Imagine this: Dan Morehead is (sometimes literally) the king of crypto. Picture him sitting down with Raoul Pal, the dynamic duo of “Let’s Talk Money and Make Heads Spin.” In a digital version of a fireside chat, they have sharp insights that make you double-check if your wealth manager knows what’s up. We’re not just talking speculation here, folks! It’s about one big “one trade” that ties macro and crypto like a surly teenager binds their hair-fiat debasement funneling money into scarce, higher-beta assets (TL;DR: losing faith in dollar bills).

The Debasement Trade Dies Hard

Morehead kicks things off with brutal honesty: “We have full employment. Inflation is giving our assets a sneaky punch, debasing them by 3% a year… and they’re still cutting rates. Oh, darling, it’s a madhouse!” But don’t feel bad if your economics textbook didn’t prepare you for this: he refers to 2020-2021 as one huge “policy mistake.” Picture this: inflation was hitting the roof at 8%, and the Fed was chilling at zero. This easing into an economic boom weakens the classic belt-tightening maneuver against “record fiscal deficits.” Morehead suggests what’s going up in asset prices isn’t just their own rise to fame, but because the price of paper money is stage diving off the charts.

Enter Pal with an analysis only a macro aficionado could love: “We use [Global Macro Investor’s] total global liquidity index to track debasement. Since 2012, the Nasdaq has a tango-worthy 97.5% correlation with this, and Bitcoin is probably flirting at 90%.” According to him, “None of it matters. It’s all one trade.” Picture a world flooded with liquidity and debasement, like a pool party where everyone throws out the usual asset-snob nuances: “It’s the greatest macro trade of all time.”

In Morehead’s eyes, this explains the increasing celeb-studded adoption. He points out how even the fancy bank research now features the “debasement trade,” with giants like JP Morgan and Goldman waving it around like some flashy status symbol. “Veronica never gives up on you!” exclaims Morehead, who’s been rhyming off debasement since he was in the lollipops phase. Pal adds that even “openly” talking about currency debasement is as common in banks now as wearing a mask to the office.

He firmly believes the real drama is from institutional under-allocation. “How can a bubble be like that one social media influencer nobody follows?” he asks. Morehead imagines a future where crypto stardom hits college dorms-level reliance, with “8 or 10” percent allocations over time-not unlike those glossy passes at a Vegas hotel bar starting at 2% and whoosh! Ends up strutting at 20% in no time.

Morehead also sees geopolitics and policy politics joining the dance-off. He implies the US election was like a red carpet reset for regulations-going from “aggressively negative” to “oh, you’re fabulous now,” which opens doors for all the retirees and big sovereign funds who got the scare of a lifetime from 2022’s FTX/Luna/Celsius meltdown and those bad boys in the enforcement squad.

He even narrates a potentially wild “sovereign arms race” for Bitcoin stashes. From US seizure cups to China’s cups, and GCC cool cats “aggressively getting into the blockchain space,” we’ve got room for acquisitions the size of Alice having tea in Wonderland. Picture this: If multiple blocs each go for million-coin stockpiles, supply dynamics could “squeeze up” like a watermelon seed in one of those fancy Instagram reels.

Because Who Doesn’t Love an Extended Crypto Rave Till 2026?

If liquidity and adoption secure the bubbly case, both still tip their hats to crypto’s cyclical nature. Four-year forecasts around those oh-so-financially beneficial halvings are a pattern deja vu for Morehead. He believes Pantera nailed past cycle predictions, like when Bitcoin reached $118,542 a few days early. Yet cryptocurrency history adds delights like 2017’s CME future listings, or 2021’s Coinbase IPO, followed by typical ~85% garnishes.

Still, Morehead pitches “this time” could be an all-season affair due to policy and allocation settings: “The regulatory changes in the US-boom, baby, trump everything!” he says, forecasting a rallying “next six to 12 months.” Pal, not one to point fingers at futurists gone wrong, agrees: “I think it’s going to stretch out.”

Now let’s talk TikTok-uh, the social spread: Baby boomers stuck in their cozy CPI corners, while Young Turks dive into digital assets. Crypto’s “virality rate” reportedly hits a soaring 95%, Morehead claims: “When you tell someone witzy about cryptos for an hour, they quickly realize ‘Oh, this is where I gotta drop some coin!'” Evangelists have their part, too: “Michael Saylor basks in the glow of a Messianic trial,” he quips, before adding his team will work on making Solana just as #lit as ETH through Tom Lee. ETFs and media bits pull wannabe investors straight to the gate, where a tiny slice can mushroom overnight. As Pal narrates, lack of crypto feels like “you’re hosed in a game of mutual encouragement.”

I just love it when technology, macro, and crypto all waltz together in someone’s adventure… and there’s no dancer better than my dear friend @dan_pantera, the OG in this space! Please enjoy.

