In a spectacle of crypto’s relentless theatrics, Bitcoin nosedived beneath the quaint threshold of $115,000, all while the market’s long traders—caught in the cruel irony of their daring—saw a staggering $700 million vanish in the blink of an eye, like a magician’s rabbit, or perhaps a badly kept secret. 😏💸

Bitcoin’s Rodeo at the $115,000 Rodeo Ring

Our beloved digital gold, Bitcoin, wobbled on the precipice of despair, dipping into the $114,000’s—an unpretty sight that prompted a quick, somewhat desperate bounce back above $115,000. Who knew that beneath the shiny veneer lay such volatility? The recent chart outlines this chaotic dance, as if Bitcoin were auditioning for a tragicomic ballet.

Last week, BTC flirted with $115K, only to rebound with the grace of a cat that just fell off a tall wall. Now, the question remains: is this dip just a fleeting hiccup or the opening act of a more dramatic exit from the comfort zone? The market’s mood swings are rivaling those of a petulant teenager.

Altcoins—The Overenthusiastic Cousins Who Got Burned

Meanwhile, altcoins, those lively little jesters, suffered a worse fate—mostly because they are too eager to follow Bitcoin’s lead, sometimes overzealously. Solana (SOL) and Hyperliquid (HYPE) took a 5% nosedive, proving that in crypto, the lesson “keep calm and HODL” is often just a bedtime story.

The Liquidation Circus: $804 Million Disappears in Thin Air

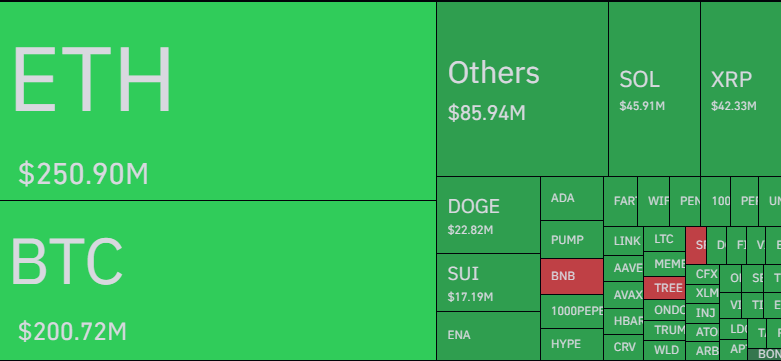

And now, for the pièce de résistance—liquidations! Thanks to the wild, unbridled volatility, over $804 million of contracts have evaporated into the ether, with longs—those overly optimistic traders who bet on the rise—accounting for 92%, or $741 million, of this tragic summa. Ouch. 🎭🃏

Ethereum took a hefty $250 million hit, slightly outpacing Bitcoin’s $200 million, perhaps because ETH’s recent antics made it look more like a diva at the peak of her tantrum—steeper declines, more speculative excitement, and all the drama that entails.

The market’s frantic heartbeat is laid bare by the soaring open interest, a kind of financial “What could possibly go wrong?” indicator, which has been surging like a caffeinated squirrel. CryptoQuant’s Maartunn hints that these wild swings may just be the opening chapters of a longer, more theatrical saga.

And as if to underscore the chaos, Bitcoin’s open interest on ByBit has jumped sharply, showing that traders remain undeterred—perhaps by recent liquidations, or perhaps by their own stubborn streaks. After all, in crypto, the show must go on, even if it’s into the abyss. 🚀🤡

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- GBP CHF PREDICTION

- USD VND PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- CNY JPY PREDICTION

- EUR USD PREDICTION

- GBP CNY PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

2025-08-02 10:18