So, Tether’s making bank again, huh? Their latest attestation says they’re sitting pretty with more assets than liabilities at the end of 2025. Big whoop. What’s next, they’re gonna start their own country?

Tether’s Reserves: Because Who Needs a Full Audit When You’ve Got BDO?

According to this report, prepared by BDO Advisory Services (you know, the guys who probably charge a fortune for a “point-in-time snapshot”), Tether’s got $192.9 billion in assets and $186.5 billion in liabilities. That’s a cool $6.34 billion in excess reserves. Wow, Tether, you’re practically a charity at this point.

BDO, one of those big-shot accounting firms, says everything’s on the up and up. Of course, they would. They’re not gonna bite the hand that feeds them, are they? Most of Tether’s liabilities are tied to those digital tokens everyone’s redeemable on demand. Because, you know, nothing says “stable” like a cryptocurrency you can cash out whenever you feel like it.

So, where’s all this money stashed? Oh, you know, the usual-U.S. Treasury bills, reverse repos, and a little something called gold. Because nothing says “we’re serious” like hoarding precious metals. They’ve also got $8.43 billion in bitcoin, because why not throw some volatility into the mix? Cash and bank deposits? A measly $34 million. Pocket change, basically.

And let’s not forget the $17.04 billion in secured loans. Overcollateralized, of course. Because Tether’s not taking any chances. Unless you count the fact that they’re in the middle of two lawsuits in New York. But hey, no provisions for those. They’re just minor details, right?

Tether’s equity took a dip from $7.09 billion in 2024 to $6.34 billion in 2025. But don’t worry, they made up for it with $10.1 billion in financial results. And then they gave away $10.86 billion in dividends. Because why hold onto money when you can just throw it around?

Oh, and did I mention they made over $10 billion in profits in 2025? Yeah, Tether’s basically a cash engine now. Meanwhile, I’m over here trying to figure out if I can afford another cup of coffee.

BDO’s like, “Hey, this assurance only applies to December 31, 2025. Don’t come crying to us if things go south tomorrow.” Thanks, BDO. Real helpful.

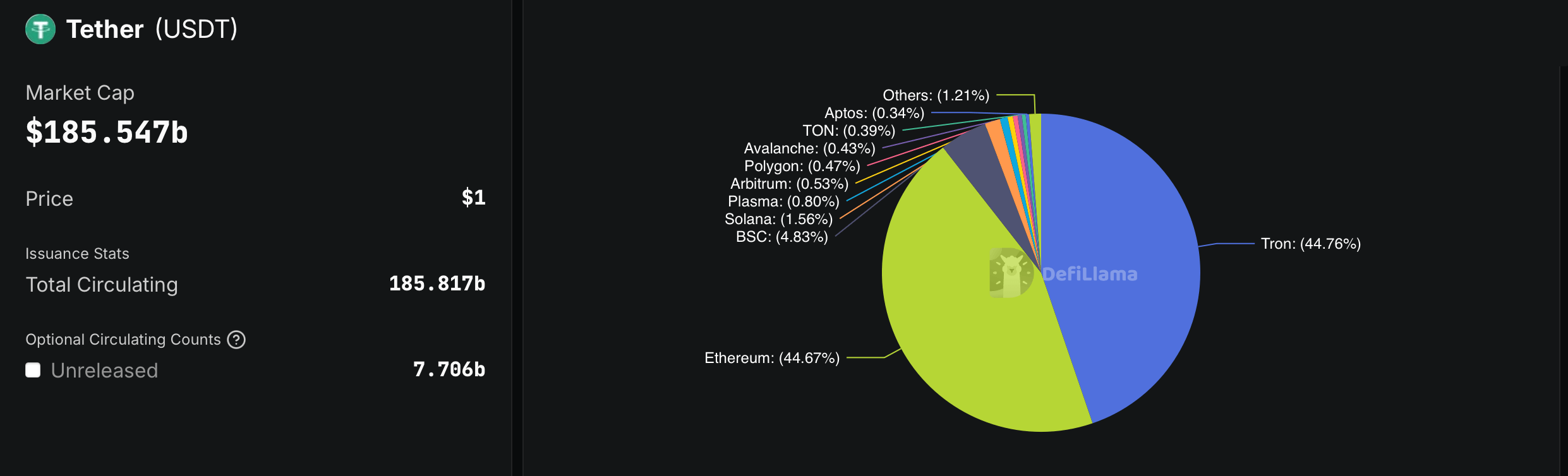

Tether CEO Paolo Ardoino says USDT is expanding because people want dollars outside traditional banking. Yeah, because who needs banks when you’ve got Tether? What could possibly go wrong?

FAQ 💵

- What did Tether’s latest attestation cover?

It reviewed Tether’s reserves and liabilities as of Dec. 31, 2025. Under ISAE 3000R standards. Whatever that means. - Did Tether’s reserves exceed its liabilities?

Yep. By $6.34 billion. Big deal. - What assets back Tether tokens?

Treasury bills, gold, bitcoin, loans, and who knows what else. It’s like a financial grab bag. - Is this a full audit?

Nope. Just a “reasonable assurance engagement.” Whatever that means. Sounds like a cop-out to me.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- BTC PREDICTION. BTC cryptocurrency

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2026-02-01 08:22