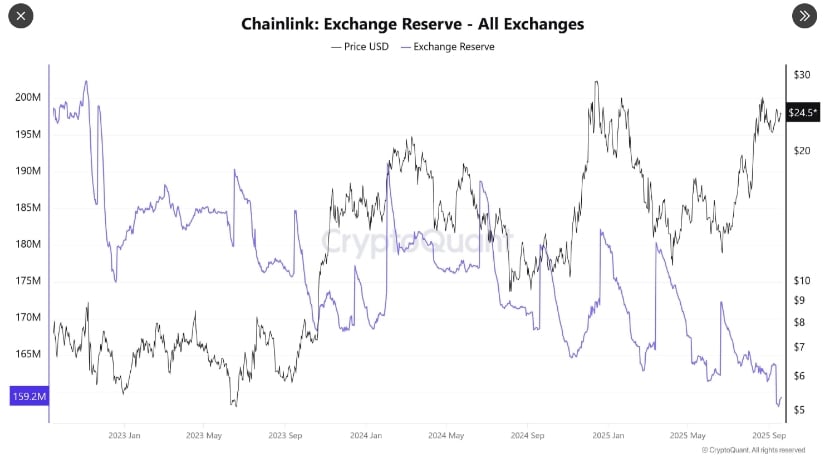

Degen Sing, that fearless oracle of market chaos, has declared war on logic itself by pointing out that Chainlink’s exchange reserves have shrunk to levels last seen in 2022-presumably when people still thought “Web3” was a new type of sandwich. Meanwhile, the Cross-Chain Interoperability Protocol (CCIP) is busy making friends in high places (banks, gaming projects, etc.), while the staking v0.2 upgrade cheerfully locks tokens away like a cosmic version of your mum hiding the biscuits. Shrinking supply? Rising demand? Sounds like the universe is playing a cruel joke on traders. Again.

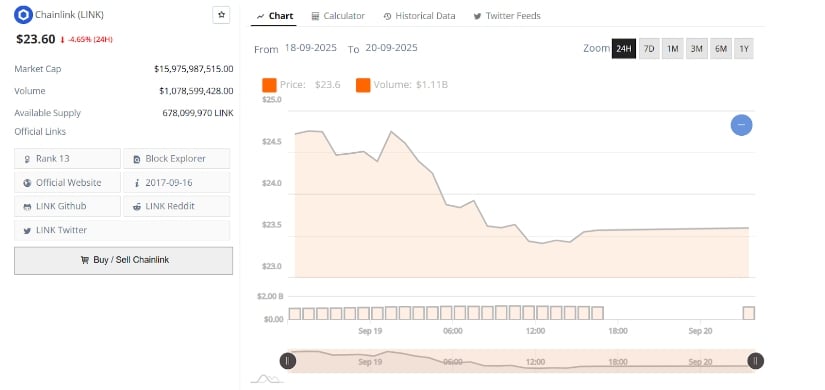

Analyst Ali, armed with a chart and a questionable grasp of reality, insists Chainlink is about to break through a “crucial resistance” at $25. If it succeeds, they claim, the token will ascend to $26.17, $27.84, and finally $30.13-a price path so precise it makes you wonder if the universe itself is trying to tell us something. Or maybe just trying to confuse us. Either way, a short-term dip to $23.3-$24 remains “possible,” because nothing says “confidence” like a backup plan involving existential despair. Current price action hovers near $23.6, with daily volume hitting $1 billion. Because nothing says “market attention” like a token that looks like it’s trying to escape Earth’s gravity-but with less fuel.

Exchange Balances Fall to Multi-Year Lows

Chainlink’s exchange reserves have plummeted to levels last seen in 2022, a time when “crypto winter” was just a metaphor and not a lifestyle. According to Degen Sing, fewer tokens are available for trading because holders have apparently decided to play hide and seek with liquidity providers. This “tightening supply” means even the faintest whiff of buying interest could send prices spiraling upward-like a toddler with a megaphone near a stock chart.

Degen Sing also noted that CCIP is now being embraced by banks, real-world asset platforms, and gaming projects. This “network usage” presumably supports long-term demand for LINK tokens, though no one has actually measured how many people want to bridge assets between chains while also wondering why they’re doing this. Meanwhile, the staking v0.2 upgrade continues to remove tokens from circulation, adding to the supply squeeze. It’s like a game of musical chairs where the chairs are made of hope and the music is a 401(k) fund.

LINK Breakout Levels and Technical Projections

Degen Sing claims the altcoin’s chart shows a “key breakout area” near $47. Clearing this, he says, could double the price-because nothing says “reliable prediction” like a number that sounds like it was pulled from a hat during a séance. Targets at $47.15 and $88.26? Sounds about as realistic as a moonbase economy run by sentient NFTs. He also insists that shrinking supply and increasing utility create a “setup” for upward movement. Presumably, the universe is watching and laughing.

This technical perspective coincides with current market trends: lower exchange balances and steady accumulation. If buying pressure builds and the token breaks through resistance, it could trigger its strongest rally since 2022. Traders are monitoring these levels like they’re waiting for a bus that never arrives-but with higher stakes and more existential dread.

Symmetrical Triangle Formation and Short-Term Levels

Analyst Ali has discovered that Chainlink is forming a “symmetrical triangle” on the 12-hour chart. If it breaks above $25, they claim, it’ll set targets at Fibonacci extension levels of $26.17, $27.84, and $30.13. This pattern, they explain, is a “narrowing range” creating conditions for a “directional move.” In other words, the universe is playing a cruel joke on traders by making the chart look like a math problem designed by a sadistic alien.

If Chainlink holds momentum above $25, the next target is $27-$28. From there, it could theoretically hit $30. The formation of “higher lows” in recent sessions is a bullish sign-or just a coincidence. A pullback toward $23.3-$24 remains possible, but staying above the rising trendline would preserve the bullish outlook. Because nothing says “bullish” like a token that looks like it’s trying to decide between a rally and a breakdown.

Recent Price Action and Market Metrics

Chainlink’s 24-hour chart recently fell after an early spike near $24.6. It then slid below $24 and stabilized around $23.6-a daily loss of 4.65%. Despite this, trading volume hit $1.11 billion, because nothing says “confidence” like a token that’s dropping but still attracting investors like moths to a flame. Market cap now sits near $15.97 billion, based on a circulating supply of 678 million tokens. Analysts say to watch the $23 support zone-if selling pressure persists, it might just collapse entirely. Or maybe it’ll rally again. Who knows? The universe isn’t answering.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-09-21 00:50