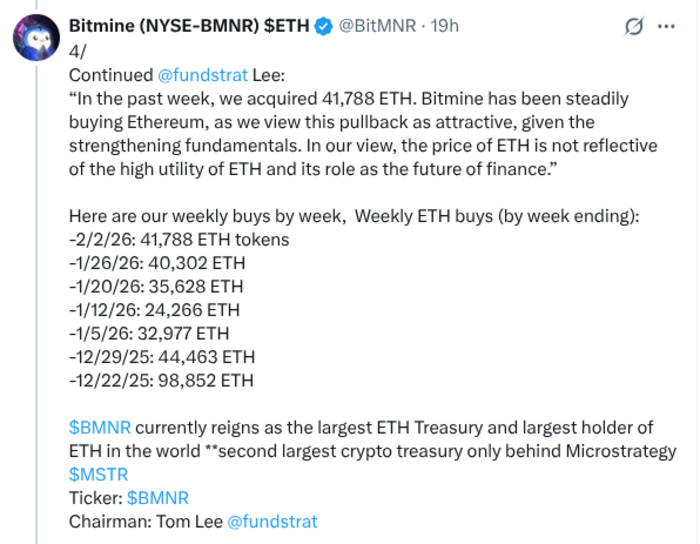

In the grand theatre of financial speculation, one Tom Lee, the Managing Partner of Fundstrat Global Advisors, has decided to don his best fortune-teller garb and predict a merry little jaunt back to riskier pastures. His hypothesis? A recent lull in the precious metals’ sparkling allure may just push capital back into the warm embrace of digital assets, with Ethereum ready to play the exuberant understudy.

While Bitcoin basked in the limelight of institutional adoration throughout the first quarter, the cosmic forces seem to be shifting. As gold and silver flirt with their historical zeniths, astute investors are casting longing glances toward assets promising both appreciation and, dare we say, a touch of native yield.

And why should we care? Historically, the market has regarded Ethereum as a high-beta romp during liquidity expansion cycles. In Lee’s esteemed analysis, the current $ETH price stagnation is merely a clever ruse, a classic accumulation phase before an anticipated repricing event, propelled by ETF flows and a renewed fervor in DeFi activities.

The on-chain data-bless it-seems to support this theory. While retail sentiment shuffles about nervously, large wallets have been accumulating like there’s no tomorrow, echoing patterns reminiscent of the euphoric 2021 bull run.

But, lo and behold! A resurgent Ethereum ecosystem brings to light the industry’s most obstinate bottleneck: fragmentation.

As liquidity waltzes back from commodities into the ‘Big Three’ (Bitcoin, Ethereum, and Solana), traders find themselves grappling with the friction of isolated ecosystems. This newfound activity underscores the pressing need for infrastructure capable of managing cross-chain volume without the headache of precarious bridges or wrapped assets.

Enter stage left: LiquidChain ($LIQUID), positioning itself as the knight in shining armor of Layer 3 infrastructure, ready to serve as the execution layer for this incoming wave of liquidity.

LiquidChain ($LIQUID) Tackles The Trillion-Dollar Fragmentation Fiasco

While market sages obsess over the fluctuating prices of assets, the real battle is waged within the hallowed halls of infrastructure. The current DeFi landscape compels users to make a choice of biblical proportions: the security of Bitcoin, the liquidity of Ethereum, or the blinding speed of Solana.

LiquidChain ($LIQUID) aims to dismantle these silos with its proprietary Layer 3 protocol. Unlike those archaic bridges that rely on the dubious ‘lock-and-mint’ mechanisms-responsible for over $2 billion in hacks-LiquidChain boasts a unified execution environment.

This architectural marvel facilitates what the protocol calls ‘Single-Step Execution.’ Instead of enduring the pain of manually bridging $ETH to Solana simply to acquire a trendy meme coin, LiquidChain merges the liquidity of $BTC, $ETH, and $SOL into a single user-friendly interface.

For the end-user, the complexities vanish like a magician’s rabbit; for the developer, it heralds a substantial reduction in liquidity bootstrapping costs. The project’s presale is drawing investors like moths to a flame, all recognizing that the next cycle won’t hinge on which chain emerges victorious, but rather which layer can elegantly connect them all.

By functioning as a Cross-Chain VM (Virtual Machine), LiquidChain facilitates verifiable settlements across diverse networks. This matters greatly-it alleviates the centralization risks tied to multi-signature bridges, replacing trusted intermediaries with cryptographic proofs. Truly, a tale for the ages!

Discover more about this unified future at the LiquidChain presale.

‘Deploy Once’ Architecture Aims for Developer Efficiency

The economic moat of any blockchain resides within its developer community; however, the current standard requires teams to manage separate codebases for EVM (Ethereum), SVM (Solana), and Bitcoin L2 environments-a veritable circus of resources!

Fear not, for LiquidChain ($LIQUID) provides a solution to this resource drain with its ‘Deploy-Once’ architecture. This feature allows protocols to write code in a singular language that seamlessly interacts with liquidity across all three major chains simultaneously.

This efficiency is paramount as institutional interest re-emerges in the market. Hedge funds and asset managers crave deep liquidity to enter positions without suffering the indignity of slippage.

A fragmented market breeds shallow pools; LiquidChain’s model consolidates them. By facilitating ‘Liquidity Staking,’ the protocol encourages users to supply the transaction fuel necessary to settle these cross-chain swaps, creating a circular economy where the $LIQUID token captures value from the frenetic movement of money between ecosystems.

If Tom Lee’s prophecy holds true and capital rotates aggressively out of commodities into crypto, Ethereum network congestion could send gas fees soaring. Thus, L3 solutions transition from mere luxury to essential for solvent trading.

LiquidChain stands as a bulwark against this congestion, offering a high-throughput lane for the market’s most active liquidity. A veritable haven for traders seeking refuge!

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2026-02-03 12:54