It is a truth universally acknowledged, that a single investor in possession of a good fortune, must be in want of a lucrative investment opportunity. And so, the recent initial public offering (IPO) of Circle has proved to be a stark reminder of the exclusivity of early-stage investments, a veritable feast to which only the privileged few are invited. 🍴

Kingsley Advani, the esteemed CEO of tokenized stock exchange Allo, has astutely observed that the future of tokenization lies in a hybrid model, a harmonious marriage of traditional finance and blockchain. This union, he believes, will enhance access, transparency, and efficiency, thereby creating a more inclusive financial system, a veritable utopia for investors of all stripes. 🌟

The Exclusivity of Early-Stage Investments

The Circle IPO, a veritable coup for those fortunate enough to have secured a piece of the action, has served as a stark reminder of the vast chasm that separates the haves from the have-nots in the world of finance. The numbers, much like the great Pythagorean theorem, tell a tale of exclusivity: a 168% gain, a return that would make even the most seasoned investor weak in the knees. 😲

And yet, this success has also exposed the dark underbelly of the financial world, a realm in which institutions have long controlled access to primary investment instruments, leaving retail investors to pick at the crumbs that fall from the master’s table. The minimum investment requirements for Treasuries or private equity, a staggering $100,000, serve as a stark reminder of the barriers that prevent all but the most affluent from participating in the game. 🚫

