Ah, the thrilling world of trading! Where numbers dance like caffeinated squirrels and price movements suggest that someone, somewhere, is buying with the fervor of a child at a candy store. As our dear UNI approaches the mystical land of crucial supply zones, the market participants are valiantly defending their precious supports while dreaming of higher targets-because who doesn’t love a good dream? 🌈

Uniswap Price Resistance and Support Zones

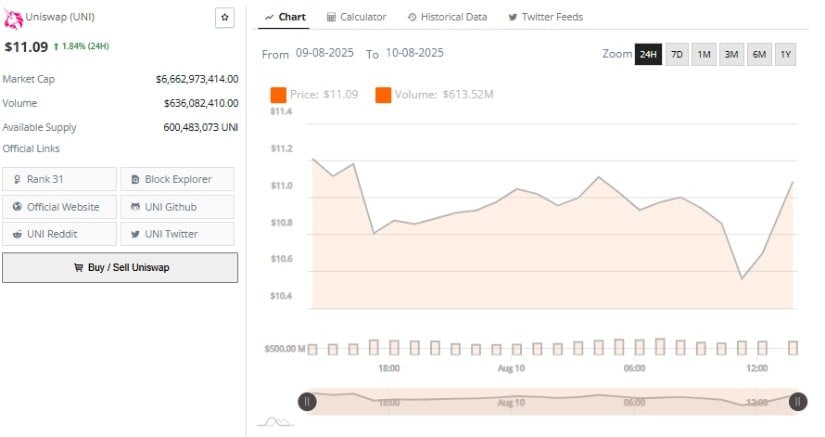

In a recent post that could only be described as riveting, CW unveiled the hourly UNI/USDT chart, which, much like a soap opera, illustrated a clear upward trend after prices hit rock bottom in early August. The price has gallantly broken through several resistance points, now flirting with a critical supply zone just above $11, which stretches from $11.20 to $11.60-an area that might as well be marked with a “Beware of Sellers” sign.

This zone is like a major obstacle in a video game where many sellers might swoop in to take profits, leaving buyers wondering if they should have brought a snack for the long haul.

Our analyst, with the wisdom of a thousand market sages, pointed out that if UNI can leap over this zone, it would be a bullish signal so strong it could probably power a small village. This would open the path toward the larger resistance or “sell wall” between $13.80 and $14.80-where dreams go to either flourish or be dashed like a poorly made soufflé.

Below the current trading price, CW highlighted crucial support areas near $9.50 to $9.80 and another between $8.20 and $8.40. These zones, once the formidable fortress of resistance, have now transformed into cozy support levels-like a warm blanket on a chilly night, indicating a healthy trend reversal where buyers are valiantly defending their key price floors.

Strong Volume Confirms Active Market Participation

Supporting the analyst’s observations, recent 24-hour data from BraveNewCoin reveals that Uniswap’s trading volume has reached a staggering $636 million. This elevated volume is like a loud cheer in a stadium, underscoring that the market is actively engaged, with buyers reacting to price dips as if they were on a rollercoaster ride, while sellers challenge gains within critical zones like gladiators in a coliseum.

Just this morning, a notable price drop to about $10.50 was met with aggressive buying that sent prices soaring back up to around $11.09. This V-shaped recovery pattern is a testament to robust demand, showcasing that buyers are committed to defending these key price levels like knights in shining armor.

The volume spikes accompanying this rebound confirm that recent price movements are backed by genuine market interest rather than the whims of a bored trader. This active engagement suggests that both bulls and bears are locked in a fierce contest, eagerly anticipating the next plot twist in this financial saga.

Technical Indicators Point to Consolidation

Now, let’s turn our gaze to the daily chart, where the price recently retreated from near the upper Bollinger Band and is now consolidating close to the mid-Bollinger Band around $10.11, which serves as a potential support level. This positioning reflects a short-term retracement following the recent rally, much like a cat that has just chased its tail and needs a moment to catch its breath.

The Relative Strength Index (RSI) is perched at 58.80, comfortably above the neutral midpoint but below overbought thresholds, indicating sustained bullish momentum without the excesses of a wild party. Furthermore, the RSI line remains above its moving average, signaling that the underlying positive sentiment hasn’t entirely vanished, despite recent price pullbacks.

This delightful combination of maintained support levels, elevated volume, and favorable momentum metrics suggests that UNI is navigating a phase of consolidation with bullish undertones. Market participants will be watching price action like hawks to see if the mid-Bollinger Band can hold as support, potentially allowing the asset to resume its upward movement. Conversely, a breach below this level might signal a deeper correction, akin to a plot twist that leaves everyone gasping.

In summary, the presence of strong buying interest and well-established support zones indicates that UNI is well-positioned for improved price performance in the near term as it eyes the elusive $14 resistance area. Buckle up, folks! 🚀

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-08-11 00:24