Stablecoins are having a moment, and one cryptocurrency is about to become the unsung hero of a new dollar-based economy, according to the geniuses at Electric Capital. 🚀

Everyone’s talking about “de-dollarization,” but let’s be real, the world’s love affair with the U.S. dollar isn’t cooling down anytime soon. In fact, it’s hotter than ever. 🌞 Behind the scenes, a massive shift is happening: billions of people and businesses are finding new ways to get their hands on dollars, not through the usual suspects like banks, but through the magical world of stablecoins. 🪙

Electric Capital, the crypto investment firm with a knack for spotting trends, says this shift is creating the biggest expansion of the dollar’s network in decades. And guess what? One cryptocurrency is poised to benefit the most. 🎉

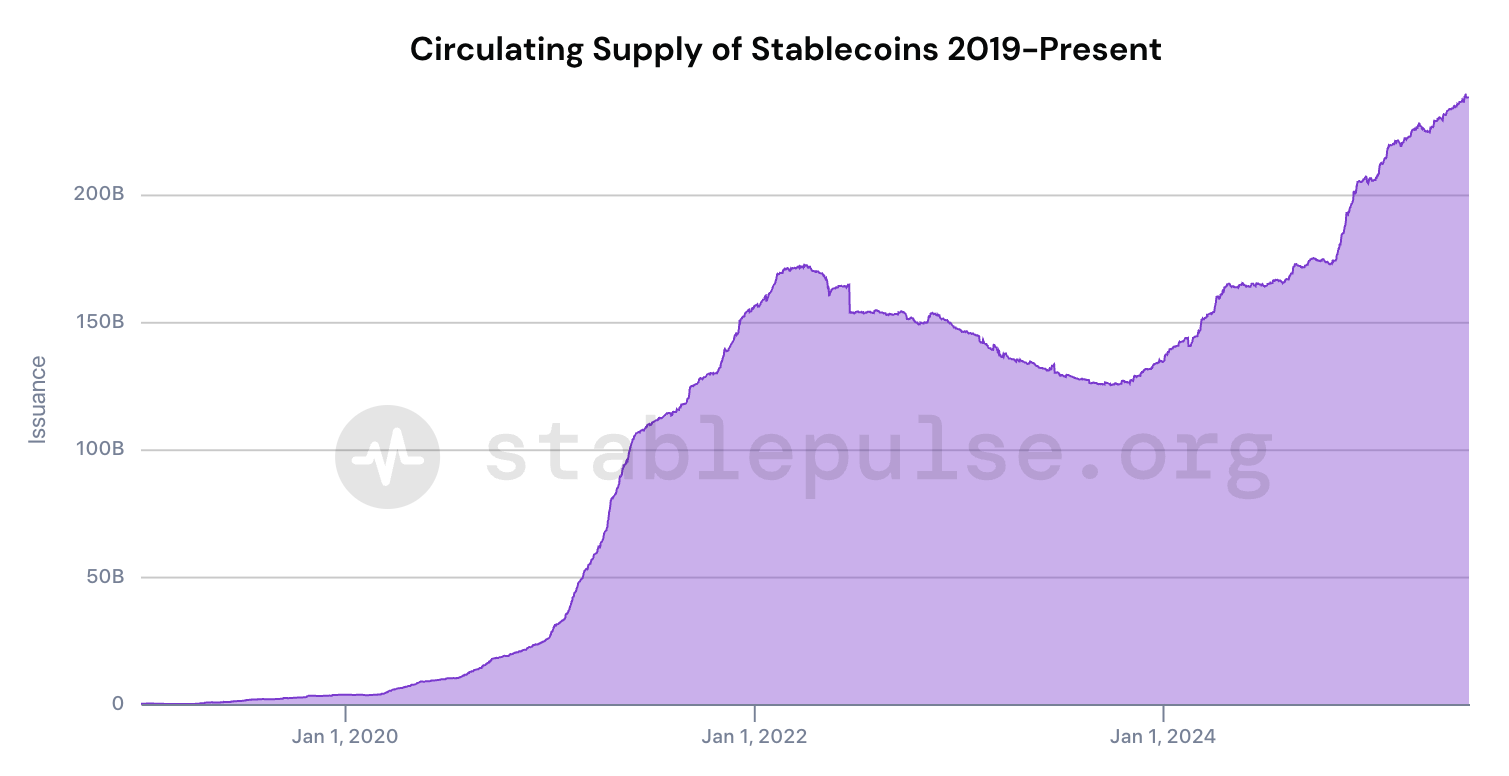

Since 2020, the stablecoin market has exploded, growing nearly 60-fold to over $200 billion. A lot of this growth is thanks to demand from emerging markets where traditional banking is either limited or, let’s face it, a bit of a mess. 🤷♀️