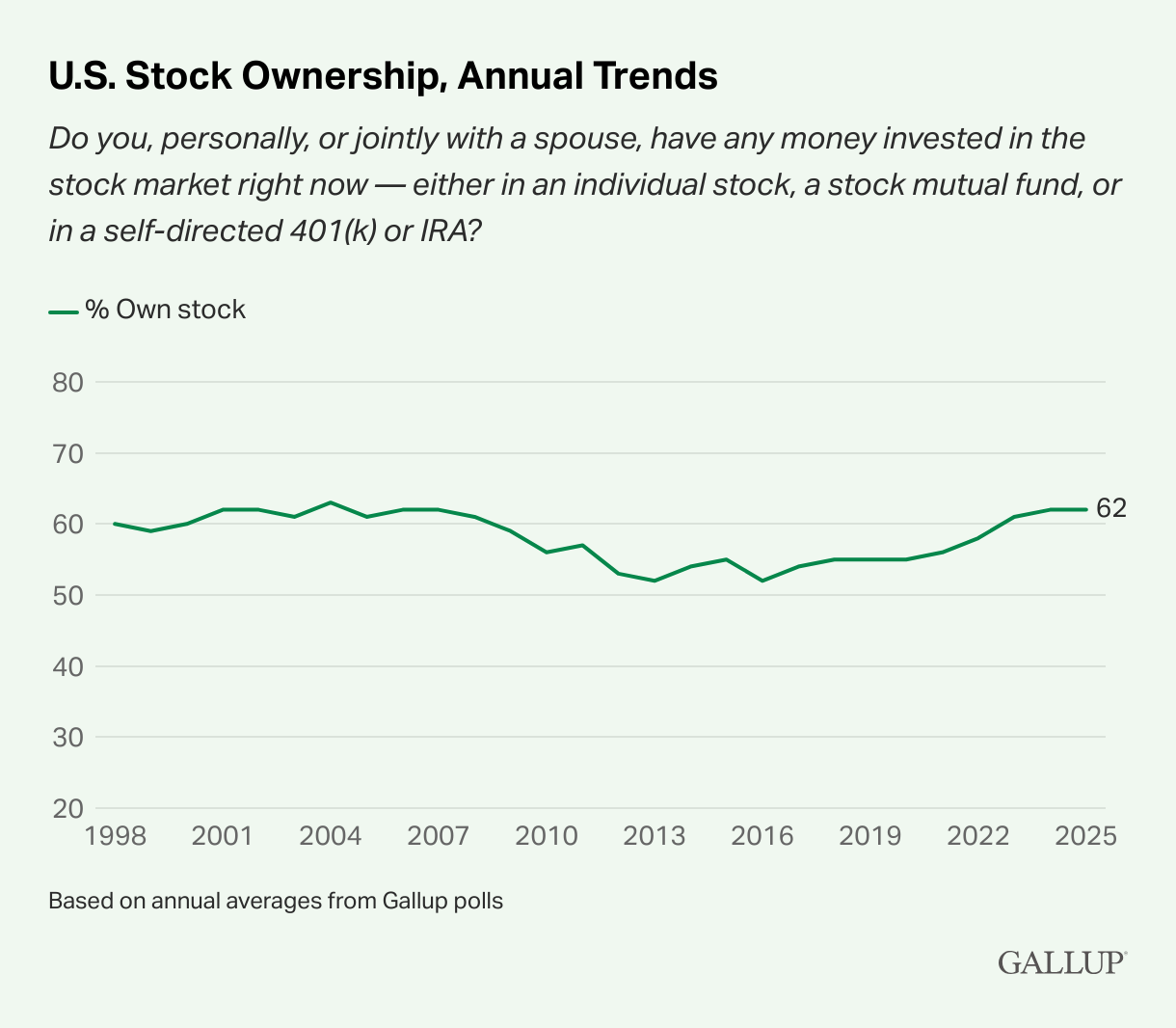

A recent Gallup poll has revealed that a mere 62% of US adults own stocks, a statistic that serves as a poignant reminder of the vast disparities that exist in the world of finance. And yet, blockchain technology, that great leveler, is slowly but surely changing this reality. 🌱

The Rise of Tokenized Real-World Assets and Blockchain Promise

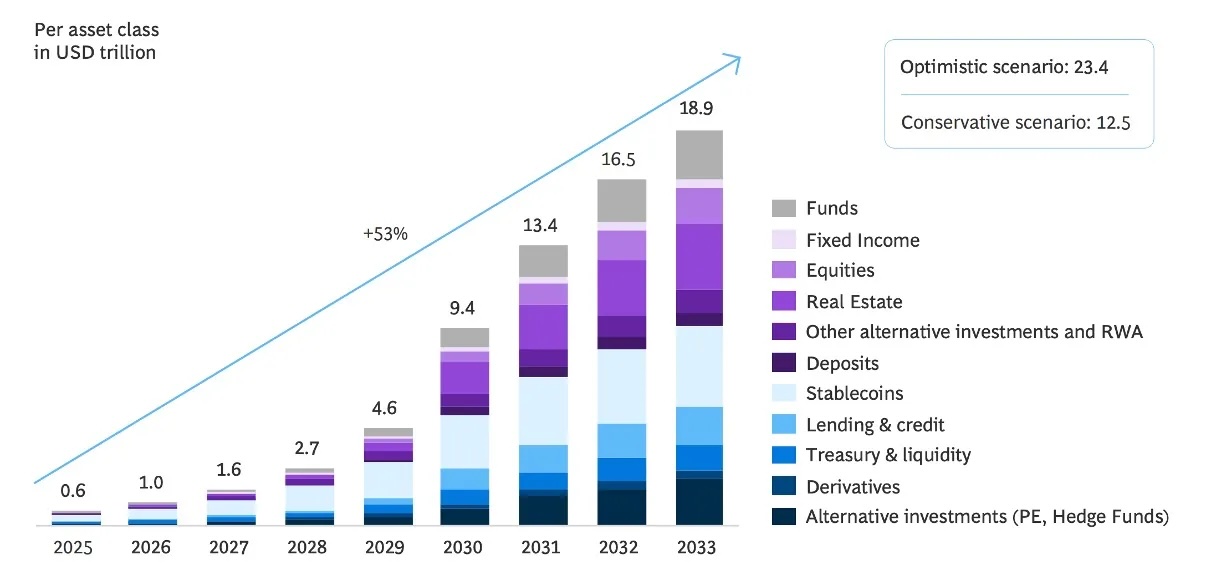

The tokenized real-world asset (RWA) market, a veritable behemoth, has gained momentum over several crypto cycles, and is now projected to be valued at a staggering $2.08 trillion, with forecasts reaching $18.9 trillion by 2033. This market, much like the great siren of mythology, holds out the promise of fractionalized ownership, enabling smaller investors to access various asset classes, a veritable feast for the financially famished. 🍴

