In a world where the absurd often masquerades as the norm, Solana, that enigmatic blockchain, has once again confounded the masses and delighted the few. The price of SOL, that elusive digital token, climbed a modest 4.05% to perch precariously at $168.48 on the fateful Monday, August 4. This movement, gentle as a summer breeze, aligned with the equally capricious movements of its rivals, Ethereum and XRP, which themselves experienced gains of 5% and 4%, respectively. Yet, dear reader, there was more to this tale than met the eye. Market whispers suggested that the SOL rally was buoyed by yet another wave of institutional inflow—like a raven perched on the shoulder of a king, foretelling great events.

And what event, you might ask, could possibly be more significant than the whims of the market? Why, the decision of Artelo Biosciences, a clinical-stage pharmaceutical firm, to adopt Solana as part of its corporate treasury. Yes, you read that correctly. In a move that would have made the great Dostoevsky himself scratch his head in wonder, Artelo became the first publicly traded pharmaceutical company to embrace the digital realm of SOL. With a commitment of $9.475 million from an at-the-market private placement, Artelo has set sail into uncharted waters, guided by the beacon of Solana’s promise.

This bold step cements Artelo’s place among the vanguard of firms adopting Solana for institutional balance sheet diversification, a trend that has been gaining momentum like a snowball rolling down a hill. Companies like Sol Strategies have blazed this trail, and now Artelo follows, with Bartosz Lipiński, the former Solana Labs Head of Engineering and current CEO of Cube Group, leading the charge. Lipiński, who orchestrated the private placement, will serve as Artelo’s technical advisor, steering the ship through the turbulent seas of DeFi and staking operations. The board of directors, ever the cautious guardians of the company’s interests, has given their blessing for a staged expansion of the SOL treasury over time.

“Solana’s unparalleled scalability and decentralized infrastructure make it a cornerstone of the future financial ecosystem. By adopting SOL as a treasury asset, Artelo is positioning itself for sustainable growth and resilience, leveraging a cutting-edge monetary network to enhance shareholder value. I am confident this strategic move will yield significant long-term benefits for both Artelo and the broader Solana ecosystem,” Lipiński noted, his words dripping with the gravity of a man who knows the weight of the world rests on his shoulders.

Gregory D. Gorgas, Artelo’s CEO, echoed this sentiment with a flourish, describing the move as a “strategic step into the digital asset space.” He emphasized the importance of this decision as a model of competitive treasury diversification in the biotech finance sector, a statement that would have made the great economists of yore nod in approval.

“This initiative reflects our commitment to innovative and disciplined capital management while taking a strategic step into the digital asset space. By integrating SOL into our treasury, we aim to enhance long-term value for shareholders through thoughtful exposure to one of the most decentralized and scalable digital assets in the market,” Gorgas declared, his voice steady and resolute.

As of the moment of truth, Solana trades at $168.48, with the bulls eyeing the $180 level as the next technical resistance point. A challenge, indeed, but one that the market watchers believe could be overcome with the right mix of sentiment and volume.

Solana Price Prediction: Can SOL Break $180 to Confirm Trend Reversal?

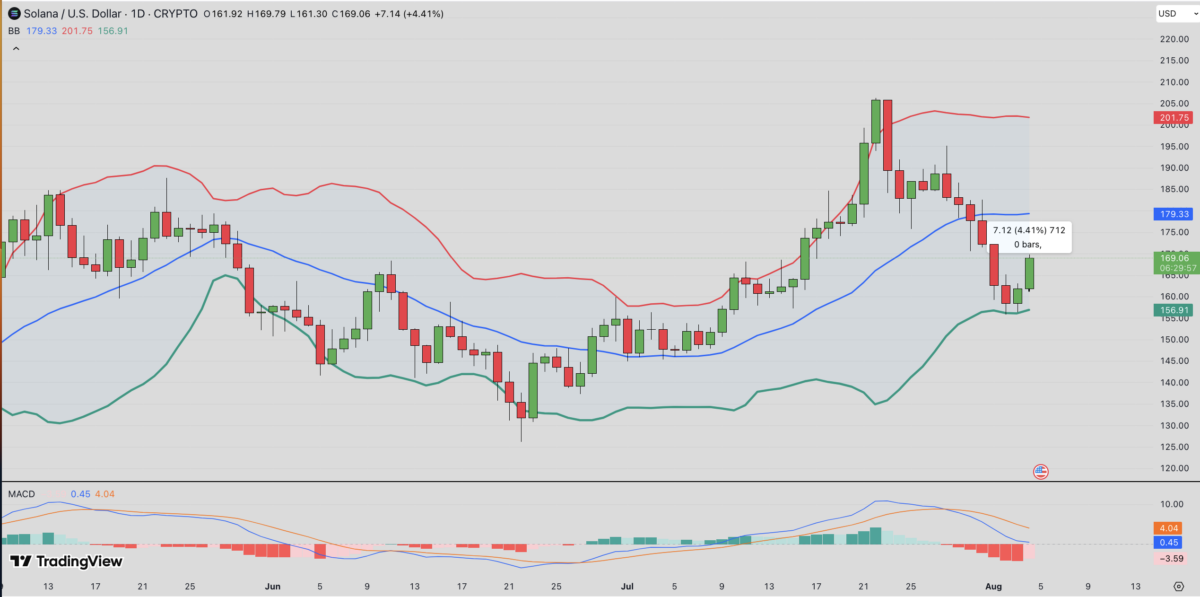

The technical indicators, those mystical runes of the modern age, show early signs of recovery. SOL has bounced sharply off the lower Bollinger Band at $156.83, reclaiming the $168 zone with a vigor that suggests the dawn of a new era. The TradingView chart below, a visual testament to the market’s pulse, reveals that the SOL price rebound is backed by a surge in sentiment and a volume that speaks of more than mere coincidence.

Solana Price Forecast | TradingView

The 20-day moving average (blue), currently at $179.30, stands as the primary resistance target. Should the bulls manage to close above this level, it could signal a return to the throne after Solana’s price suffered double-digit losses in the previous week. On the MACD, the blue line has crossed above the orange signal line near 0.40, a bullish crossover that often precedes a surge in price momentum during recovery phases. If the bulls maintain their grip and SOL closes above $175, a retest of the $185–$190 range is not out of the question. The sustained positive sentiment from corporate adoption could be the catalyst that propels Solana to new heights.

However, should the market reject the advance near $175, the price could retreat to the support at $156.83 (lower Bollinger Band), with a deeper decline potentially testing the $150 mark. Such is the unpredictable nature of the market, where every gain is met with the specter of loss.

Solaxy Positioned to Capitalize on Growing Solana Institutional Adoption

Amidst the tumult of Solana’s rise, Solaxy, the first layer-2 project on Solana, finds itself in a position of great opportunity. As Solana trades above $168, the growing interest from institutions, from hedge funds to pharmaceutical firms, validates the confidence in Solana’s technical infrastructure and vibrant ecosystem. The launch of Solaxy’s mainnet, accompanied by major CEX listings and the promise of up to 70% staking APY, beckons investors to seize the moment. Those eager to capitalize on the growth of Solana’s ecosystem can visit Solaxy’s official presale page to secure their place in this grand experiment.

Solaxy Presale

Thus, the stage is set for a drama that could redefine the boundaries of finance and technology. Will Solana and its allies prevail, or will the forces of doubt and uncertainty prevail? Only time will tell, and in the meantime, we watch with bated breath, for in the world of crypto, every day is a new chapter in a story that is far from over. 📈💥

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- EUR KRW PREDICTION

- GBP RUB PREDICTION

2025-08-05 00:58