Yet, macro warning lights flash in the background: structural US deficits rivaling a horror movie, a monetary-fiscal duo wrestling between refinancing needs and price stability, and an aging workforce leaving AI gains in the limelight. “Debasing your dollar against everyone else’s?” Morehead says, as if it’s a dance no one wants to lead. Here’s where gold and crypto are the glow sticks everyone turns to. “That’s why everything’s at record prices… except paper money,” he concludes, like an elegant period after a long, predictable sentence.

In a cosmic wrap, Morehead steers the lens to human milestones: crypto is 17 and the Internet’s still young at 53. The teens of the financial world yet hold “0.0” institutional love. When the “one trade” rolls on-liquidity up, fiat down, and adoption up-their journey seems to be pointing somewhere optimistically upwards.

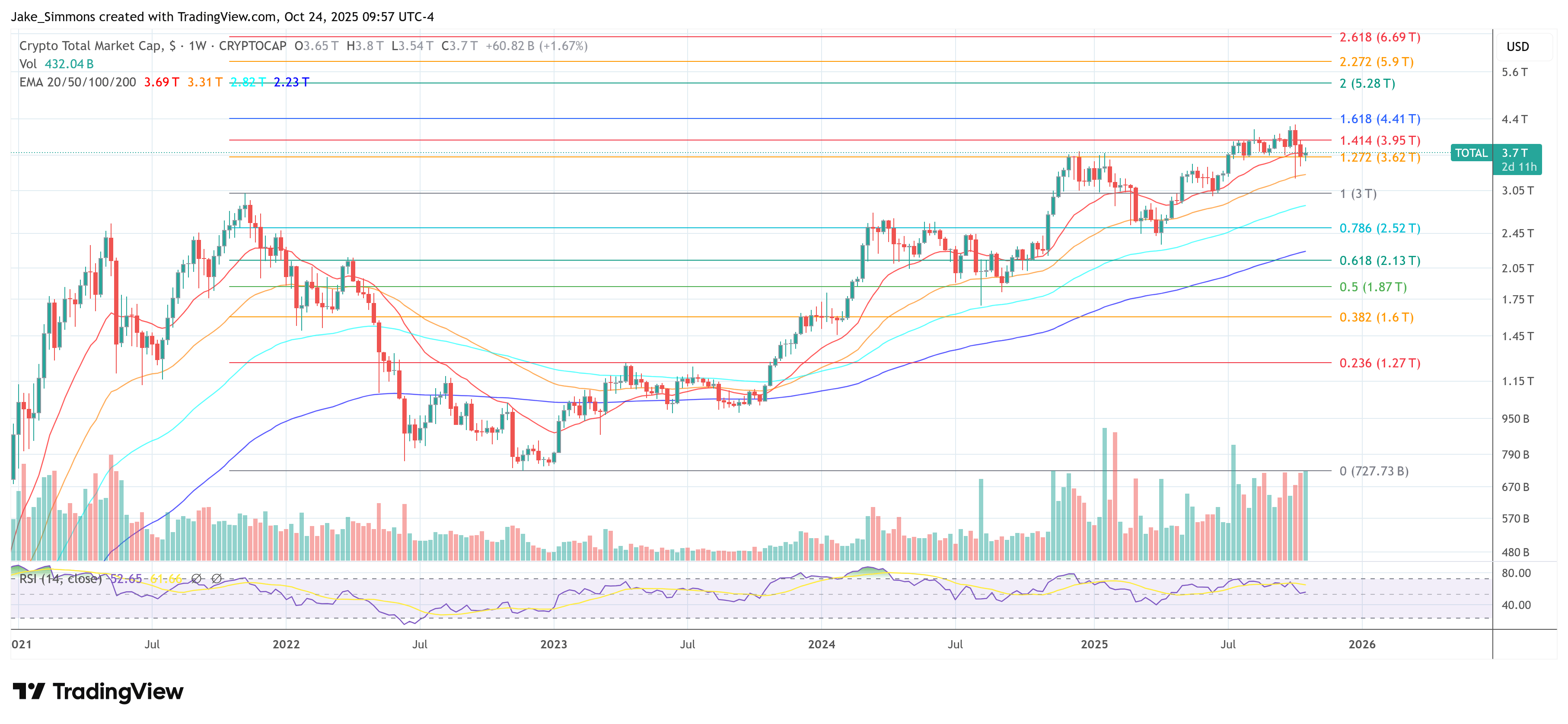

Summing it up in the wise words of Morehead: “If you hold crypto for four or five years, I think it’s like 90% you’ll win the jackpot… It’s basically Harambe not seeing any lions.” Here’s the fun fact: At press time, the total crypto market cap stands at a whopping $3.7 trillion. So, yeah, it’s doing great!

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- USD MYR PREDICTION

- Gold Rate Forecast

- HBAR’s Price Tango: A Bumpy Ride with a Bearish Twist!

2025-10-25 07:23