Ah, October, the month of golden leaves, crisp air, and the inevitable shattering of crypto dreams. “Uptober,” they called it, with the naivety of a man betting his soul on a roulette wheel. And yet, here we are, watching the castle of cards crumble like a Dostoevskian protagonist under the weight of his own hubris. 🃏💔

- October began with the pomp of a coronation, Bitcoin crowned in glory, ETF inflows and institutional greed pushing prices to heights that made even the most jaded traders blush. “Uptober,” they whispered, as if the name itself were a talisman against the abyss. 🏰✨

- But fate, that cruel jesters, had other plans. A $19 billion liquidation event struck like a thunderbolt, amplified by the thin order books and the crowded derivatives market. The crypto world, once a carnival of hope, became a morgue of shattered dreams. ⚡💀

- Yet, the analysts, those eternal optimists, insist the seasonal rally is not yet buried. Like a character in *Crime and Punishment*, they cling to hope, even as the noose tightens. 🙏🤡

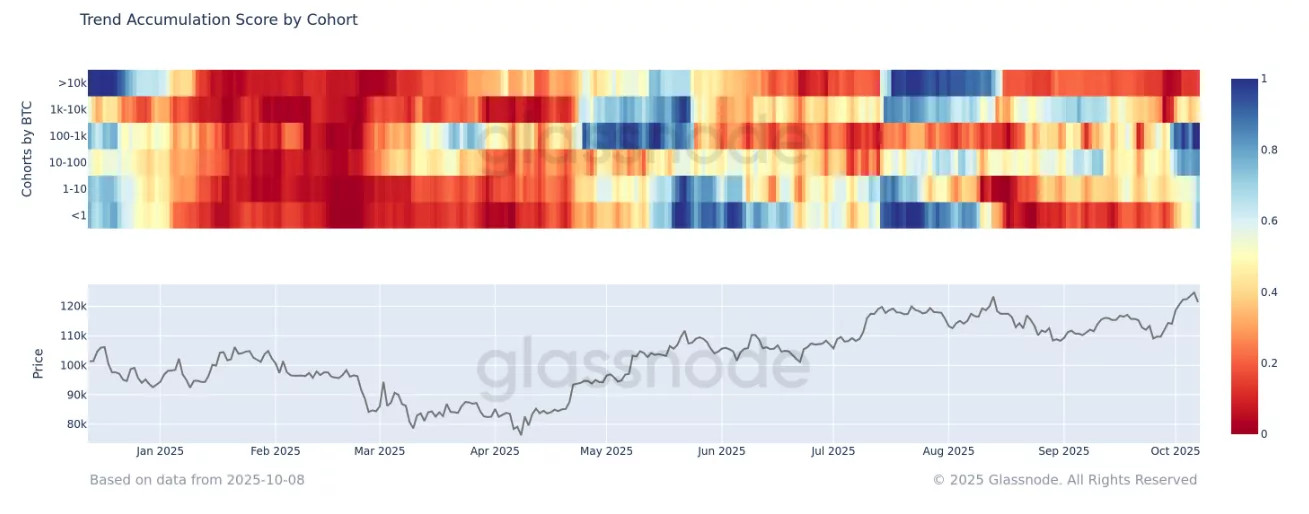

October started as a farce and turned into a tragedy. Bitcoin, that digital Prometheus, soared to $126,000, only to be cast down by the gods of liquidity and leverage. Glassnode, those modern-day soothsayers, noted that Bitcoin “broke through the $114k-$117k supply zone,” a triumph as fleeting as a Russian summer. ☀️❄️

“Uptober,” they said. Since 2013, Bitcoin has averaged a 46% return in October, a statistic as reliable as a Raskolnikov confession. But this year, the gods of the market decided to play a cruel joke, turning “Uptober” into “Downtober.” 🎭🔻

On October 11, the market suffered its greatest humiliation: a $19 billion liquidation, a massacre of leveraged positions. Bitcoin plummeted to $102,000, a fall as dramatic as a character in *The Brothers Karamazov* grappling with existential despair. 🌀😵

Liquidity, Leverage, and the Farce of It All

The analysts, ever observant, noted that Bitcoin’s price swings were not just from selling but from the thin order books, which turned the market into a slapstick comedy. Kaiko, in their mid-October note, summed it up with the gravitas of a Greek chorus:

“Volumes spiked as panic swept through crypto markets, exposing a stark liquidity gap across BTC order books. As selling accelerated, there simply wasn’t enough resting depth to absorb the flow; order books thinned out to the point of appearing empty for several minutes across major BTC venues.”

Kaiko

Even after the flash crash, some analysts, like characters in a Dostoevsky novel, cling to hope. K33 Research, in a moment of delusional optimism, declared themselves “increasingly optimistic,” as if excessive leverage and structural risks were mere trifles. 🤹♂️🤪

“We view the coming weeks as an opportune window for capital deployment into BTC, expecting the reset in perps and the normalization of funding dynamics to provide a constructive foundation for renewed upside momentum.”

K33 Research

Glassnode, ever the pragmatist, pointed out that before the liquidation drama, institutional demand was robust, with $2.2 billion in U.S. spot-ETF inflows. But what is money, after all, but a fleeting illusion? 💼🌫️

Uptober, in its tragic comedy, reveals the duality of the crypto world: institutional flows push prices higher, yet a single liquidity event, exacerbated by thin order books and crowded derivatives, can erase progress in an instant. What comes next? Perhaps a resurrection, or perhaps the final act of a grand tragedy. 🎭🤔

Will market makers, institutional buyers, and option sellers rebuild depth, or will October be remembered as the month the rally hit a liquidity wall and crumbled? Only time, that eternal judge, will tell. ⏳⚖️

Read More

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

2025-10-18 12:45