Whilst the tumultuous month of August saw the markets for cryptocurrency engage in a most unsteady dance, remarkably, the economy of stablecoins found itself expanding by no less than $17 billion-an acquisition most unexpected as one would consider the times quite averse to such gains.

As of the second of September, annum Domini 2025, the estimable defillama.com reports a fiat-pegged, U.S. dollar-driven crypto economy valuing at $284,558 million-an increase of no small degree from $267,091 million on the first of August. This represents a most noteworthy growth of $17,467 million. Notably, Master Tether, accorded the title USDT, having accreted a market cap near $167.97 billion, boasts control of 59.03% of said market’s worth. Witness, if you will, the grandeur of such numerals!

The illustrious Circle, daring in their pursuits, witnessed their USDC amass a market cap of approximately $71.85 billion, with a welcomed import of some $7.98 billion. Ethena’s USDe, that young contender, did observe a rise in its supply of over 41%, now valued at $12.403 billion. As these digits do soar, one must admire the perseverance of these economic entities.

It is of interest, should one wish to indulge in such trivia, that Sky’s DAI graced August with a growth of $880 million-a climb of over 20%. Their USDS, alas, saw a modest retreat of $300 million. The World Liberty Financial, yet another rising player, augmented their USD1 by $349 million in that same month. Meanwhile, the BUIDL from Master Blackrock did suffer a trifling 0.6% dip.

To conclude the list of notables, Ethena’s USDtb took a modest rise of $72 million, Falcon Finance’s USDf added $146 million, while Paypal’s PYUSD advanced by $162 million-a notable ascent indeed. The latter crossed the formidable $1 billion mark in mid-August, and now boasts an all-time high market cap.

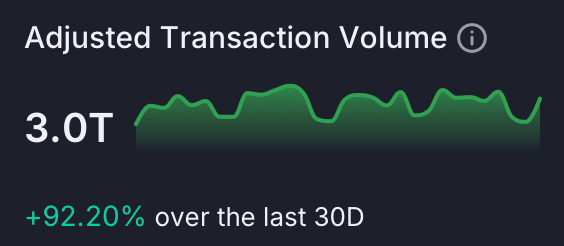

The scrupulous accounts from Artemis Terminal delineate that over the past thirty days, adjusted transaction volumes for stablecoins did leap over 92% to meet the staggering $3 trillion mark. Not to be overlooked is the increase in transactions by 16.9% to a grand 1.2 billion, and addresses by nearly a quarter, reaching 41.7 million. Long-term observations disclose that Ethereum and Tron have, as if by design, become the keystone of stablecoin liquidity. As new contenders like Arbitrum and Base make inroads, they still find themselves in the company of behemoths, suggesting a lengthy tenure for the latter as the bedrock of a veritable $280 billion pie.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-09-03 09:58