Stop the presses! (Just kidding, it’s 2025, nobody’s used a press since grandma’s rotary phone.) Investors are once again frothing at the mouth over all things digital asset-related. The global crypto market cap has crept up by 3% in the last 24 hours, which probably explains why your friend Chad just texted you “LFG 🚀” unironically.

Suddenly, every crypto-adjacent stock is hotter than an air fryer at a Super Bowl party. If you thought the excitement would stay in early 2020s memes, think again. Here are the crypto stocks bringing the drama today:

Coinbase Global (COIN)

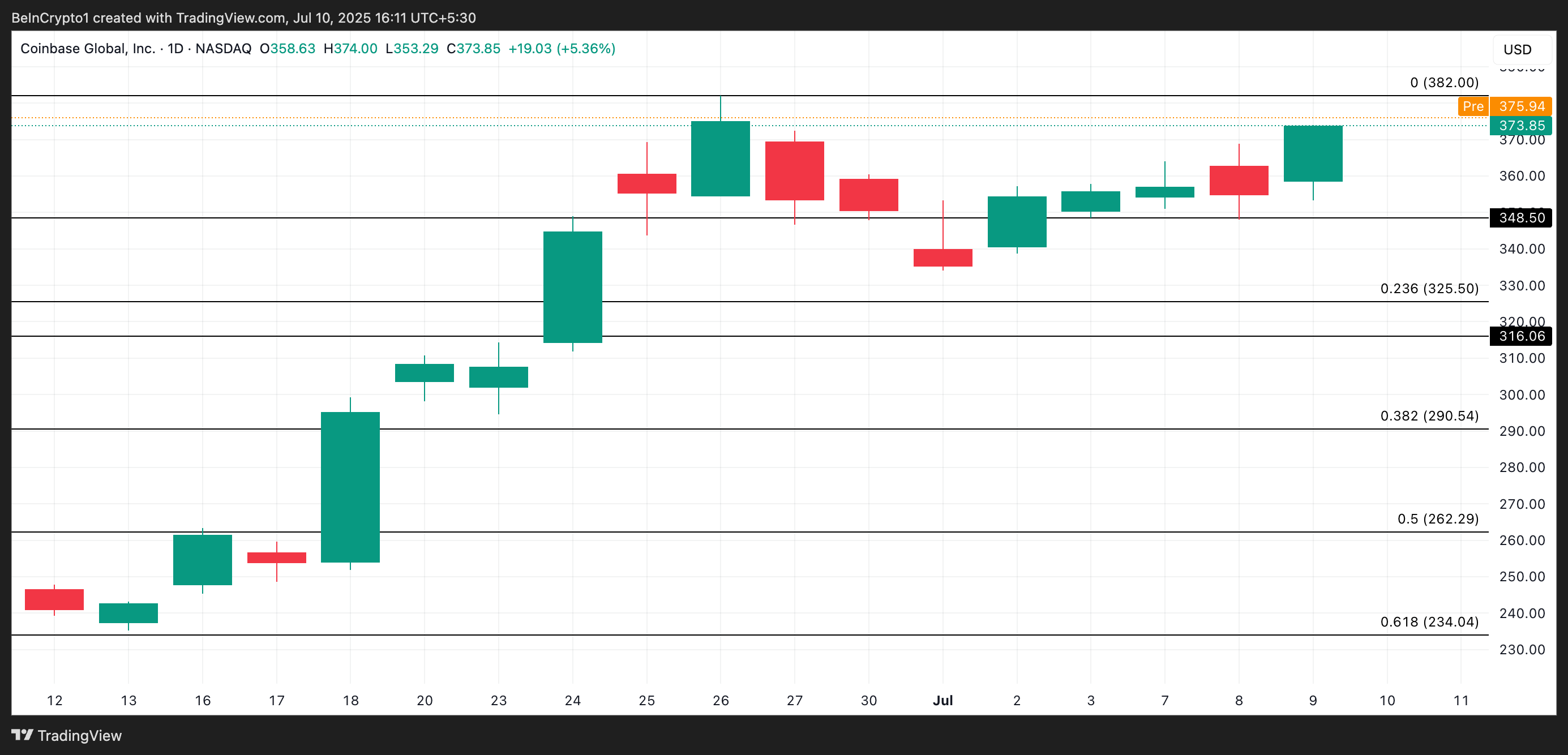

Coinbase just closed at $373.85—which is basically the cost of a tank of gas—up $18.93. Because nothing inspires investor euphoria (or panic eating Doritos at 2 a.m.) like a pending earnings release.

The company will drop its Q2 2025 shareholder letter and financial results on July 31, sometime after the market closes and also, presumably, after everyone’s blood pressure medications have kicked in. You’ll find it all on the Investor Relations portal—pro tip: BYO confetti.

