Well, slap my wallet and call me stable! Dollar-pegged tokens did a little jig this week, raking in a cool $703 million. But don’t get too excited, folks, the sector’s still down 0.61% for the month. That’s a $1.9 billion ouchie that keeps the crypto circus in check. And leading the charge? Blackrock’s BUIDL, leaping 36.03% like a kangaroo on a sugar high!

Stablecoin Market Caps Do the Limbo as February Says Adios

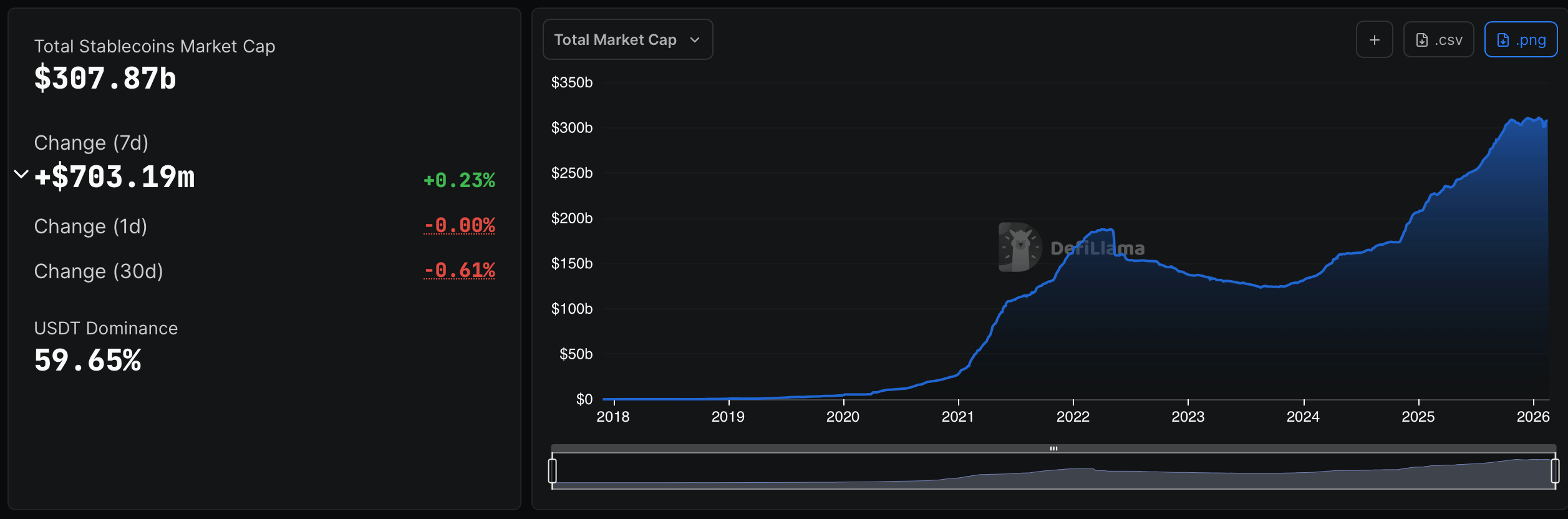

So, the stablecoin economy added some bling this week, but it’s still nursing a 30-day hangover. Artemis Terminal says adjusted transaction volume hit $7.5 trillion. That’s 1.8 billion transactions, folks-enough to make your head spin like a slot machine! As February waves goodbye, the dollar-pegged economy sits pretty at $307.87 billion, according to defillama.com.

Of course, the big boys-USDT and USDC-still hog the spotlight, controlling 83.62% of the pie. Tether (USDT) took a tiny 0.10% dip, but it’s still sitting pretty at $183.652 billion. USDC, on the other hand, did a little happy dance with a 0.74% gain, hitting $73.794 billion. USDT’s dominance? A whopping 59.65%. USDC? A respectable 23.97%. It’s like a crypto oligarchy, folks!

Sky dollar (USDS) holds third place with a $6.852 billion market cap and a 3.80% gain-not too shabby! But Ethena’s USDe took a 1.65% nosedive, landing at $6.229 billion. World Liberty Financial’s USD1 got a 4.36% haircut, trimming its market cap to $5.109 billion. But the real star? BUIDL, the U.S. Treasury-backed stablecoin that’s rocketing like a Brooks comedy!

Blackrock’s BUIDL saw its market cap soar 36.03%, hitting $2.462 billion. And Circle’s USYC? It added 9.43%, reaching $1.688 billion. Looks like Treasury-backed stablecoins are stealing the show while the ‘Big Two’ (USDT and USDC) are snoozing at the wheel.

These yield-bearing tokens are where the action’s at. Of the $307 billion total, they account for 6.66%-or $20.44 billion. Traditional finance is going onchain faster than you can say “blockchain,” and tokenized Treasurys are hotter than a Brooks movie premiere. Capital’s chasing those programmable dollars like they’re the last slice of pizza!

For now, the ‘Big Two’ still rule with their sheer size, but the winds of change are blowing. The next chapter of the stablecoin saga? It’s not just about stability-it’s about who can pay you to play!

FAQ ⏰

- What’s the current size of the stablecoin market? The dollar-pegged stablecoin market’s sitting at about $307.87 billion. That’s a lot of zeros, folks!

- Which stablecoin gained the most this week? Blackrock’s BUIDL took the crown with a 36.03% leap. Ka-ching!

- How much volume did stablecoins process in the last 30 days? A cool $7.5 trillion across 1.8 billion transactions. That’s more action than a Brooks film!

- What share do USDT and USDC control? Tether (USDT) and USDC together own 83.62% of the pie. It’s a crypto duopoly, baby!

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- EUR JPY PREDICTION

- Gold Rate Forecast

- EUR RUB PREDICTION

- Silver Rate Forecast

- XRP’s Wild Ride: Liquidity Vanishes Faster Than Brooks at a Drama Club Meeting!

- USD PLN PREDICTION

- Brent Oil Forecast

- Bitcoin: Is the Bubble Finally…Deflating? 📉

2026-02-21 14:57