So, Analyst Charting Guy, who apparently spends his weekends drawing red lines on charts like some modern-day oracle, has noticed that Dogwifhat’s epic struggle against the monstrous resistance range of $1.20 to $1.40 is kind of like trying to get your cat to commute on a Monday morning. Multiple moving averages and red trendlines have all squished themselves into this tiny space, creating a technical traffic jam worthy of the Hitchhiker’s Guide’s least favorite planet.

If Dogwifhat manages a breakout (read: escapes this crowded drama club) fueled by a rising stampede of trading volumes, we may finally bid farewell to the dreaded ABC correction-(which sounds suspiciously like a preschooler’s alphabet song but is, alas, more boring). This, in theory, could trigger what the Elliott Wave theorists call a “third-wave rally,” which is the financial equivalent of a soap opera plot twist, potentially rocketing our beloved meme coin toward a jaw-dropping $4 to $5. Buckle up.

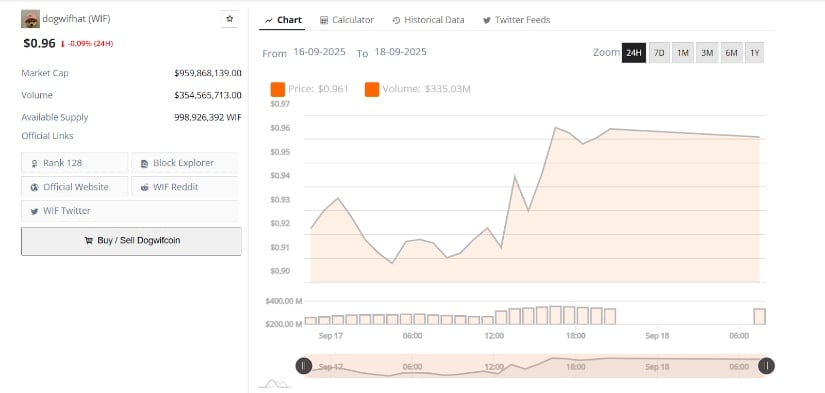

Meanwhile, analyst TOP GAINER TODAY – who sounds like a contestant in some unfortunate game show – proudly points out that Dogwifhat’s market cap is a wholesome $959.86 million with a daily volume chugging along at $354.56 million. This means lots of people are at least pretending to care. The coin dodged below $0.50 once or twice (don’t ask) but is clinging to that support like your last shred of dignity at a family reunion. Clearing the upper triangle boundary (yes, another shape! The financial charts love shapes) is mission critical if we’re to see any kind of bullish reversal that doesn’t end in a noose of despair.

Weekly Price Chart Forms Key Levels (Whatever That Means)

Our furry friend Dogwifhat was last spotted close to $0.96 after an early dip, which could have been caused by the coin witnessing a squirrel or simply market jitters. Over the last 24 hours, it danced precariously between $0.90 and $0.96-like a slightly intoxicated flamingo on ice. The market cap remained fairly placid at $959.86 million, buoyed by an energetic trading volume of $354.56 million and almost a billion tokens ready to pounce (998.92 million to be precise).

Buyers, presumably caffeine-fueled, strutted in during midday and gave the price a gentle nudge upwards, leaving our crypto coin basking at the upper end of its range like a cat on a sunny windowsill.

The price action looked like a slow morning recovery: a groggy ascent after a stumble. An afternoon rally pushed the token to the serene $0.96, where it settled down with the sophistication of a calm librarian, or possibly a bored panda. Volume surged during this move, suggesting that yes, people are still paying attention and defending their $WIF holdings like they’re defending the last biscuit in the jar.

Now, eyes are glued to the mystical $1.00 mark-psychological resistance, which means it’s basically a financial unicorn that dogs and cats alike want but might never catch. Sitting just below that is the $0.92-$0.94 zone, a kind of emotional security blanket for the trend.

Key Resistance Zone and Elliott Wave Structure: More Nerdy Stuff

Charting Guy (clearly the star of this saga) reminds us WIF is tiptoeing up on the brink of a critical resistance band near $1.40-imagine a red carpet made of horizontal and diagonal red lines, with moving averages throwing a wild party right in the middle. This isn’t just any technical barrier; it’s the Mt. Everest of meme coin charts, and Dogwifhat needs Sherpa-level stamina to get past it.

The Elliott Wave-a concept that sounds like a radio station for math geeks-apparently suggests that the ABC correction phase (the market’s way of saying “hold my beer”) might have finally clocked out. This sets the stage for a new, impetuous third wave, which, if it happens, could launch Dogwifhat from its humble abode near $1.40 all the way to some wild lands between $4 and $5. Dream big or go home, right?

Symmetrical Triangle Signals Potential Breakout (Triangles Are Back and They Mean Business)

Over at Binance, the WIF/USDT chart is currently engaged in an intense game of “How Tight Can We Get?” inside a symmetrical triangle, which, frankly, sounds like a torture device. The token is loyally hugging an ascending trendline that’s been faithfully climbing up since it was below $0.50, while an overpowering descending trendline near $1.20 keeps it in check like an overzealous bouncer.

The current weekly candle (because candles apparently like to measure finance too) hovers around $0.92, indicating a stewing pot ready to boil over into a “decisive movement” – which could be anything from a rocket launch to a slow, mournful plummet.

And what of our favorite analyst, TOP GAINER TODAY? He assures us that breaking out of this triangle might initiate a $5 rally, complete with impressive checkpoints at $4.0 and $5.0-because what good is a rally without a few shiny goals?

A weekly close above $1.20 to $1.50, accompanied by heavy volume (like an enthusiastic rave), would confirm a bullish reversal and slap a confident “Elliott Wave Approved” sticker on this ride.

Market Outlook and Support Levels: The Cliffhanger

In short: traders are nervously watching two critical levels like hawks with anxiety.

The $1.20-$1.50 zone is the ultimate boss level that must be vanquished to declare victory and bring forth the anticipated Elliott Wave extravaganza.

Below that, the ascending trendline starting around $0.50 is the trusty safety net that hopes to catch Dogwifhat should it stumble (because crypto is not for the faint of heart).

The immediate question is whether our plucky coin can boldly cross and hold above the sacred $1.00 mark-a feat requiring substantial buying interest and volume levels that make it rain like a hacker in a cyberpunk nightclub.

If this happens, and the weekly candle manages to close above the upper boundary of the mystical triangle, we might just witness the dawn of a new market era. Elliott Wave fans will be able to gawk happily at targets between $4 and $5, while everyone else will either celebrate or cry softly into their overpriced lattes. ☕🚀

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

2025-09-19 02:12