In the hushed corridors of economic despair, the Federal Reserve shall unveil its verdict this day at 2:00 PM ET, followed by the enigmatic Chair Jerome Powell’s symposium at 2:30 PM ET. The markets, in their collective delirium, cling to the hope of a 25 basis point reprieve, though the traders’ fervor (nearly 85% probability) suggests this ritual will pass like a phantom through the halls of Wall Street. Yet, what is a rate cut but a hollow promise when the soul of the market has already priced it in? 😂

Lo, the true drama lies not in the cut itself, but in Powell’s oratory-a performance that may yet unravel the threads of liquidity, rates, and the fragile tapestry of economic prophecy beyond 2025. Will he be the savior or the jester? Only time shall tell.

FOMC Rate Cut Decision: A Tale of Already-Priced Despair

Bitcoin and equities, in their recent paroxysms of optimism, have already danced to the tune of this expected 25 bps cut. As the sage Michaël van de Poppe mused, “When the market knows the punchline, the joke dies.” Should Powell deliver no surprises, the crowd may yet turn on the very news they craved, selling it like a cursed relic. 🐄

Powell’s Speech and the Dot Plot: The Real Villains of the Piece

Three specters shall haunt this FOMC meeting:

- The 2026 dot plot-a map of the Fed’s median rate outlook, as if the future could be charted by bureaucrats.

- Powell’s tone: Will he croon the lullaby of dovishness or bark the warnings of hawkish caution?

- Dissenting votes-a harbinger of discord within the Fed’s ivory tower.

These, dear reader, shall dictate the ebb and flow of liquidity-a lifeblood for crypto’s fragile heart. 💉

FOMC Meeting: A Tragic Lack of Data

Amidst the chaos, the government shutdown has stolen two months of CPI data, leaving the Fed to navigate the murky waters of inflation without a compass. One might ask: Can a central bank govern without data? The answer, it seems, is a resounding “No,” but the show must go on. 🎭

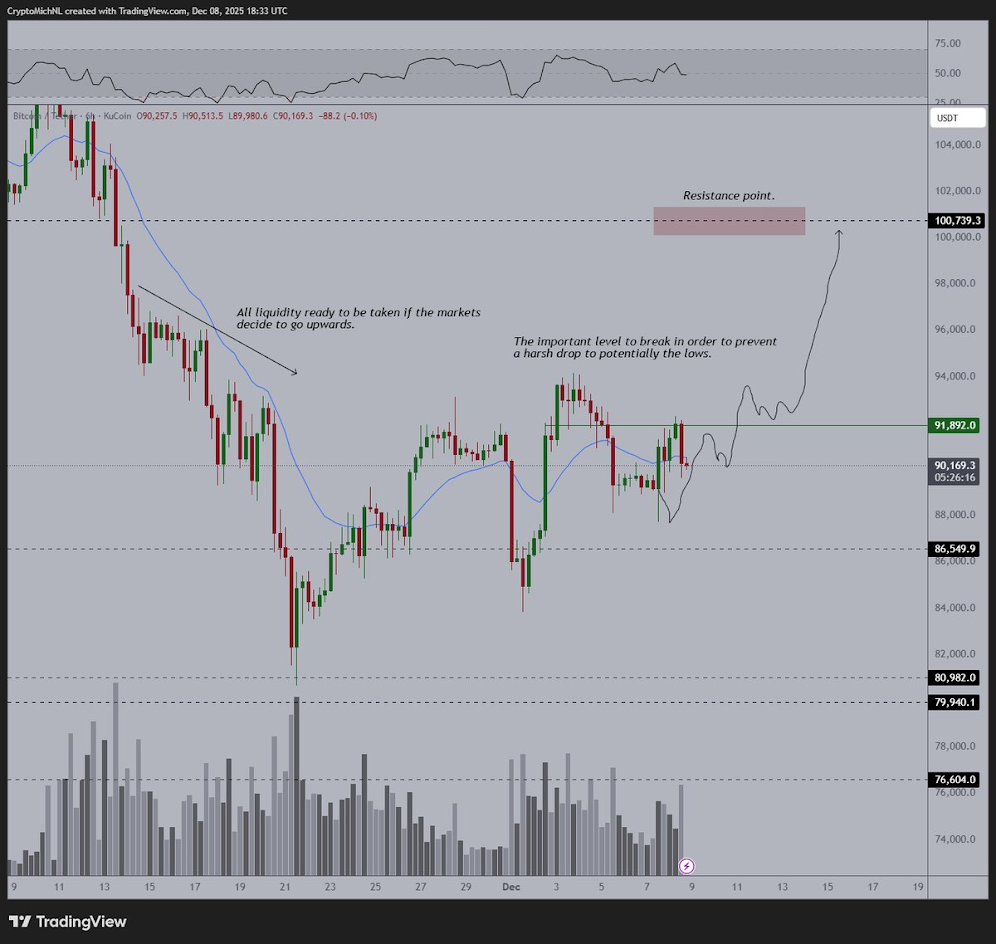

Bitcoin, in its tragicomedy, now dances to the whims of equities. When stocks rise, Bitcoin stumbles; when stocks fall, Bitcoin plummets. Van de Poppe, ever the oracle, warns of the $92,000 resistance-a wall that may yet shatter the dreams of many. Should it fail, the descent to $78,000-$82,000 may be swift and merciless. 🚀💥

The Two Paths of the FOMC: Utopia or Dystopia?

- The Fed cuts rates-a gesture as empty as a politician’s promise.

- Powell hints at liquidity support-a fleeting hope.

- The labor market’s weakness is acknowledged-a confession of failure.

Bearish Scenario

- The Fed cuts rates but whispers uncertainty-a double-edged sword.

- No mention of bond buying or liquidity tools-a betrayal of trust.

- Inflation concerns dominate-a requiem for growth.

A return to December 2024’s hawkish tyranny may yet turn the Santa rally into a Santa dump, a fate as cruel as it is poetic. 🎄🔥

Never Miss a Beat in the Crypto World! 🎵

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. For those who dare to gamble with their savings. 🎲

FAQs

When shall the fateful hour strike for the Fed’s deliberations?

The Fed’s verdict arrives at 2:00 PM ET, with Powell’s symphony at 2:30 PM ET. A timetable as rigid as a bureaucrat’s schedule. 🕒

How might this meeting affect Bitcoin’s plight?

A hawkish Powell may send Bitcoin tumbling toward $78k-$82k, while a dove might let it soar past $92k. A tale as old as time. 🕊️🕊️

Why does this meeting teeter on the edge of madness?

Two months of CPI data are missing, a void the Fed must fill with guesswork. A tragedy of errors. 🤯

Read More

- EUR USD PREDICTION

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- USD MYR PREDICTION

- EUR RUB PREDICTION

- GBP CHF PREDICTION

2025-12-10 10:48