What ho, old sport! Here’s the lowdown:

By Omkar Godbole (All times ET, what?)

So, “solana” means sunshine in Spanish, does it? Jolly good! And what’s sunnier than exchange-traded funds (ETFs) based on the programmable blockchain Solana’s native token, SOL? 🌞 Not much, unless you’re a chap who fancies a spot of rain. Investors have been chucking funds into U.S.-listed spot SOL ETFs like there’s no tomorrow, while giving bitcoin and ether the cold shoulder. Bitwise and Grayscale’s SOL ETFs have raked in $368.5 million since their late October debut, while BTC and ETH ETFs are left nursing their wounds with outflows exceeding $700 million each. Crikey! 📉

Traders, bless their cotton socks, haven’t noticed the difference and have kept SOL under pressure alongside the big boys-bitcoin and ether-in the past 24 hours. The SOL/ETH ratio on Binance has taken a nosedive, hitting its lowest since August, while SOL/BTC is still in the doldrums. Bitcoin, meanwhile, is struggling to find its footing above the $100,000 mark, despite holding on for dear life. 🪨

In the past 24 hours, BTC has been stuck between $101,000 and $104,000, while smaller altcoins like FIL, UNI, NEAR, and WLFI have been having a jolly good time. Ether, the old bean, has been pottering about near $3,500. Meanwhile, the CoinDesk DeFi Select Index and Metaverse Select Index have taken a tumble, losing 6% and 4.2%, respectively. Oh, the humanity! 😱

In the news, the U.S. House has finally ended the 41-day government shutdown, releasing back pay and restarting federal spending. Timothy Misir, head of research at BRN, reckons this will unlock nearly $40 billion in deferred liquidity over the next month. How much will flow into crypto? Your guess is as good as mine, old chap. 🤷♂️

In traditional markets, the yen has hit a record low against the euro after Prime Minister Sanae Takaichi told the central bank to “go slow” on interest-rate increases. This aligns with market expectations of another quarter-point Fed rate cut next month. Yet bitcoin isn’t rallying-is it stimulus fatigue? Only time will tell. Stay alert, and keep your stiff upper lip! 🕵️♂️

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. No need to thank me, old bean. 🙏

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. Toodle-pip! 👋

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. Cheerio! 🧐

- Day 3 of 3: Mining Disrupt Conference (Dallas)

- Day 2 of 2: Cardano Summit 2025 (Berlin)

- Day 2 of 3: Blockchain Summit Latam 2025 (Medellin, Colombia)

- Nov. 13: Canadian Bitcoin Consortium’s 5th Annual Summit (Toronto)

- Nov. 13: Digital Asset Investment Event (Amsterdam)

- Day 1 of 2: Bitcoin Amsterdam

Market Movements

- BTC is up 0.85% from 4 p.m. ET Wednesday at $102,785.04 (24hrs: -1.83%). Not too shabby! 💼

