In a plot twist worthy of Ankh-Morpork’s own Moist von Lipwig, Bitcoin had a dramatic fainting spell below $108,000 on August 30. Cue market watchers armed with lorgnettes, monocles, and an eagle eye for suspicious whales who’ve been snoozing longer than the average wizard’s nap.

On-chain analysts-who are just like wizards except with less pointy hats and more spreadsheets-witnessed a whale wallet suddenly waking up, flexing its financial muscles, and splashing around enough Bitcoin to cause nervous sweating among traders. Should you panic? Well, panicking is trendy in crypto.

Bitcoin Trips Over Its Own Tail as Whale Goes on Ethereum Shopping Spree

On August 29, Arkham Intelligence (think Unseen University for blockchains, minus the exploding pantry) reported some shadowy entity holding more Bitcoin than the Discworld has trolls, deciding to try Ethereum on for size. Because, why not?

They shifted $1.1 billion to a new address, probably because their old wallet was getting a bit stuffy, and started buying Ethereum as if it was on sale at the Guild of Merchants. Forget tulips, ETH is the new craze. 💸

BREAKING: $5 BILLION BTC WHALE BUYING UP TO $1 BILLION $ETH

A whale holding over $5B of BTC is currently buying $ETH. He just moved $1.1 BILLION of BTC to a new wallet and has started purchasing ETH through Hyperunit/HL.

This whale bought $2.5 BILLION of ETH last week, and…

– Arkham (@arkham) August 29, 2025

Arkham insists the whale’s been stockpiling ETH like a Discworld alchemist collecting jars of unidentified liquids: $2.5 billion last week alone. No word on whether the whale is also hoarding moon cheese or overpriced NFTs.

Lookonchain (who, rumor says, lost six monocles that day in disbelief) revealed this whale tossed 4,000 BTC-worth over $430 million-into Hyperliquid, presumably to see what would happen. The answer? Market chaos, naturally.

The whale’s Wall Street shuffle spread through the crypto world faster than a rumor in the Thieves’ Guild. Bitcoin took a 2% nosedive, landing below $108,000, while Ethereum did some jazz hands and grinned at the gains. ✨

Meanwhile, speculators-legendary for their optimism and questionable snacks-were left holding empty bags and regrets.

CoinGlass tracked liquidations like a city watch searching for lost sausages: over $400 million evaporated faster than a wizard’s dignity at Hogswatch. Ethereum’s long positions suffered a $133 million haircut, Bitcoin’s tried to keep up but only managed to lose $109 million. Oops.

