What to know:

- Solana (SOL) has surged 33% since early August, outperforming major cryptocurrencies like bitcoin and ether over the past few weeks

- The token is benefitting from crypto investors rotating profits beyond BTC and ETH, YouHodler’s head of risk said.

- SOL could replicate ether’s 200% rally as up to $2.6 billion in treasury inflows and ETF decisions loom, Arca’s Jeff Dorman said.

In this article

BTCBTC$111,928.65◢1.02%

BTCBTC$111,928.65◢1.02% SOLSOL$209.82◢2.08%

SOLSOL$209.82◢2.08% XRPXRP$2.8493◢0.77%

XRPXRP$2.8493◢0.77%In the current cryptocurrency landscape, while Bitcoin hovers around $110,000 and Ether (ETH) stabilizes following new highs, Solana has been shining as a notable outperformer in the market over the past few days.

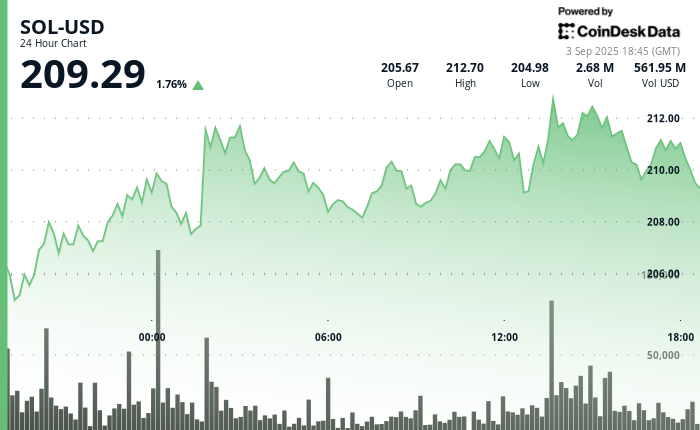

On Monday, the token was traded near $211, marking a 33% increase from its early August lows. This impressive growth places it among the top performers in the CoinDesk 20 Index over the past month. Over the past month, SOL has also risen by 34% compared to bitcoin and has strengthened by 14% against Ether since mid-August.

The rally reflects a broader rotation into altcoins, analysts said.

The distribution of profits among cryptocurrency holders persists, as stated by Sergei Gorev, risk chief at YouHodler, in a market update sent to CoinDesk. He noted that liquidity has shifted away from Bitcoin and towards secondary tokens, with an observable surge in favorable trends in financial inflows towards SOL.

The investments might be prolonged, as corporations seek substantial, easily tradable projects to invest in over a period of time, according to Gorev. He also mentioned Solana (SOL) and XRP as potentially intriguing market prospects for the future.

Jeff Dorman, the head investment officer at Arca, predicted that SOL could mirror Ethereum‘s comeback that took place earlier this year. He highlighted Ethereum’s recent rise following increased adoption of stablecoins, a surge in ETF investments, and constant demand from digital asset treasuries (DATs), which contributed significantly to ETH’s nearly 200% growth since April.

According to Dorman’s recent report, it seems likely that SOL may follow the same strategy that Ethereum recently implemented over the next few months.

As a passionate crypto investor, I’ve been eagerly watching the market, and just recently, the first U.S.-listed Solana ETF made its debut in July. However, it’s essential to note that this ETF is futures-based, which might not align perfectly with the spot market’s dynamics.

Exciting news is on the horizon though! Reputable asset managers like VanEck and Fidelity have already filed applications for spot products related to Solana. The verdicts on these applications are expected later this year, so let’s keep our fingers crossed for a more direct representation of the Solana market in the ETF world soon!

Currently, at least three Decentralized Autonomous Treasuries (DATs) focused on Solana are attempting to gather funds. If successful, these efforts could potentially funnel around $2.65 billion worth of SOL within the upcoming month.

If Solana’s market cap is just a fifth of Ethereum’s, its price could become significantly more sensitive to any potential inflows.

“Dorman noted that Solana (SOL) could experience significant growth, given its current position. Considering that the price of Ethereum (ETH) skyrocketed approximately 200% with around $20 billion in fresh demand, one might expect similar or even greater growth for Solana if it receives $2.5 billion or more of new demand.”

Recent events could add to the momentum. For instance, Galaxy Digital, a Nasdaq-listed digital asset group, has moved to tokenize its shares on Solana. Moreover, the approval of the Alpenglow upgrade is anticipated to boost transaction speed and finality.)

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2025-09-03 23:18