This news pumped the stock even further in pre-market: $375.94 and climbing. If people keep YOLO-buying, we might see COIN audition for the role of $382. If, conversely, everyone collectively realizes they don’t know what “staking” actually means, we could tumble down to a more sensible $348.50.

Don’t look at this chart too long, or you might start believing in technical analysis.

Galaxy Digital (GLXY)

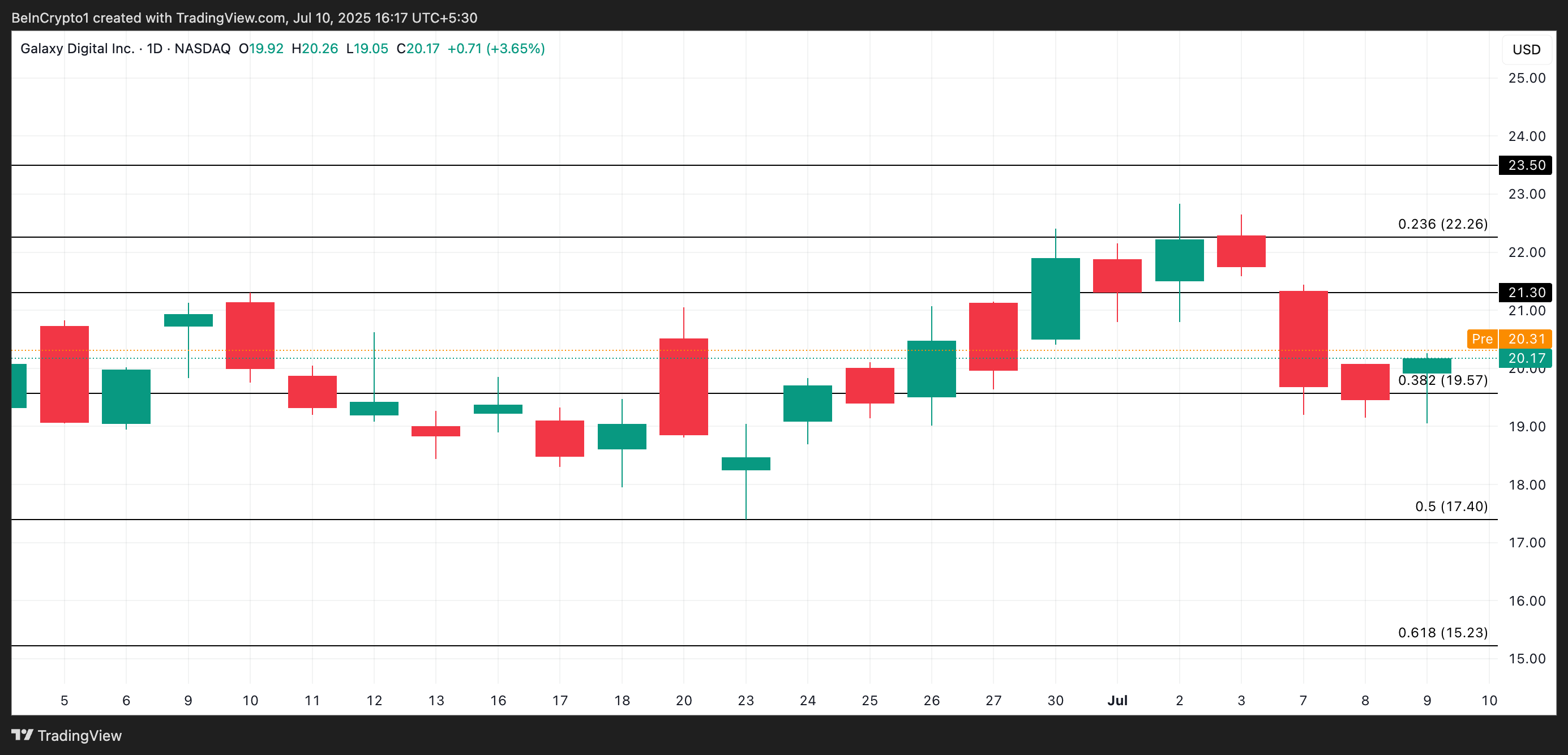

Galaxy Digital wrapped up the day with a 1% gain to $20.17, thanks to their hot new partnership with Fireblocks—and if you’re still thinking about actual blocks on fire, I can’t help you.

This new integration lets over 2,000 institutional clients do some serious digital asset staking from their comfy Fireblocks vaults, powered by Galaxy’s validator infrastructure (which, I assume, is very high-performance and not powered by hamster wheels, but I can’t prove that).

The strategy here: get institutions hooked on staking until they’re staking digital assets between bites of avocado toast. In pre-market trading, GLXY is at $20.31, but if bullish energy continues, $21.30 is in play. If not, we could see GLXY flopping below $19.57 like my hopes for an ’80s perm comeback.

