with some projecting that SEI could reach as high as $1.50 by year-end, should macro and ecosystem developments remain favorable. Momentum indicators seem to favor a continuation of the rally at least in the short term. The MACD line has crossed above the signal line, and RSI has continued to trend upward. This means buyers are currently dictating short-term price action.

Multiple bullish catalysts in play

Momentum indicators seem to favor a continuation of the rally at least in the short term. The MACD line has crossed above the signal line, and RSI has continued to trend upward. This means buyers are currently dictating short-term price action.

Adding to that, derivatives data further supports this outlook. According to CoinGlass, open interest in SEI futures has surged by more than 210% over the past three weeks, rising from under $50 million in mid-June to approximately $318 million as of press time. Traders are likely positioning themselves in anticipation of a breakout. Meanwhile, data from DeFiLlama shows total value locked across Sei’s DeFi protocols has reached a new all-time high of $1.4 billion. The scale of capital inflow points to sustained user activity across decentralized applications beyond just speculative interest in the SEI token alone.

As more liquidity anchors into the network, Sei stands to benefit from deeper markets, greater pricing stability, and improved conditions for developers building DeFi infrastructure. Further support for Sei’s growth outlook may come from institutional positioning. Circle’s IPO prospectus, filed recently with U.S. regulators, confirms a holding of 6.25 million SEI tokens. This level of exposure suggests that Circle views Sei as a meaningful component in its broader blockchain strategy.

Moreover, Sei is currently one of eleven blockchain networks under review by the Wyoming Stable Token Commission for the upcoming WYST stablecoin project. A final decision is expected on July 17. Should Sei qualify for the selection, it would mark another big step toward regulatory alignment and could further reinforce the network’s credibility as a compliant, institution-ready blockchain infrastructure in the U.S. 🏛️🌟

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Crypto Mayhem: Banks at Risk of Losing Their ‘AAA’… And Their Minds! 😬

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

2025-07-11 12:55