- ETH is up 1.75% at $3,482.55 (24hrs: -1.08%). Steady as she goes! ⚓

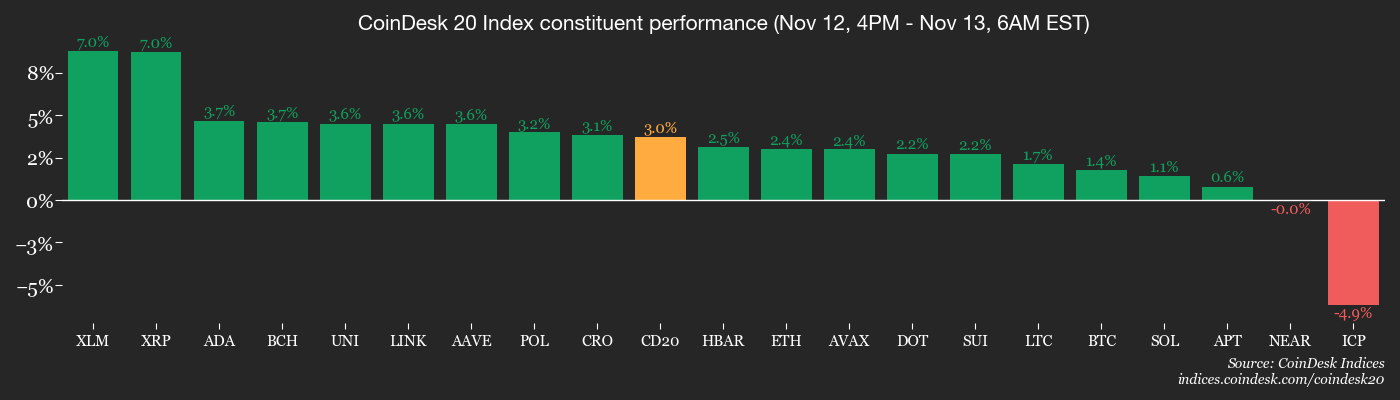

- CoinDesk 20 is up 2.04% at 3,368.95 (24hrs: -0.81%). Jolly good show! 🎩

- Ether CESR Composite Staking Rate is down 7 bps at 2.86%. Oh, dear. 😢

- BTC funding rate is at 0.0059% (6.459% annualized) on OKX. Small beer, what? 🍺

- DXY is down 0.19% at 99.31. Down the drain, eh? 🚽

- Gold futures are up 0.49% at $4,234.10. Shiny! ✨

- Silver futures are up 0.67% at $53.81. Not too bad, old boy. 🥈

- Nikkei 225 closed up 0.43% at 51,281.83. Ticking along nicely. 🕰️

- Hang Seng closed up 0.56% at 27,073.03. Jolly decent! 🧢

- FTSE is down 0.42% at 9,870.02. Oh, bother. 🐻

- Euro Stoxx 50 is up 0.19% at 5,798.45. Steady on! 🚂

- DJIA closed on Wednesday up 0.68% at 48,254.82. Top-hole! 🎉

- S&P 500 closed unchanged at 6,850.92. Flat as a pancake. 🥞

- Nasdaq Composite closed down 0.26% at 23,406.46. Oh, dear. 😕

- S&P/TSX Composite closed up 1.38% at 30,827.58. Smashing! 🏆

- S&P 40 Latin America closed down 0.97% at 3,145.09. Not their day, what? 🌧️

- U.S. 10-Year Treasury rate is up 0.9 bps at 4.088%. Up she goes! 🚀

- E-mini S&P 500 futures are unchanged at 6,871.00. Steady as she goes! ⚓

- E-mini Nasdaq-100 futures are unchanged at 25,600.00. No movement here. 🧘♂️

- E-mini Dow Jones Industrial Average Index are up 0.04% at 48,389.00. Ticking along. 🕰️

Bitcoin Stats

- BTC Dominance: 59.77% (-0.22%). Still the king, eh? 👑

- Ether-bitcoin ratio: 0.03391 (0.94%). Not too shabby! 💼

- Hashrate (seven-day moving average): 1,081 EH/s. Chugging along! 🚂

- Hashprice (spot): $42.75. Small change, what? 🪙

- Total fees: 2.61 BTC / $268,962. Not a bad haul! 💰

- CME Futures Open Interest: 138,410 BTC. Plenty of interest! 📈

- BTC priced in gold: 24.4 oz. Shiny stuff! ✨

- BTC vs gold market cap: 11.46%. Holding its own! 🏋️♂️

Technical Analysis

- SOL has been making lower highs and lower lows since mid-September-a bearish trend, old chap. 📉

- Prices are clinging to the 61.8% Fibonacci retracement line, the so-called golden ratio. Hold on tight! 🤞

- If it breaks below, the bears might take over, sending it down to $129. Oh, lor! 😱

Crypto Equities

- Coinbase Global (COIN): closed unchanged on Wednesday at $304, +0.58% at $305.76 in pre-market. Steady Eddie! 🧢

- Circle Internet (CRCL): closed at $86.3 (-12.21%), +2.67% at $88.60. Bouncing back! 🏀

- Galaxy Digital (GLXY): closed at $31.27 (+1.72%), +0.64% at $31.47. Ticking along! 🕰️

- Bullish (BLSH): closed at $45.5 (+0.24%), -0.88% at $45.10. A bit of a dip. 🌊

- MARA Holdings (MARA): closed at $14.41 (-1.5%), -0.35% at $14.36. Not their day. 🌧️

- Riot Platforms (RIOT): closed at $15.46 (-4.21%). Oh, dear. 😢

- Core Scientific (CORZ): closed at $16.44 (-5.08%). Rough day! 🌪️

- CleanSpark (CLSK): closed at $13.33 (-5.09%), +0.23% at $13.36. A glimmer of hope! ✨

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $47.73 (-4.64%). Not looking good. 😬

- Exodus Movement (EXOD): closed at $19.91 (-6.48%). Ouch! 😣

Crypto Treasury Companies

- Strategy (MSTR): closed at $224.61 (-2.91%), +0.45% at $225.62. A bit of a rollercoaster! 🎢

- Semler Scientific (SMLR): closed at $25.73 (-5.92%), -3.23% at $24.90. Downward spiral. 🌀

- SharpLink Gaming (SBET): closed at $11.57 (+0.09%), +3.89% at $12.02. On the up! 🚀

- Upexi (UPXI): closed at $3.38 (+5.3%), +1.48% at $3.43. Smashing! 🏆

- Lite Strategy (LITS): closed at $2.01 (-3.37%). Not their finest hour. 🕰️

ETF Flows

Spot BTC ETFs

- Daily net flows: -$278.1 million. Oof! 😖

- Cumulative net flows: $60.19 billion. Still a tidy sum! 💼

- Total BTC holdings ~1.34 million. Not too shabby! 🧳

Spot ETH ETFs

- Daily net flows: -$183.7 million. Another ouch! 😣

- Cumulative net flows: $13.59 billion. Decent, but could be better. 🧐

- Total ETH holdings ~6.53 million. Plenty to go around! 🍪

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- POL PREDICTION. POL cryptocurrency

- USD VND PREDICTION

- EUR RUB PREDICTION

- GBP RUB PREDICTION

2025-11-13 16:02