CoinDesk Indices

What to know:

Welcome, my weary traveler, to the cryptic journey of Crypto Long & Short – where we dig deep into the pulse of the digital markets. Brace yourself for some cold, hard insights, straight from the crypto trenches. Sign up for the full weekly dose of brilliance, delivered directly to your inbox every Wednesday.

Let’s talk about this week’s headlines, shall we?

- Andy Baehr from CoinDesk Indices gives us a “Vibe Check” – a tale of two markets: fast and slow, like tortoises and hares but without the cute part.

- Sam Ewen from CoinDesk tells us why internet-native communities crave internet-native currencies, and surprise, stablecoins are the logical (and only) bridge.

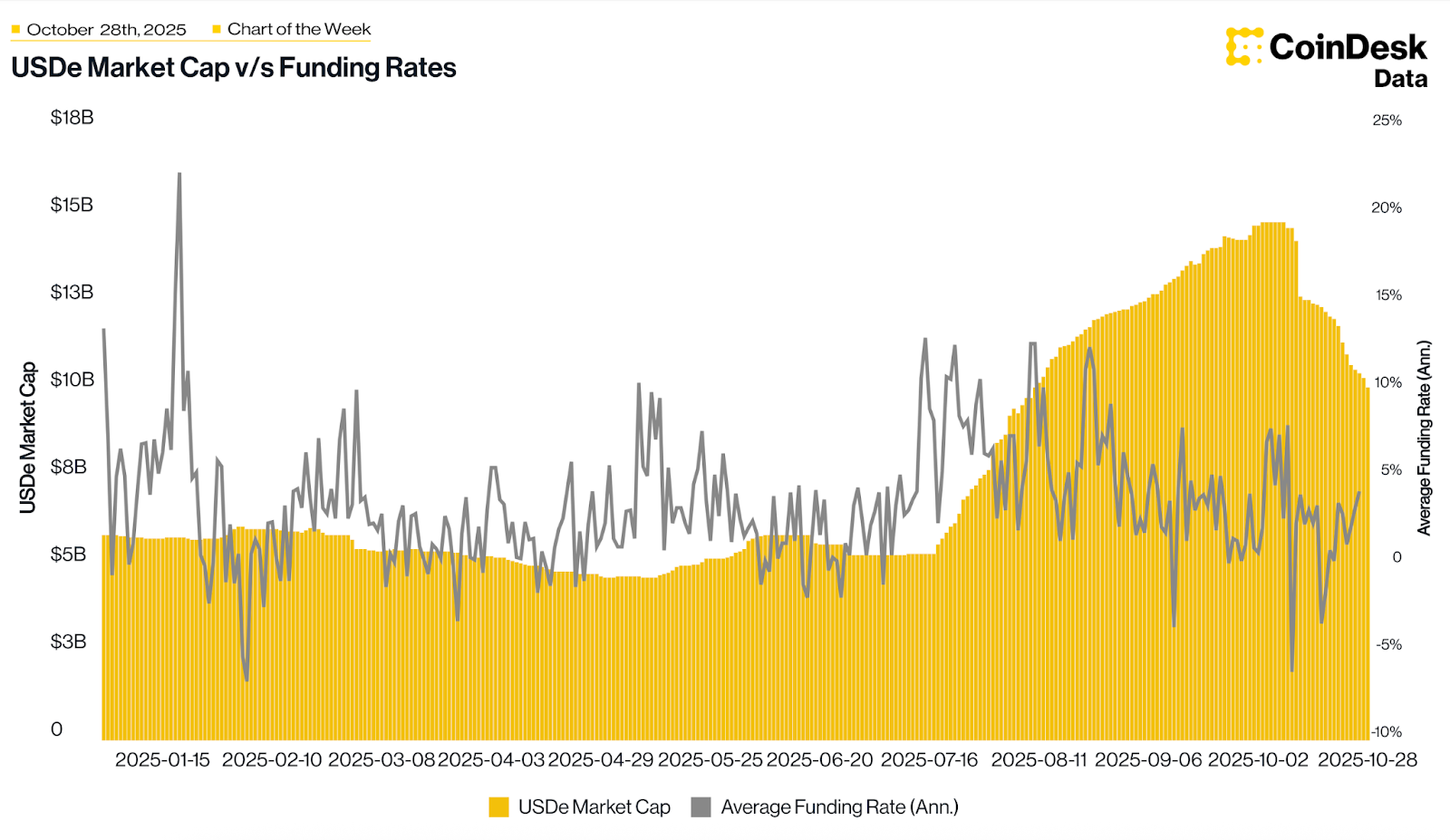

- In “Chart of the Week,” we examine Ethena’s USDe drop – you might want to sit down for this one.

Don’t forget – hit me up on LinkedIn with your burning questions, or even suggestions for future newsletter topics. Now, enjoy the ride!

-Alexandra Levis

Vibe Check

Fast Money, Slow Money

– By Andy Baehr, CFA, head of product and research, CoinDesk Indices

