In a world where decentralization is the new black, Tron’s Sunperp struts onto the catwalk of perpetual DEXs, boldly asking, “Why not add another contender to the chaos?”

Sunperp Opens on Tron; Traders Eye Fees, Slippage, and Funding

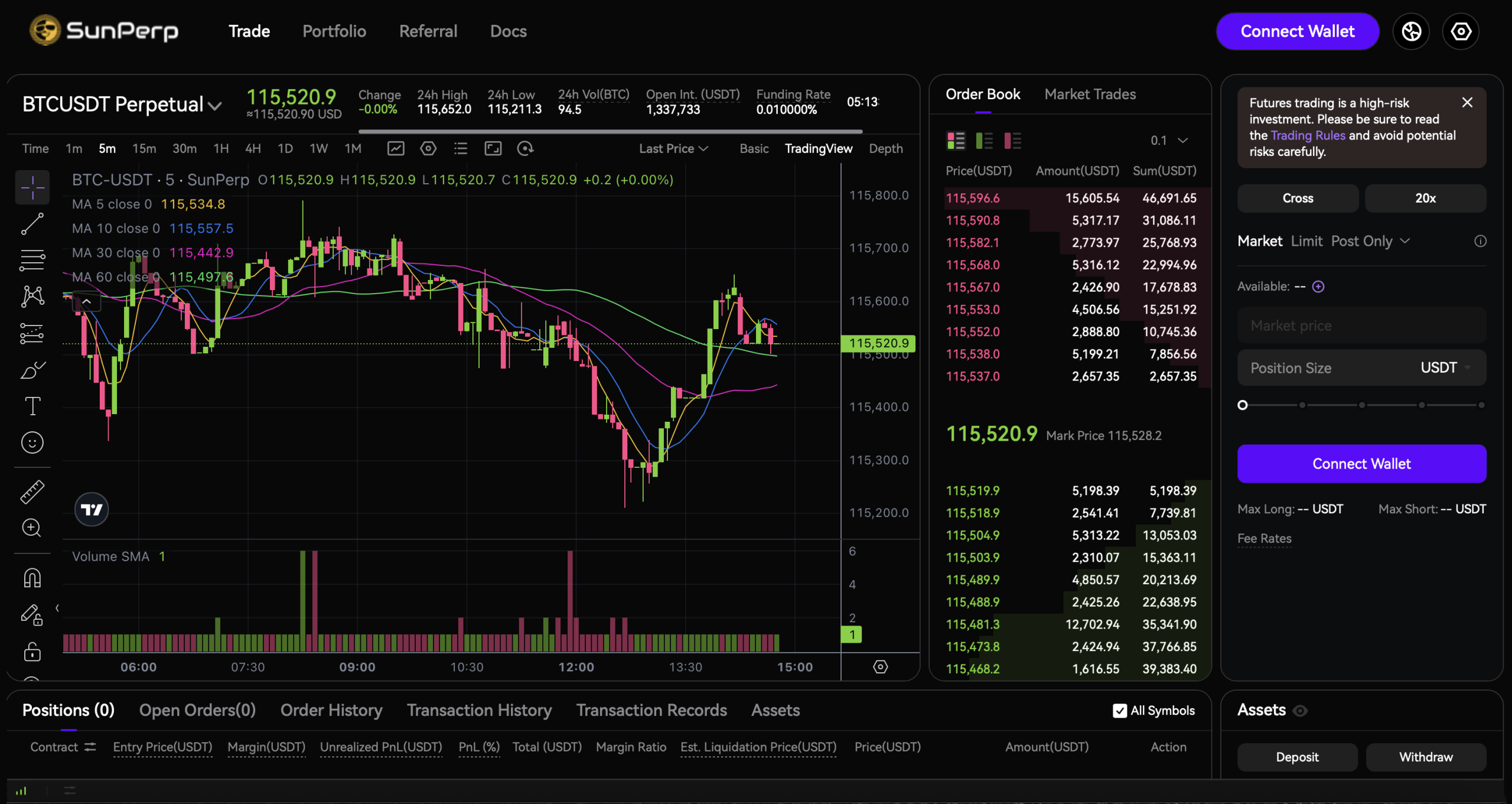

Sunperp, that most dazzling of Tron’s new jewels, proclaims itself a “perpetuals palace” where traders might lose their shirts-or perhaps keep them, if the stars align. Its designers, ever the romantics, promise a veritable symphony of technological bravado: aggregated liquidity (because one network’s chaos isn’t enough), off-chain matching with onchain settlement (a gas-free waltz through the blockchain), and multi-source oracles whispering sweet, algorithmic truths.

The parchment of Sunperp’s wisdom boasts millisecond-level matching-a feat akin to slicing through time with the precision of a Parisian watchmaker. Tiered fees, tied to trading volume, dangle the illusion of fairness, while “transparent” risk parameters shimmer like mirages in the desert of DeFi. How very noble.

