Amidst the swirling mists of market speculation, one voice rises above the din, a voice that speaks of Ethereum’s ascent to the dizzying heights of $10,000. This is no mere whisper in the wind but a clarion call from none other than Arthur Hayes, the co-founder of BitMEX and a seasoned crypto investor. In a treatise that reads more like a prophecy than a market analysis, Hayes lays bare the forces that could propel Ethereum to its celestial throne by year’s end.

On the sacred day of July 23, Hayes unfurled his vision on Substack, a digital parchment where the secrets of the universe are often scribbled. He paints a picture of a world where the United States, under the shadow of wartime economic policies, embarks on a grand experiment of credit expansion. This, he posits, will not only fuel “asset bubbles” but will do so with a particular fondness for cryptocurrencies, with Ethereum basking in the glow of this newfound favor.

Hayes, ever the seer, foresees a future where Ethereum, long overshadowed by the likes of Solana, emerges from the ashes of the FTX scandal to reclaim its rightful place. He sees the hands of Western institutional investors, once hesitant, now reaching out to embrace Ethereum-based assets. Financial luminaries such as Tom Lee have already begun to herald the dawn of a new era, and the DeFi ecosystems are stirring, hinting at a breakout that could redefine the crypto landscape.

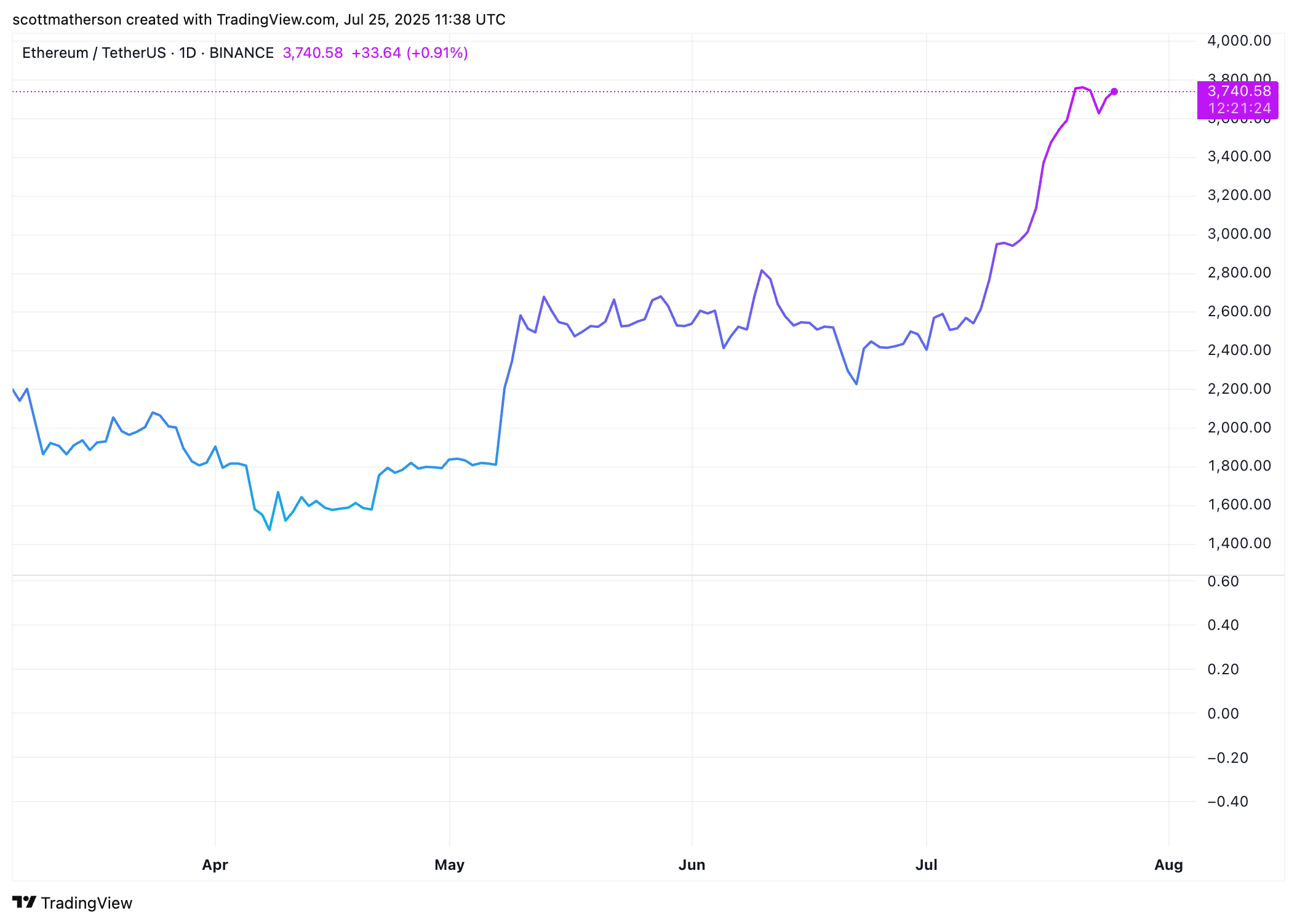

But Hayes’ vision extends beyond mere speculation. His venture capital firm, Maelstrom, has thrown its lot in with Ethereum and the broader ERC-20 ecosystem. With the boldness of a gambler at the table, Hayes declares that the next “Ether bull run” is nigh, predicting a staggering 176.3% rise from Ethereum’s current price. And if Ethereum is to soar to $10,000, why should Bitcoin be left behind? Hayes envisions a world where Bitcoin could touch the stratospheric heights of $250,000 by year’s end.

In his report, Hayes weaves a tapestry of macroeconomic narratives, tying Ethereum’s fortunes to the broader shifts in fiscal policy and geopolitical conflict. He speaks of a United States that is veering towards a form of state-sponsored capitalism, a system that, in its quest to fuel wartime production, encourages banks to lend freely, creating a fertile ground for inflation and, paradoxically, for the growth of non-essential assets like cryptocurrencies.

Hayes’ logic is both chilling and compelling. As the crypto market cap swells, so too does the amount stored in stablecoins, many of which find their way back into US Treasury bills. In a world where the crypto market cap reaches $100 trillion by 2026, stablecoins could indirectly fund trillions in government debt, making cryptocurrencies not just a sideshow but a central player in the drama of wartime fiscal policies.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR USD PREDICTION

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-07-25 18:21