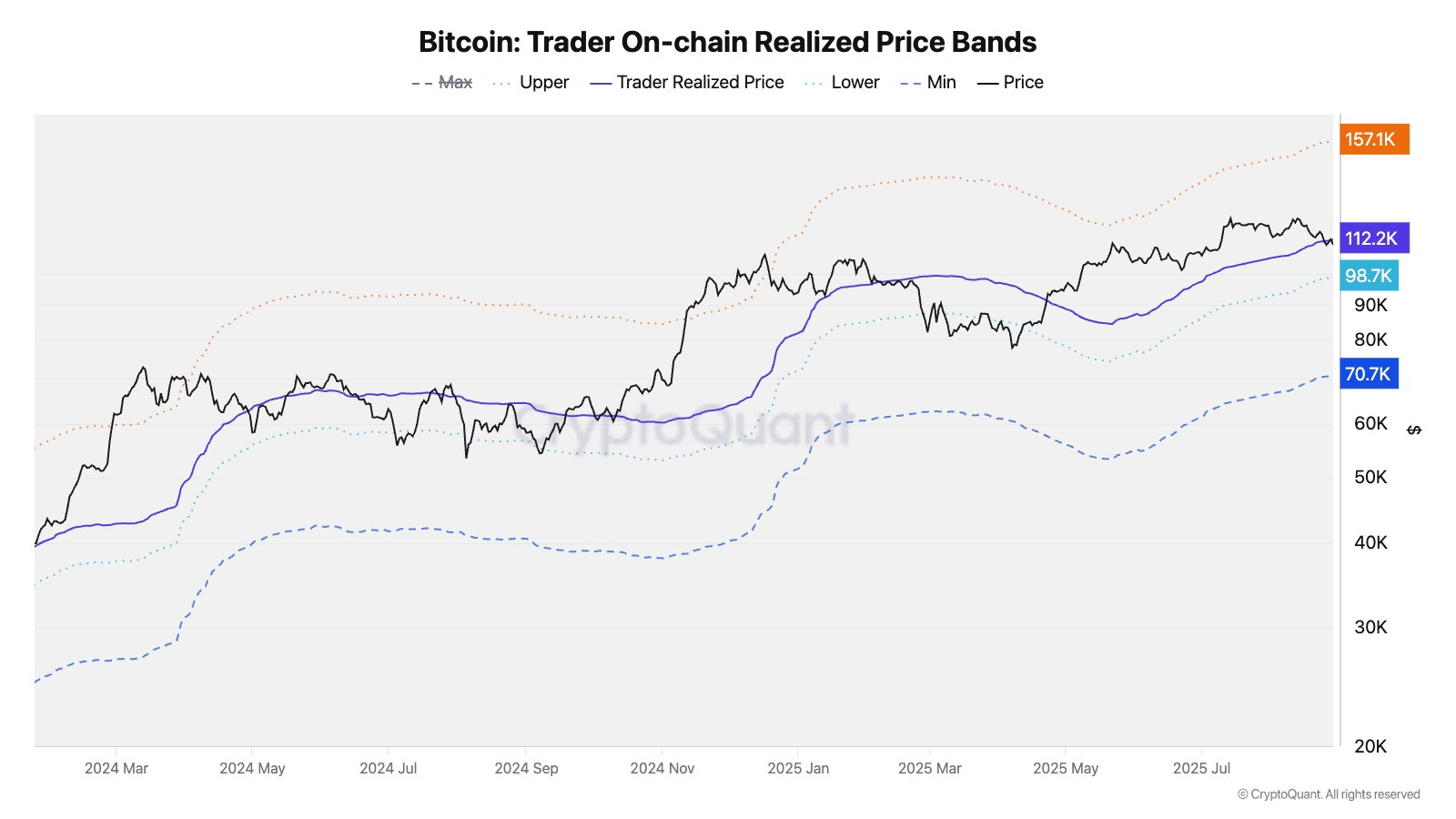

Julio Moreno, head researcher at CryptoQuant, suggested Bitcoin really ought to get its act together and hop back to $112,000, ideally before lunch. Failing that? Pack your bags for the wilds of $100,000. (“It’s just a test, you say? Well, let’s hope it’s multiple choice!”)

Moreno also pointed out that market sentiment is currently somewhere lower than a dwarfish mining accident. The Bull Score index dove to 20-the crypto equivalent of asking for a hug and getting a sock. Expect wild volatility, dramatic exclamations, and a fond hope for the next whale to do something so loony that everyone forgets this week ever happened. 🐳🪙

And so, dear reader, as the Disc turns-eh, I mean the blockchain spins-watch the whales, clutch your wallet, and avoid explaining any of this to your grandma. She won’t believe you anyway.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD VND PREDICTION

- Solana’s Plunge: A Tale of Memecoins, Rewards, and Falling Revenues 🚀💸

- Bitcoin: Is the Bubble Finally…Deflating? 📉

- Silver Rate Forecast

- Stablecoin Saga: Korea’s Rules Delayed 😮

- OMG, Are Memecoins Over? Pump.fun’s Revenue Just Took a Nosedive 🤔

- BNB AUD PREDICTION. BNB cryptocurrency

- XRP to the Moon? 🚀 (Maybe…)

2025-08-30 18:12