The fast money has been keeping its distance, like an old lover who only shows up when the market’s doing well. A few months ago, on a Sunday afternoon, a whale decided to toss 24,000 bitcoins into the deep end. The market didn’t just flinch; it broke. And just like that, ETH‘s all-time high of $4,955 evaporated into thin air. A rally that was brighter than my last Instagram post? Over. Gone. Done. SOL gave it a shot, but the market just wasn’t interested.

Then came September 17 – the Fed decided to cut rates by a quarter-point, plus a couple of future hints. But surprise! Not even that could resurrect the market’s spirit. Geopolitical tensions, tariffs, and a failing government shutdown made sure of that. Even gold, everyone’s favorite shiny metal, dropped faster than my patience when my Wi-Fi cuts out.

Of course, just when it seemed like things couldn’t get worse, President Trump pulled out the big guns on October 10. A 100% tariff on Chinese imports. Cue the liquidations – the most severe in crypto history. Market structure? Fragile. Optimism? Dead. “Auto deleveraging” became the buzzword. But let’s not forget the moment I saw Moses the Jeweler melting an Audemars Piguet – because if that’s not a market top, I don’t know what is.

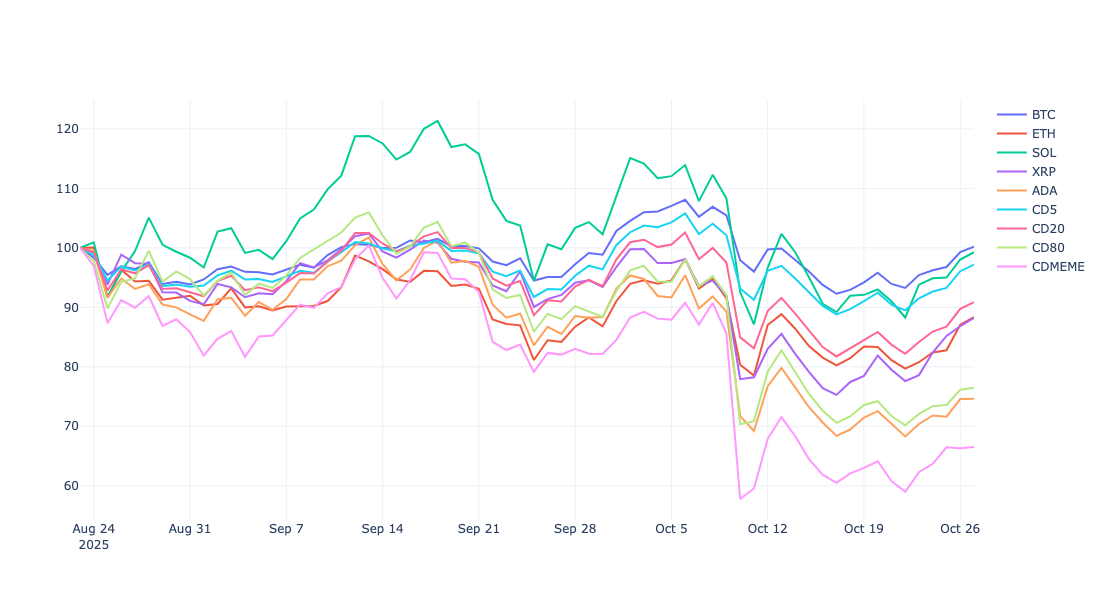

Top names and benchmark indices had a rough ride the last two months

The slow money was over here, just chilling. Never skipped a beat.

