In the early days of November, the price of Bitcoin embarked on a rather turbulent escapade, akin to the unpredictable nature of young gentlemen at a seasonal social gathering. On the Friday afternoon of the seventh, the premier cryptocurrency, with the nonchalant air of a debutante in unfamiliar company, dipped momentarily below the once reassuring mark of $100,000, much to the consternation of the investors who, until recently, found comfort at the aforementioned figure.

This downward capitulation has been duly attributed to a most interesting shift in the dispositions of the investing class, none more curious than that of the long-term holders (LTHs). A distinguished crypto savant, Julio Moreno by the name, shared his observations upon the intriguingly transformative behaviour of these steadfast custodians of Bitcoin.

The Apparent Demise of Demand

On a recent occasion of public discourse on the medium known as X, Mr. Moreno took note that the venerable long-term holders of Bitcoin have, indeed, parted with portions of their hoards. An activity not entirely unfamiliar, for it is habit amongst these prudent investors to reduce their holdings during the exuberance of bull markets, much like the well-to-do gentleman who briefly parts with his possessions to secure the most advantageous of trades.

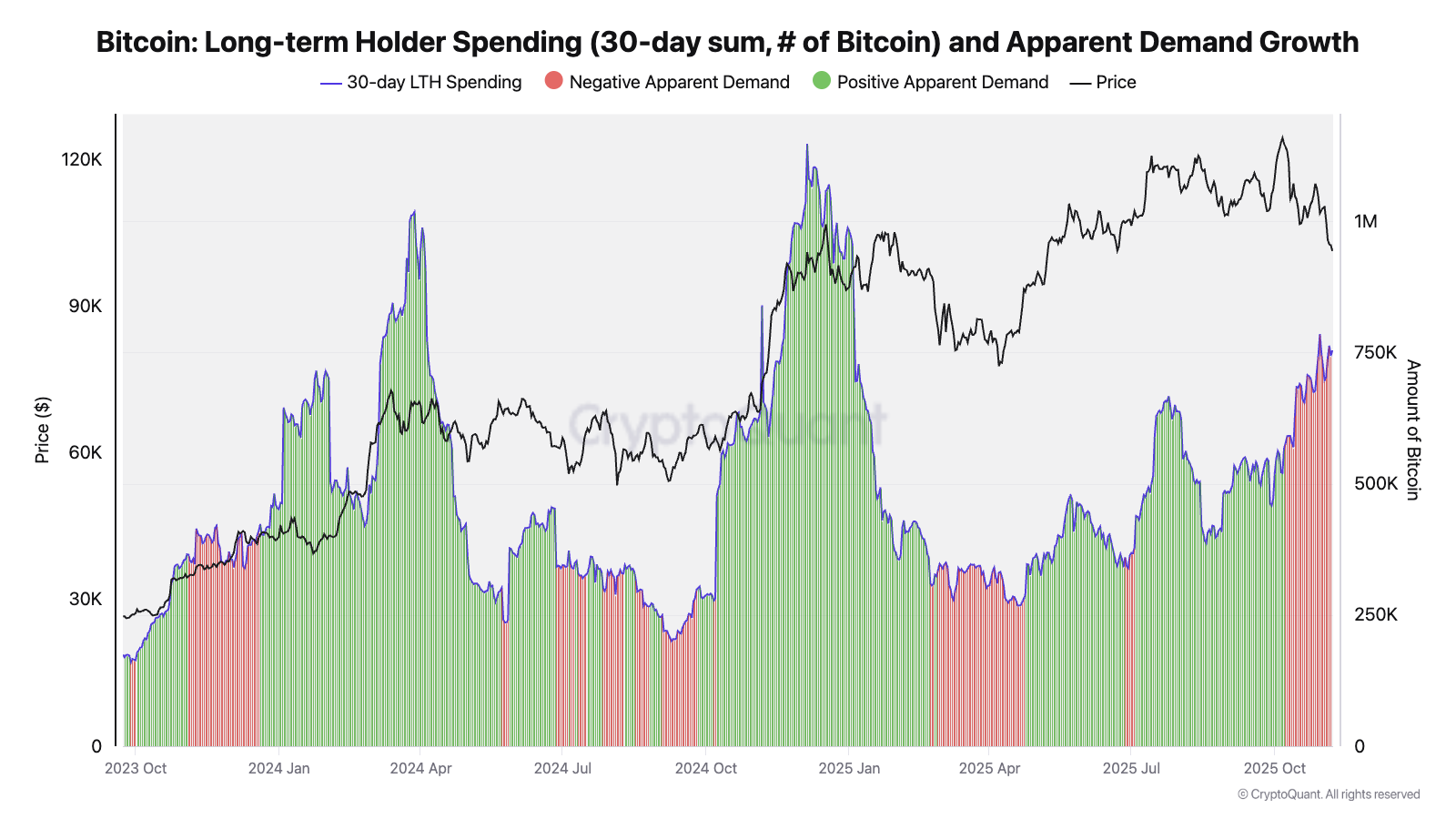

Alas, Mr. Moreno pointed out, a peculiar situation is afoot this time, for there seems to be a daunting absence of counterparts eager to fulfill these offloads. Backing this observation, he illustrated a chart most compelling, featuring long-term holder expenditure and a measurement known as apparent demand growth – a conundrum of exchanges that weigh the newly acquired against the freshly minted.

Mr. Moreno noted – with a keen eye – that previous occasions, where Bitcoin reached its zenith amid considerable long-term holder sales, were accompanied by a heartening swell in apparent demand. This was verily observed during the climactic ascents of January through March of 2024, and again in the chilly months of November and December that followed. To contrast, the present condition seems rather devoid of such mercantile enthusiasm.

Should we not, therefore, direct less of our watchful gaze upon these transactions made by steadfast holders? For it is in the hopeful rebirth of positive apparent demand growth that Bitcoin may turn its fate to a more favourable temper.

A Glimpse at the Fortunes of Bitcoin

As is appropriate at this juncture, it is reported that the audacious Bitcoin has made a modest recovery to a station modestly above $100,000. Currently engaged at the value of approximately $103,700, it marks an ascent of nearly three percent over the course of yesteryear – a slight elevation that can, at times, hold the promise of more graceful inclines to come.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

- EUR ARS PREDICTION

- Oh Dear, Plunge in Crypto Could Have You Pining for Traditional Acorns

2025-11-09 06:13