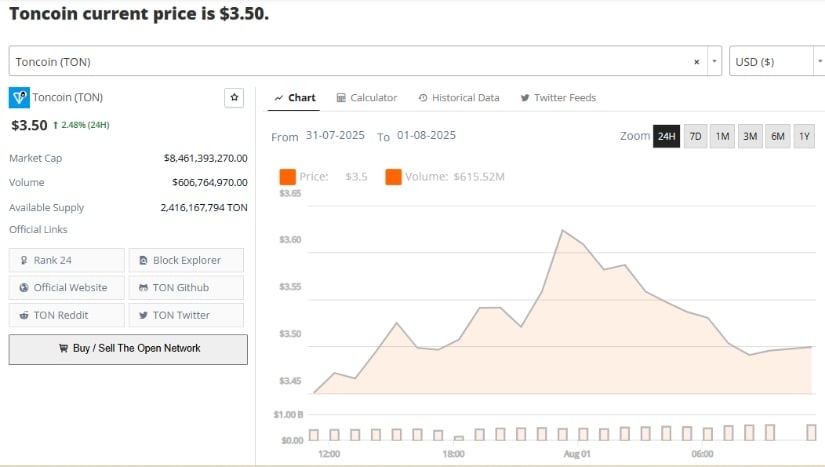

Let’s talk about Toncoin, the plucky digital upstart that’s been loitering around the water cooler of the crypto space lately. (In crypto, the water cooler is mostly Telegram groups populated by people with wolf profile pictures, but never mind.) After weeks of lethargic sideways shuffling that would make a sloth look ambitious, TON has abruptly woken up with the sort of gusto usually reserved for last-minute tax filers.

Suddenly, derivatives volume is climbing, technical indicators are flashing green, and Telegram’s bustling ecosystem has magically become the hottest club in Digital Asset Town. Analysts are now craning their necks to see if TON can muscle past $3.61—a number that’s less a price level and more a psychological Everest worthy of its own documentary special.

TON Derivatives Data: Apparently, Traders Still Have Money

Here’s where things get perky: Derivatives traders are pouring in like it’s Black Friday at a discount hoverboard store. Coinglass, apparently the civil registry of speculative crypto numbers, claims TON’s futures volume ballooned 19.49% (which is a lot in human terms) to $634.98 million. Open interest? Up 12.05% to a svelte $383.80 million. It’s the kind of enthusiasm not seen since people actually cared about Beanie Babies.

The result? Traders are applying leverage like it’s coconut oil at a bodybuilding competition, and you can practically hear the bullish chanting echoing off the digital walls.

RSI & MACD: Technical Analysis for the Terminally Optimistic 📈

Meanwhile, TON’s RSI—the technical equivalent of a sports car’s tachometer—sits at 65.78. For reference, “overbought” territory is 70, so technically, we’re not yet at the stage where everyone is irrationally exuberant, but you can see it from here. The MACD is even more chipper: line above the signal, no sign of a bearish crossover, all systems go, insert more jargon as needed.

If you like your analysis with a sprinkle of numbers, TradingView has 9 green “buy” signals (presumably from caffeine-fuelled robots) out of 17. The 50-day and 100-day SMAs are acting as support zones at $3.28 and $3.05, or as the crypto crowd calls them, “pleasant places to dream.”

TON Fundamentals: Telegram’s Not-So-Secret Sauce 🥫

The technicals scream “party,” but the fundamentals brought snacks. The TON Wallet just parachuted into the U.S. with Apple Pay and Google Pay integration, making it easier for 87 million Americans to accidentally lose their life savings in crypto. The numbers are gobsmacking:

-

Daily transactions above 2 million (which is like, a lot—unless you’re Visa)

-

Active wallets at 45 million (not all are your grandma, but give her time)

-

On-chain wallets topping 159 million (about 158,999,999 more than I personally own)

And in truly modern fashion, a juicy some genius who bought the @crypto username for $350,000 may now be turning down a $25 million offer. That’s the kind of ROI that makes your stockbroker cry into their instant noodles. This spotlight on digital identity makes Telegram’s head honcho, Pavel Durov, look slightly more like a wizard than usual.

Chart Structure: TON’s “Gravity? Never Heard of It” Moment 🚀

Technically, TON has been leaping over resistance levels like a caffeinated gazelle. The latest victim, $3.44, now acts as a cozy floor for bulls to rest their weary wallets. Price is squeezing higher, with a bullish continuation pattern so textbook it should have its own chapter.

Should TON gallop past $3.61—and according to Fibonacci, who apparently now works in crypto analytics—it might not dawdle until $4, or even $6.93, that oh-so-alluring number last seen in 2024 back when Dogecoin millionaires still roamed the plains.

Carl Moon, a popular crypto analyst (and probable astronaut given these targets) says, “Breakout opens the gates for $6.93.” Indicators agree. Wallets whisper. My dog’s barking. You get the picture.

Risks: Because Gravity Eventually Wins 🪂

Yes, yes, what goes up, often comes down, especially if someone yells “Black Swan!” in a crowded market. So, keep an eye on those support zones: $3.34 and $3.38 (thanks, Fibonacci, you eternal optimist).

The VWAP at $3.54 offers short-term support. If that buckles, trendline support sits down near $3.30 or even $3.15. At that point, expect the usual barrage of Twitter posts with fire and snowflake emojis.

The Crystal Ball: Will TON Soar or Trip Over Its Own Shoelaces?

With indicators glowing green, user stats climbing, and every crypto influencer polishing their rocket gifs, the stage is set for TON to try for $3.85, maybe even $4, or take another shot at stardom with $6.93.

Just remember—momentum is only truly confirmed when price decisively breaches $3.61. Until then, the only guarantee is that Telegram group chats will remain a mix of brilliant memes, questionable charts, and that one guy yelling “LFG!!!” in all caps.

For the curious (and/or masochists considering buying TON), keep half an eye on price action and all those ever-excitable derivatives signals. And bring popcorn.

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- GBP CHF PREDICTION

- USD VND PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- GBP CNY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- XRP Rockets Past $1B: The Fastest CME Contract to Make Wall Street Blush 🚀💰

2025-08-02 00:45