Big moves in M&A: Coinbase dropped $375 million to scoop up Echo. FalconX snagged 21Shares. Ripple went big with its $1.25 billion acquisition of Hidden Road, giving it a fresh coat of paint and calling it Ripple Prime. Big money, slow but steady.

And regulation? Moving fast. The SEC approved generic listing standards in September, cutting crypto ETF review times from 240 days to 75. The first crypto ETF tracking a market index? Yup, that’s out too – the CoinDesk 5. Not bad, right?

And then there’s JPMorgan. You know, Jamie Dimon’s “pet rock” – which now backs loans at the world’s biggest bank. From skepticism to crypto collateral. What a time to be alive.

So, while the fast money takes its sweet time to return, the slow money has been building, expanding, and growing. As the whales take their naps, the real players keep on playing.

Expert Insights

Stablecoins and Internet-Native Money

– By Sam Ewen, head of social media, multimedia and media innovation, CoinDesk

Oh, the internet. The land of memes, TikToks, and cat videos. But also, it’s home to the next wave of financial revolution. Let me break it down for you:

Vice is 31. The Sims? 25. Facebook? 21. Roblox? 19. Minecraft? 16. Instagram? 15. All of them existed before Bitcoin. Crazy, right? And here we are, after decades of digital lives, watching the internet generation evolve. Gamers, social media aficionados, digital traders – all these internet-savvy folks have spent years navigating virtual worlds. They built, traded, collected, and socialized online, long before Web3 was even a buzzword.

So, surprise, surprise – they want internet-native currencies. And the perfect candidate? Stablecoins. They’re the bridge that connects the online world to the offline economy. Bitcoin might have started it all, but stablecoins are the real deal, especially for those with an intuitive understanding of digital value.

Back in the day, if you were 30 in 2000, typing your credit card info into a website felt like playing with fire. Today? $16 billion is spent daily on e-commerce. Trust evolves. Just like digital money will. Age matters, and the younger generation is already fluent in digital value.

Now, let’s zoom out a bit. The Global South – regions outside the western world – where banking infrastructure is like dial-up internet. Places like sub-Saharan Africa, where a sudden currency devaluation pushed people toward crypto as a hedge against inflation. Combine that with a growing, digitally fluent population, and it’s easy to see why stablecoins are the future.

I’ve been to Rio, Seoul, and Singapore, and guess what? Stablecoins are the talk of the town. Seriously, you can’t go anywhere without hearing about it:

- In Brazil, developers see stablecoins as a way to build a stable career – talk about job security!

- In Seoul, one-third of adults use crypto. The Korean won is now the second most traded fiat in crypto. Let’s just say, they’re ahead of the game.

- And in Singapore, regulators are all in – working on how stablecoins fit into a pro-business regulatory regime. It’s only a matter of time before the whole world catches up.

Mark my words: digital currency is happening, and the old guards? Well, they better evolve – or get left behind. Blockchain and stablecoins are driving that change. Wake up, world.

Chart of the Week

Let’s talk about Ethena’s USDe. This little stablecoin has gone from $14 billion to $10 billion in just 30 days. Why? Well, its yield was compressed, courtesy of BTC and ETH perpetual funding rates. But don’t panic – it’s recovering. The funding rates are now back in the 2-4% range, which means money will start flowing again. And just like that, the market cap of USDe will bounce back.

Looking for more? Well, the future is here. Keep up with the latest updates at coindesk.com, and stay ahead of the curve. 📈

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 Crypto Whales Beware: Phishing Plunge Masks Sinister Shift! 🕵️♂️

2025-10-29 20:48