Order types abound! Market, limit (with FOK, GTC, and IOC as exotic spices), post-only, plan orders, trailing strategies, and TWAP-all served with a side of USDT, the stablecoin that’s neither stable nor a coin, but rather a philosophical quandary wrapped in a blockchain. P&L? Calculated in USDT, naturally. One might wonder, in this age of digital alchemy, if we’re all just trading illusions.

Sunperp’s risk tools include an insurance fund-a pot of gold at the end of a rainbow that may or may not exist-and auto-deleveraging (ADL), a delightful mechanism that reduces opposing positions during market stress. Users are treated to an on-screen ADL risk indicator, a charming little countdown to oblivion. Price-deviation protection? It’s like a chivalric code for when the market turns feral.

The documentation, a tome of optimism, insists core contracts are non-upgradable (a rare vow of chastity in a world of endless revisions) and warns of “testing mode.” Risks? Smart-contract bugs, liquidity droughts, and network congestion-because nothing says “trust us” like a laundry list of disclaimers.

Liquidations trigger when the mark price-a Frankenstein’s monster of spot venues and funding rates-reaches a position’s threshold. Small fry get fully devoured; whales are nibbled in tiers. How democratic!

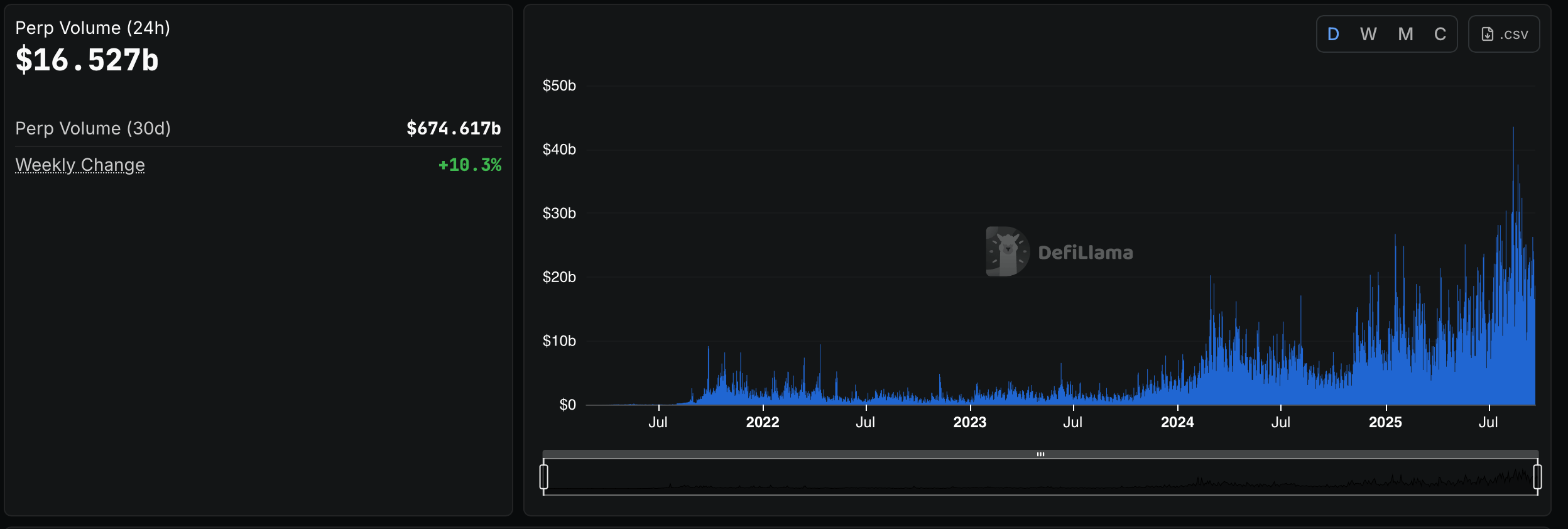

Yet, dear reader, let us not forget: Sunperp enters a battlefield where only the fittest (or most audaciously marketed) survive. Competitors like Hyperliquid and GMX parade deep liquidity, rebates, and airdrops like peacocks at a garden party. DefiLlama’s charts? Hyperliquid reigns supreme, hoarding 31.48% of daily volume. Sunperp’s entrance is less a revolution, more a well-timed curtsy.

Traders, ever the skeptics, will dissect fees, spreads, and funding rates like Victorian pathologists. Tron’s founder, Justin Sun, a modern-day P.T. Barnum, tweets: “Sunperp’s got three big perks: deposit paybacks, lowest fees, and airdrop hype.” One wonders if “do the math” is a dare or a plea.

“Jump in and try the cheapest Perp DEX on Tron – do the math!”

In this grand theater of decentralized finance, Sunperp offers a rulebook thicker than a Dickens novel and an invitation to duel against titans. Will it triumph? Perhaps. Or perhaps it’s merely another act in the eternal spectacle of blockchain’s obsession with reinventing the trading wheel-with a few extra emojis for flair. 🎪

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-09-22 01:08