Bitdeer Technologies Group (BTDR)

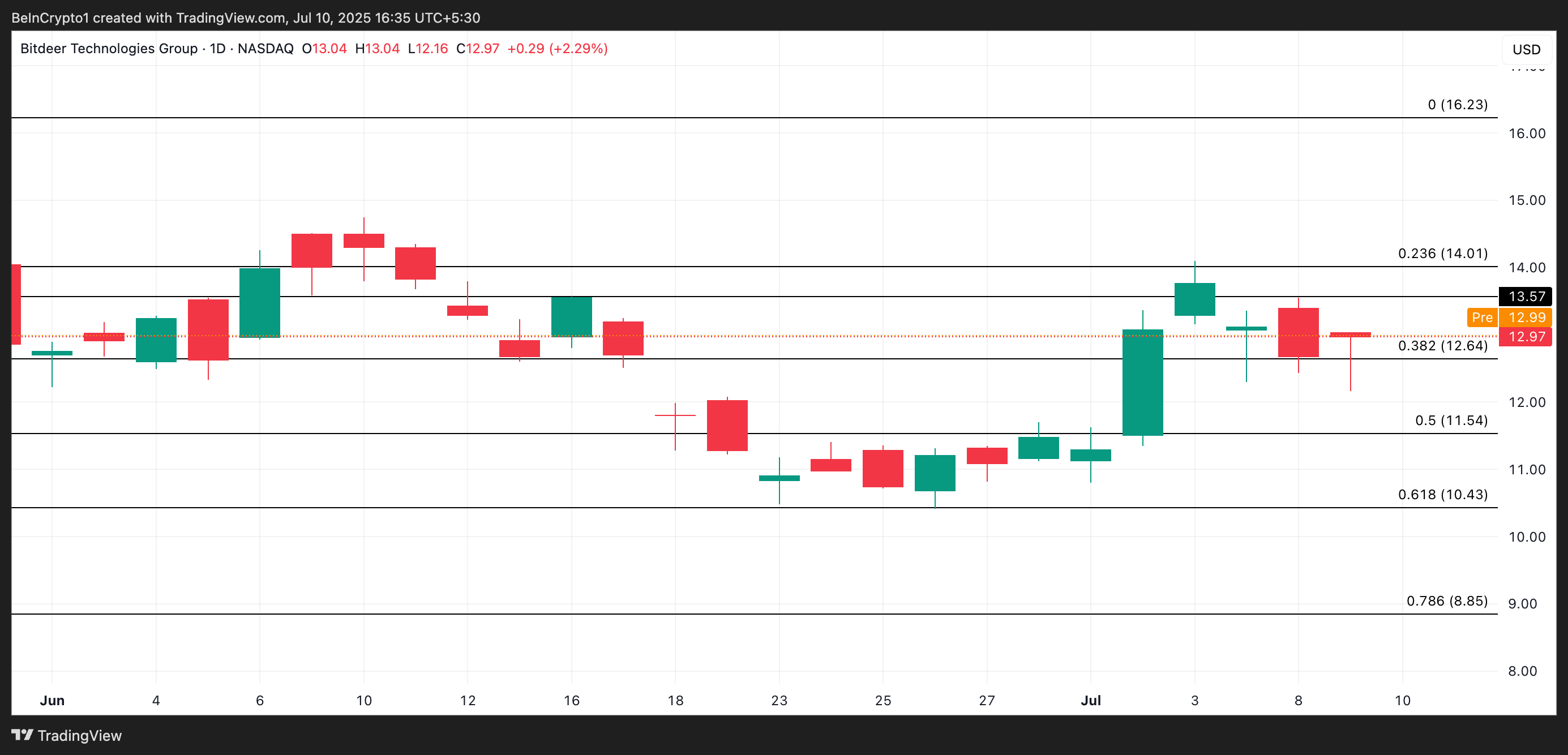

BTDR investors started smiling again after Bitdeer announced it self-mined 203 bitcoins in June (up 4% from May, and yes, someone’s counting). Credit goes to their SEALMINERs, which—despite sounding like a group of Navy mammals with pickaxes—just means machines boosting hashrate performance.

They’ve now cranked out 14.9 EH/s worth of SEALMINER A2 rigs, and scattered them across the U.S., Norway, and Bhutan, because why not.

BTDR ended yesterday at $12.97, and before lunch it’s at $12.99. If buyers stampede the open, we may see $13.57. If not? Well, $12.64 is looking as inviting as a mid-tier AirBnB.

Will these stocks moon, or will they crash harder than my attempt at intermittent fasting? Stay tuned. Or just refresh your portfolio every six seconds. Either works. 💸😂

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- Gold Rate Forecast

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Oh Dear, Plunge in Crypto Could Have You Pining for Traditional Acorns

- EUR ARS PREDICTION

- EUR AUD PREDICTION

2025-07-10 15:41