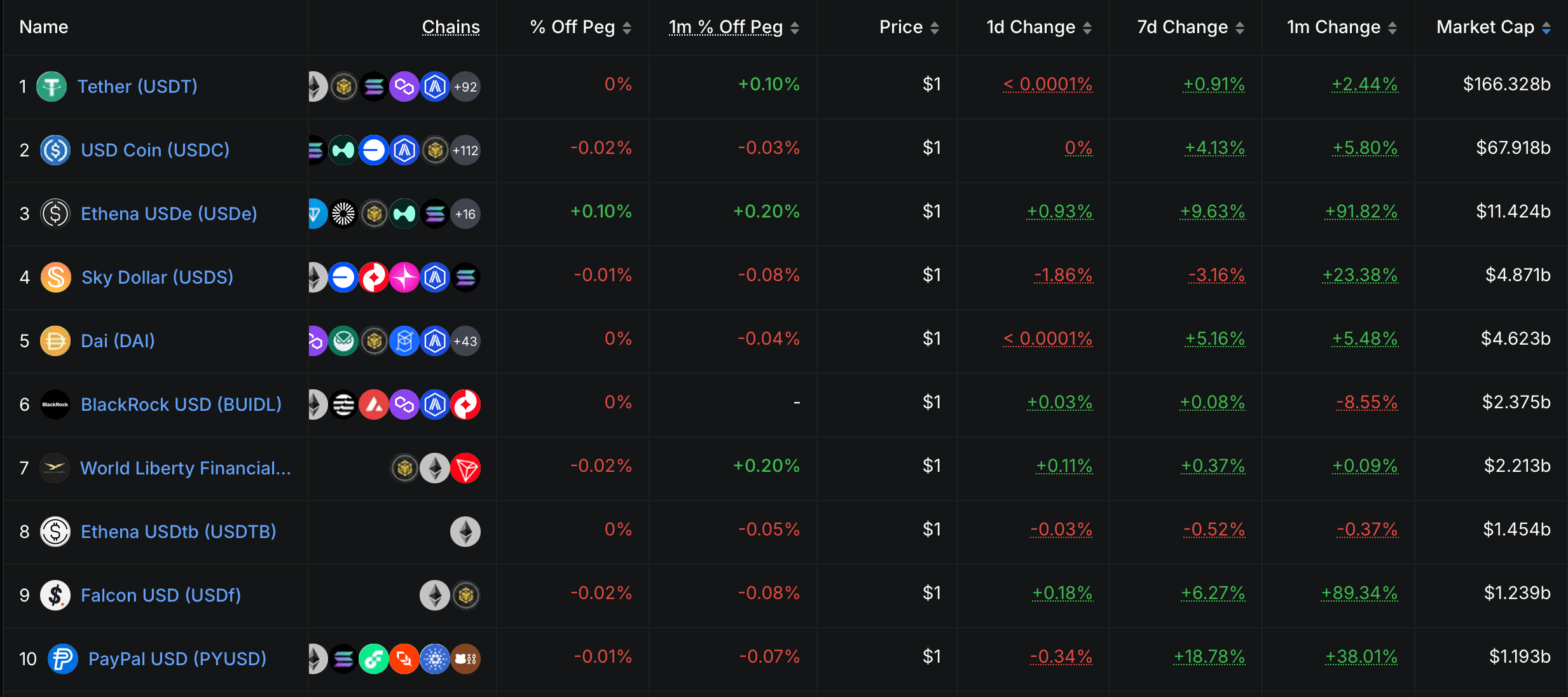

The stablecoin economy, now a grotesque monument to modernity at $276.8 billion, has birthed yet another marvel-or monstrosity-depending on your perspective. Falcon Finance’s synthetic stablecoin, USDf, has clawed its way into the top ten, crossing the $1 billion mark in market capitalization. Ah, the sweet smell of success… or is it desperation? 🏦

USDf: A Dostoevskian Tale of Overcollateralization and Madness

Falcon Finance’s USDf is not merely a stablecoin; it is a testament to human ingenuity… or folly. An overcollateralized synthetic stablecoin, it clings to the U.S. dollar like a drowning man to a life raft. Its collateral? A hodgepodge of crypto assets-stablecoins like USDT and USDC, alongside volatile tokens such as BTC and ETH. Truly, a masterpiece of modern absurdity. 🤡

To mint USDf, one must overcollateralize-a process as Kafkaesque as it sounds. Stablecoins are accepted at a 1:1 ratio, while volatile tokens demand higher deposits ($150 in ETH for 100 USDf). A price swing, and poof! Your collateral vanishes into the ether. Literally. 🌬️

