Gather ’round, dear reader, for a tale more twisted than a Moscow alleyway, about a digital gold rush and the nation that dreams to clutch its shimmering tail.

Imagine a chart, fiery and fervent, that stoked the flames of fervor on social media-an axe ready to chop down the mighty figure of American Bitcoin dominion, whispering, “By 2025, nearly 40% of all Bitcoin shall belong to the U.S.” But beware, for such visions are often but illusions spun by the grand puppeteers of hysteria.

Is it possible? A question quite as absurd as expecting a cat to dance ballet. The U.S. leads the chorus in holding Bitcoin, yes, but the reality’s closer to a farcical play than a nation’s conquest.

U.S. Bitcoin Holdings: The Shaded Curtain of Truth

The prophecy claims the U.S. secretly guards 7.8 million BTC-an empire almost half of all circulating crypto. Yet, look behind the velvet curtain: the truth is more modest, less orchestral symphony, more humbling jazz.

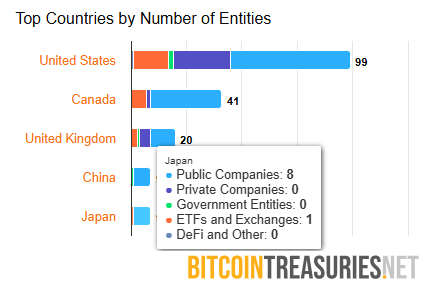

The government’s coffers, scarred from seizures like Silk Road and Bitfinex, boast a mere 198,022 BTC-think of it as a pawn shop, not a treasury. Meanwhile, corporate giants like MicroStrategy and MARA claim roughly 876,517 BTC, a sizable chunk but still a fraction of the fantasy. MicroStrategy alone grins with over 600,000 BTC, like a miser clutching his coins in a comic book.

Private companies and ETFs dance around, holding 188,105 BTC and a spectacular 1,342,715 BTC respectively-ever-growing, like a villain’s army in a Bulgakov novel, but still not enough to challenge the U.S. myth.

Summing it all: approximately 2.6 million BTC, or a mere 13% of the circulating supply-less than a dozen horror stories dressed as apocalypse.

Where the Whopper of 40% Began

That fiery chart? Born from the mind of one Fred Krueger-no, not that Freddy-but a man with an appetite for sensationalism. He boldly claims the U.S. might snatch 8 million BTC by year’s end, a number as bright and dangerous as a carnival mirror.

“Bitcoin is mainly a U.S. thing,” he proclaims, as if India and Europe are two forgotten characters in a Borges-like tale. But the truth? Less melodramatic, more mundane.

Who owns Bitcoin?

1/ It’s mainly a US thing

2/ India lurks at number two

3/ Europe? Not involved, just sipping tea

– Fred Krueger (@dotkrueger)

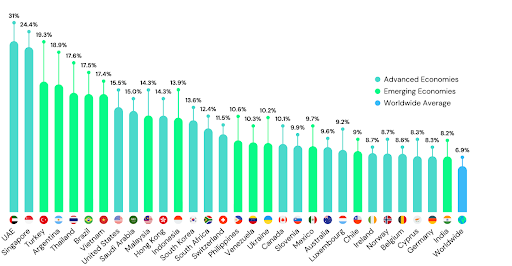

What of the American retail investor? Could their modest holdings push the country’s total to that absurd 8 million? Sadly, the data resembles a comic strip-about 15.5% of Americans dabble in crypto, owning small bags of Bitcoin, not armies of digital treasure.

Most are mere collectors of coins, not hoarders in the classic sense.

India’s Rising Crypto Serenade

Ah, India-a land of spice and aspirations, now also a burgeoning crypto hub. Holding an estimated 1 million BTC, or about 5% of the global stash, it’s the new borrower of success stories and heartbreaks alike.

The rise is meteoric-near doubling yearly since 2018-yet the Indian pavements are paved with hurdles: regulations, taxes, and bureaucratic labyrinths that resemble a Kafkaesque nightmare. Still, hope persists that one day, Indians will own enough Bitcoin to buy their own Taj Mahal-if only they can clear the legal fog.

Europe, China, and the Rest of the Circus

Outside the grand American stage, the other players perform smaller acts. Europe courts about 900,000 BTC-an aristocratic collection of institutions and investors-while China, alas, holds around 194,000 BTC, mostly under state lock and key, a grim reminder of the great firewall’s crypto shadow.

Latin America and Asia, excluding India, tip the scales with around 400,000 BTC each, Africa and distant lands hitch a ride with 300,000 BTC combined. Even when added together, the total doesn’t threaten the U.S.’s dream-yet it proves Bitcoin is as decentralized as a Bulgakov subplot, each character with their fleeting role in the grand chaos.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

2025-08-06 22:02