“This shift, much like the great Copernican revolution, goes beyond a mere technical upgrade, suggesting a meaningful redistribution of access and control. By distributing ownership, tokenization levels the playing field and moves to a future where its gatekeeping model no longer holds,” Advani has astutely observed. 🔓

The tokenization of assets, much like the great alchemical process of old, has the power to transform the base metals of finance into gold. It lowers barriers to investment, reducing minimum amounts and making these assets more accessible to retail investors, a veritable miracle. ✨

Broadening Tokenized Investments

Tokenized stocks, a veritable innovation, represent an important development in the broader market. Institutions, much like the great leviathans of the deep, are increasingly leveraging blockchain technology to offer more accessible versions of traditionally exclusive assets. Kraken’s recent launch of tokenized stocks has served as a poignant reminder of this shift. 🌟

Besides equities, other tokenized assets, much like the great flotilla of ships that sail the seven seas, are contributing to this expansion. Tokenized Treasuries, valued at over $7.3 billion, are a veritable treasure trove of investment opportunities. 🏹

“The arrival of tokenized equities, bonds, and yield-bearing instruments is quickly balancing the appetite of institutional and retail investors,” Advani has noted, his words dripping with the wisdom of the ages. 🙏

Meanwhile, as tokenized markets grow, decentralized finance (DeFi) lending platforms, much like the great engines of progress, are allowing users to borrow stablecoins while displaying real-time risk data on the blockchain, a veritable marvel of modern technology. These platforms, much like the great bastions of freedom, operate without intermediaries, offering open access without requiring broker approval or accredited investor status. 🚀

Several jurisdictions, much like the great beacons of hope, have already established regulatory frameworks for digital assets, ensuring that tokenized securities can be issued, traded, and settled securely on blockchain technology. Regulatory efforts, much like the great pillars of justice, promote transparency and accountability, strengthening the credibility and stability of the tokenized market. 🏛️

Stability Through Broader Participation

One key benefit of broader participation in tokenized markets, much like the great law of gravity, is the potential to reduce volatility. Increased holder diversity, much like the great melting pot of cultures, dilutes the impact of large market-moving transactions, often driven by whales, leading to more stable markets. 🌈

“Wider participation strengthens markets, especially in driving away short-term speculators. The presence of diverse holders dilutes whale-driven price swings, on-chain proof-of-reserves eliminates opaque practices like rehypothecation, and transparent collateral dashboards make trades visible 24/7,” Advani has astutely observed, his words shining like a beacon in the darkness. 🔦

As tokenized markets grow more stable, they will open the door to a future with more inclusive and accessible financial systems, a veritable utopia for investors of all stripes. 🌟

Transforming Wealth Creation Using a Hybrid Model

Advani has emphasized that tokenization, much like the great philosopher’s stone, isn’t just about expanding financial access – it fundamentally transforms wealth creation. 🔮

“Tokenization isn’t about adding risk or overthrowing legacy infrastructure. It’s about allowing anyone to own yield-bearing assets outright and creating a wealth creation market that’s open and fairer.” 🌟

Looking ahead, he envisions a hybrid model, much like the great symphony of life, where traditional finance (TradFi) and blockchain coexist and complement each other. Tokenized assets, much like the great building blocks of the universe, won’t replace traditional systems but will enhance them, offering greater accessibility, transparency, and efficiency. 🌈

Ultimately, this hybrid approach, much like the great elixir of life, could help balance the benefits of both financial structures, supporting the development of a more transparent and accessible financial system for a wider range of participants. 🌟

Read More

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

2025-07-15 20:48