What You Ought to Know:

- Well, it appears that the good ol’ US of A and our friends from Iran are at it again, stirring the pot just in time for nuclear chit-chat. Hold on to your hats, because this could mean a wild ride for Bitcoin and other big-ticket items in the market.

- This geopolitical merry-go-round showcases just how rickety our current crypto setup is-sort of like a three-legged chair at a family reunion, only more precarious when the panic sets in.

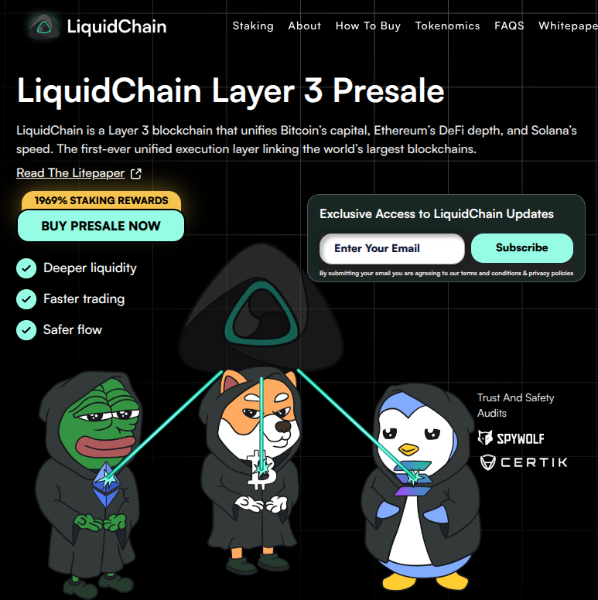

- Now, don’t fret too much, because LiquidChain ($LIQUID) is here to save the day! It’s like the Swiss Army knife of crypto, bringing Bitcoin, Ethereum, and Solana together under one roof, making liquidity as easy as pie-minus the risk of getting your fingers sticky with wrapped assets.

- Money is flowing into these new-fangled infrastructure projects like a river after a spring thaw, with the $LIQUID presale raking in a cool $526K as folks scramble to fix the liquidity mess.

Ah, geopolitics! Back in the driver’s seat once more, casting long shadows over negotiations about nuclear matters. The latest news has the US advising its citizens to skedaddle out of Iran quicker than you can say “nuclear fallout.”

Now, while this might seem a world away from crypto, we all know that geopolitical shenanigans can send shockwaves throughout the markets. For Bitcoin and the digital asset crowd, this whole situation is a bit like a double-edged sword: it proves that money that can’t be censored is mighty tempting, but also makes folks quiver in their boots, pulling back institutional dollars faster than a rabbit caught in headlights.

The market’s response? Classic textbook stuff! Traders are hedging their bets like a cautious gambler at a poker table, fearing that talks might go belly-up and lead to more sanctions or a ruckus in the region.

Bitcoin, bless its heart, is currently tiptoeing through some sensitive territory, reacting with all the grace of a cat on a hot tin roof whenever these headlines drop. But looky here, the real issue lies deeper: during these geopolitical flare-ups, liquidity tends to scatter like chickens when a hawk swoops down, leaving investors to either sit on their hands or flee to stablecoins.

And therein lies the crux of our current predicament-the market infrastructure reveals its gaping cracks when fear reigns supreme.

When panic takes the wheel, speed isn’t just a luxury; it’s a matter of life and death. But alas, we find ourselves dealing with clunky bridges and risky wrapped assets that make moving capital feel like running a marathon in quicksand. Anyone who’s tried to bridge assets during a flash crash knows the agony all too well.

This systemic hiccup is drawing the attention of savvy investors who want solutions to unify this chaotic landscape. Enter LiquidChain ($LIQUID), an ambitious project that aims to smooth out the bumps exposed by geopolitical stress.

LiquidChain ($LIQUID): The Harmonizer of $BTC, $ETH & $SOL Liquidity

While the markets are shaken by headline-driven chaos, the infrastructure side of things is quietly evolving behind the scenes. The core idea behind LiquidChain is as straightforward as a country road: liquidity shouldn’t be stuck in separate silos like an old-time fiddle in the attic.

Right now, if a trader wants to react to news-like a sudden breakdown in US-Iran talks-they face more friction than a wagon wheel in a mud puddle if they want to move their hard-earned value from Solana dogecoin to Bitcoin safety, or from Ethereum DeFi into stablecoins.

LiquidChain operates as a Layer 3 (L3) protocol designed to merge the liquidity of Bitcoin, Ethereum, and Solana into a single execution environment. This is important, folks, because it eliminates the need for those complex and often wobbly bridging mechanisms. Instead of ‘wrapping’ assets and inviting nasty counterparty risks to the party, LiquidChain uses a cross-chain virtual machine (VM) to ensure everything settles nice and neatly.

This industry has long been in desperate need of a solution that doesn’t just slap a band-aid on the problem but actually wipes the slate clean.

For developers and institutions, this ‘deploy-once’ architecture is a game changer. In a market reacting to macro-political shocks, the ability to access deep liquidity across three major ecosystems without juggling three different codebases is worth its weight in gold. By serving as a unified liquidity layer, the project makes sure that even when external tensions cause the global markets to fragment like a cheap mirror, the digital asset economy keeps flowing smoothly.

EXPLORE $LIQUID NOW

Smart Money Zeroes in on the $0.01355 Presale Entry

During times of macro indecision, institutional money often veers toward utility-heavy infrastructure. While retail traders obsessively refresh their feeds to catch every twist and turn of nuclear talk headlines, the big fish are looking at the plumbing that will support the next bull run.

The buzz surrounding the LiquidChain presale is a clear indication of this shift towards foundational technology.

$LIQUID has already reeled in over $529K, a testament to the strong early interest from investors who see the limitations of current L2 solutions. Priced at $0.01355, $LIQUID is an early bird special for those wanting to stake their claim in a protocol aimed at cornering the market on cross-chain efficiency.

The tokenomics are designed to encourage long-term participation, with use cases stretching from liquidity staking to transaction fuel. What many overlook is that as decentralized finance matures, value will likely drift from the flashy ‘casinos’ (DEXs) to the sturdy ‘roads’ (infrastructure) that connect them.

By tackling the liquidity fragmentation dilemma, LiquidChain positions itself as an essential utility, come rain or shine, whether the geopolitical climate is bullish or bearish. With the presale still rolling, the opportunity to grab tokens at the current price is dictated by market demand.

BUY YOUR $LIQUID FROM ITS OFFICIAL PRESALE PAGE

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2026-02-06 14:12