To maintain its peg, falcon usd (USDf) employs arbitrage and delta-neutral trading. When USDf dips below $1, buyers swoop in; when it climbs above, users mint and sell. A delicate dance of greed and fear-Dostoevsky would be proud. 💃

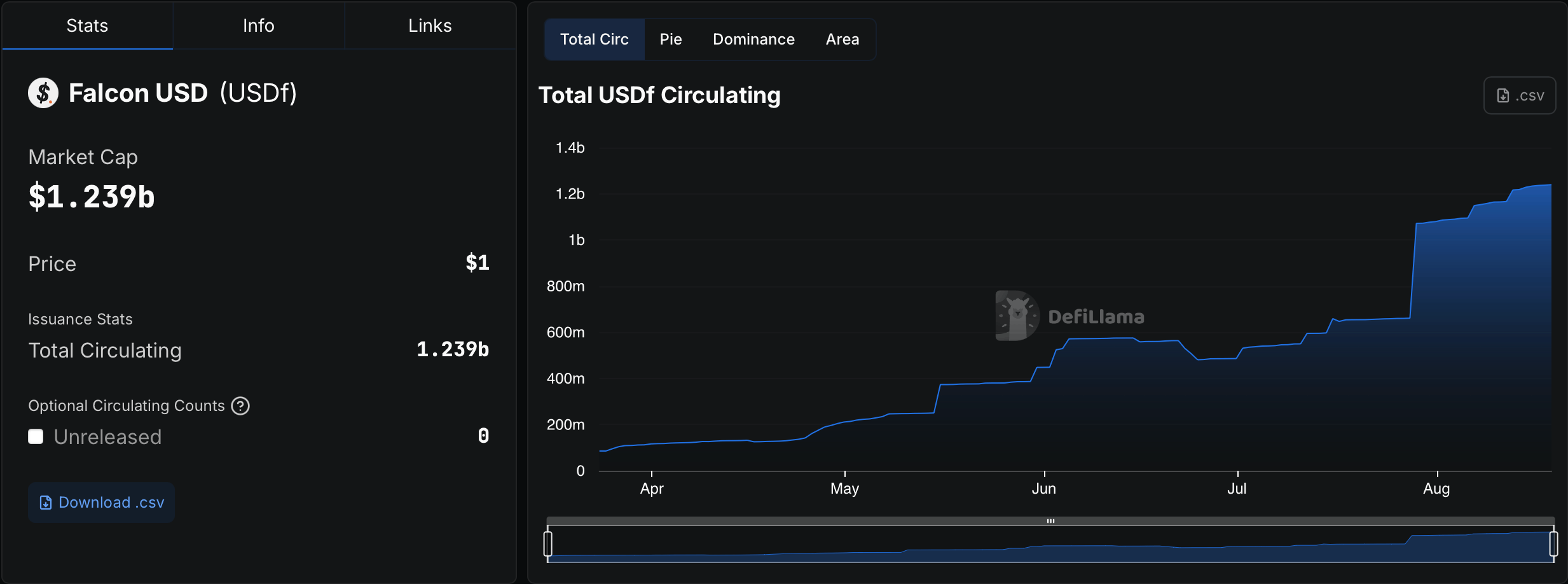

At the end of March, USDf’s market capitalization stood at $85 million. Today, it has ballooned to $1.24 billion-a 1,355.29% increase in 146 days. A meteoric rise, or perhaps, a cautionary tale? 📈📉

Documentation reveals that holders can stake USDf to receive sUSDf, an appreciating ERC-4626 token. Yields are generated from market-neutral strategies like funding-rate arbitrage (44% of returns) and cross-exchange arbitrage (34%), offering up to 11.8% APY. Locking sUSDf for three to twelve months can raise returns to 15%. Ah, the allure of passive income! 🤑

The protocol maintains a collateral ratio between 115% and 116%, with reserves audited quarterly and monitored in real time using Chainlink Proof of Reserve. As of Aug. 18, 2025, USDf’s market capitalization stood at $1.24 billion. Growth drivers include partnerships with Bitgo, integration with tokenized treasuries, and deployment on trading platforms like Uniswap and Curve. Truly, a testament to human progress… or hubris. 🚀

USDf sits among a wave of fresh contenders climbing into the top ten stablecoin ranks, alongside Sky’s USDS, Blackrock’s BUIDL, World Liberty Financial’s USD1, and Ethena’s USDtb. Truly, the stablecoin sector is a circus, and we are all its clowns. 🎪

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- EUR USD PREDICTION

- USD TRY PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR ILS PREDICTION

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- EUR JPY PREDICTION

- Silver Rate Forecast

- USD MYR PREDICTION

2025-08-20 06:57