Electric Capital points out that billions of people around the world are dealing with currency risks. Political instability, poor monetary policies, and high inflation (sometimes above 6% annually) are making local currencies as stable as a three-legged chair. In these places, holding dollars means more financial security. 💰

“Over 4 billion people face significant currency risks due to political instability, poor monetary policy, and structural inflation. For these populations, holding dollars means financial security.”

Electric Capital

Businesses also need dollars to thrive. The U.S. dollar is the king of global trade, involved in about 88% of all foreign exchange transactions. For many small and medium-sized enterprises and freelancers, especially in emerging economies, digital dollars are a game-changer, helping them avoid currency mismatches and simplify cross-border payments. 🌍

But here’s the kicker: stablecoins allow anyone with internet access to hold dollars, no bank account or government permission needed. This global accessibility is a game-changer. 🌟

The Problem with TradFi (aka the Old Guard)

While this new wave of dollar holders is exciting, it comes with its own set of challenges. Millions of new users want more than just to hold stablecoins; they want to earn yield, invest, and access financial services. But traditional finance? Well, it’s like trying to fit a square peg in a round hole. 🤦♂️

The U.S. banking system, for example, is all about strict regulatory compliance, which often excludes many people globally. Cross-border financial services are expensive, slow, and generally designed for institutions or the wealthy, not everyday users in emerging markets. 🤑

This gap calls for new financial infrastructure that is global, safe for institutions, and resistant to government interference. Enter the hero we’ve been waiting for… 🦸♂️

How One Crypto Stands Out

According to Electric Capital, Ethereum (ETH) is the superhero of this new digital dollar economy because it meets three key requirements:

- Global Accessibility: Ethereum works 24/7 and is available to anyone with internet access, whether in New York, Nigeria, or rural Nepal. 🌐

- Institutional Safety: Ethereum offers the security, regulatory clarity, and flexibility needed for institutions to build large-scale financial products. 🏦

- Resistance to Government Interference: Ethereum operates in a decentralized manner, making it harder for governments to restrict or censor. 🛡️

Electric Capital’s analysts note that Ethereum’s history of community funding and Proof-of-Work launch gave it broad asset ownership and a culture focused on decentralization, creating a moat that’s tough for other blockchains to replicate. 🤔

The Ethereum network supports more than $140 billion in stablecoins, over $60 billion in decentralized finance protocols, and billions more in tokenized real-world assets. 🤯

In traditional finance, a reserve asset is the trusted base layer that supports lending, borrowing, and transactions. Think U.S. Treasuries, gold, and the dollar itself. 🏛️

The report explains that as stablecoins on Ethereum grow, participants need a secure, productive asset to back financial activities. ETH fits this role perfectly, the analysts suggest, because it is:

- Scarce, with predictable supply and low inflation. 🕵️♂️

- Productive, generating yield through staking. 💸

- Collateralized, backing over $19 billion in lending protocols. 📊

- Resistant to Seizure or Censorship by governments. 🚀

- Programmable and Liquid, deeply integrated into the on-chain financial system. 🤝

As stablecoin adoption increases, so does the demand for ETH to power the ecosystem, they say. 📈

Layer 2s as Supporters, Not Competitors

More than that, Ethereum’s Layer 2 scaling solutions make transactions faster and cheaper, opening up more use cases for ETH as collateral and reserve asset, expanding its reach in the digital dollar economy, the analysts claim. 🤝

Beyond powering DeFi and stablecoins, ETH also has properties that make it a strong store of value, comparable to Bitcoin but with the added bonus of yield potential. 🤑

And, unlike gold, which just sits there looking pretty, ETH holders can earn staking rewards, a feature that appeals to investors who prefer assets that generate income. The report suggests that rather than competing with Bitcoin, ETH and BTC might both take market share from traditional stores of value like gold, treasuries, and real estate in the years ahead. 🤝💰

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-07-14 13:06